Indiaʼs retirement population is growing. Additionally, with increasing life expectancy, a large segment of people are looking for longer retirement solutions. The following charts contain insights related to retirement goals, instruments for retirement planning, allocation of corpus post retirement and planned sources of income post-retirement, as per a survey.

Also read: How to decide on higher EPFO pension

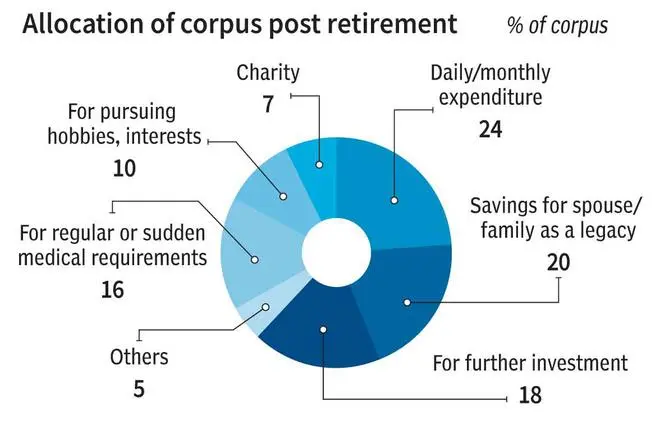

The major portion of the retirement corpus is allocated for daily expenditure, savings for family, further investment and medical expenses.

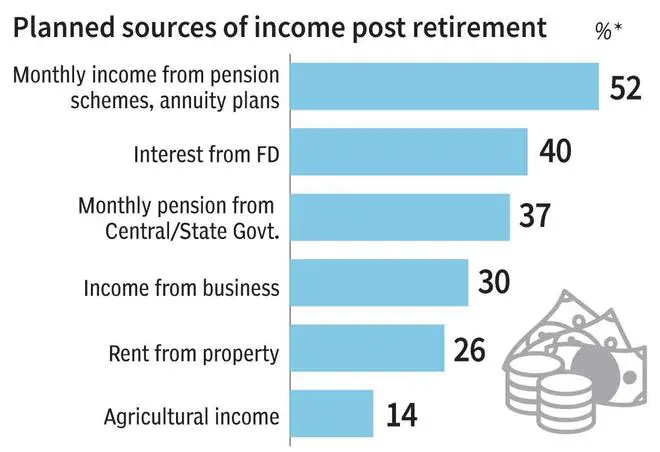

To prepare for retirement, individuals are recognising the importance of products that are risk-free and offer guaranteed returns for life, such as annuity plans.

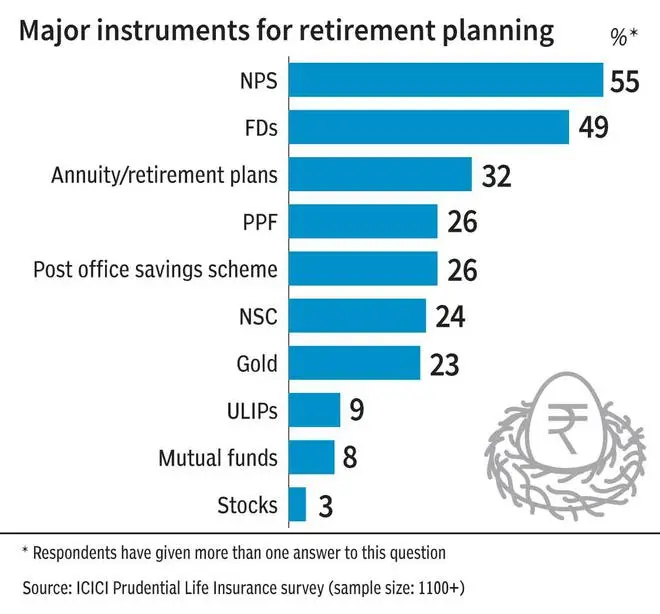

Well-prepared individuals for retirement start investing for retirement before even they are 40. They invest mainly in NPS and retirement/annuity plans, besides fixed deposits, to become retirement-ready.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.