Debt-strapped Sri Lanka has reached a staff-level agreement with the IMF, that promises access to $29 billion over a 4-year period under the institution’s Extended Finance Facility. Given Sri Lanka’s $51 billion external debt, that sum is extremely small. It also comes with a host of conditions varying from increases in fuel and electricity tariffs to increased taxation to reduce government deficits — policies that a government with limited legitimacy would find difficult to impose on an economically devastated population.

Yet, the Sri Lankan government is hoping that the agreement would be passed by the IMF board, because it is a step towards convincing foreign creditors and investors to ‘return’ to the country, only to add to the burden of its existing foreign liabilities.

But this is by no means the first step to resolution. Rather the IMF has made its “assistance” conditional on Sri Lanka persuading its multiple creditors to restructure and reschedule past debt. Official bilateral and multilateral creditors may go along, to help Sri Lanka out. But private bondholders who account for more than 80 per cent of Sri Lanka’s debt to private creditors would be less willing to accept any deal that requires them to take some losses. At least some of them are likely to hold out.

A decade back, in 2012, bondholders accounted for 55 per cent of the outstanding long-term debt Sri Lanka owed to private creditors (Chart 1). Debt to private creditors accounted, in turn, for 28 per cent of outstanding long-term debt stocks. But between that year and 2020, by which time outstanding long-term debt had risen from $26.2 billion to $46 billion, the share of private creditors had risen to 37 per cent, and of bondholders in private credit to 84 per cent. This is a major obstacle to finding a way of extricating the country from the debt it is currently trapped in.

Widespread issue

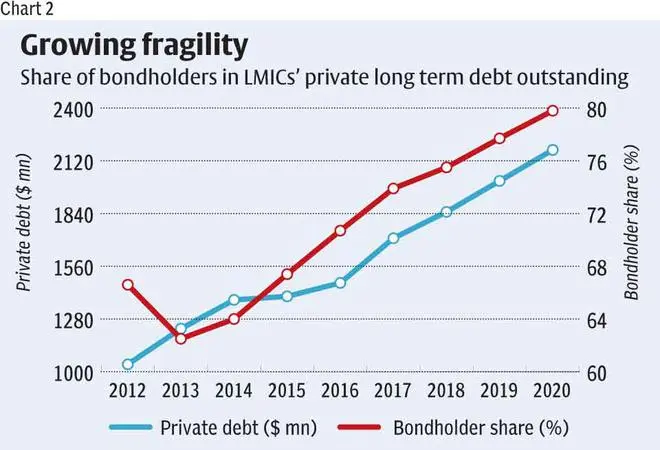

The problem afflicting Sri Lanka is not unique. It is widespread across less developed countries, even if particularly acute in a few. Private long-term external debt outstanding of countries identified by the World Bank as belonging to the low and middle income category more than doubled from $1.04 trillion in 2012 to $2.18 trillion in 2020 (Chart 2).

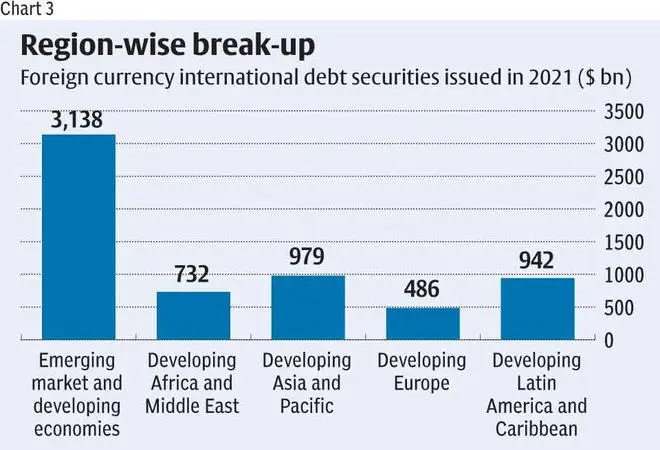

The share of bondholders in that debt rose from 63 per cent in 2013 to 80 per cent in 2020. Regionally, Latin America and the Caribbean and Developing Asia and Pacific led the way, though in the case of the latter the presence of China inflates the total (Chart 3).

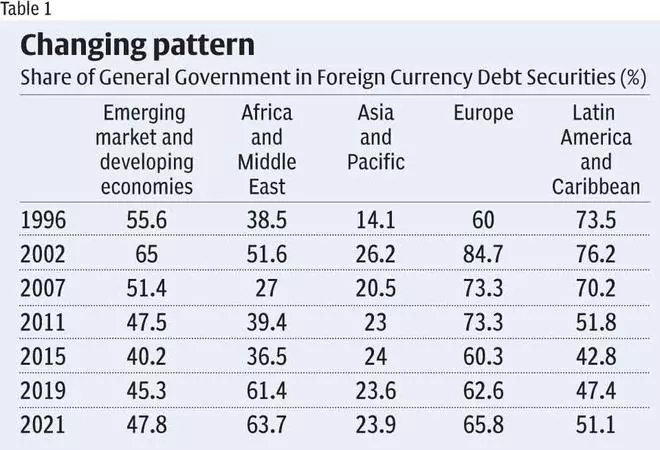

What is noteworthy, however, is the variation in bond-based borrowing by government in the different regions. Overall, the share of governments in foreign currency bond issues across emerging market and developing economies (EMDEs) has fallen from 65 to 48 per cent between 2002 and 2021, in keeping with the liberalisation-driven shift to bond-based foreign currency borrowing by private financial and non-financial corporations.

But this fall has been largely driven by declines in developing Europe (from 85 to 66 per cent) and Latin America and the Caribbean (from 76 to 51 per cent).

On the other hand, the share of government issuance has risen in Africa and the Middle East (from 39 per cent in 1996 to 64 per cent in 2021) and in developing Asian and the Pacific (from 14 to 24 per cent over the same years).

Clearly attracted by low interest rates and easier access to bond markets, developing country governments have been issuing foreign currency bonds to finance expenditures.

A 2014 IMF report noted: “Sub-Saharan Africa’s access to capital markets is picking up significantly. Easy global financial conditions — low interest rates in advanced economies and low global risk aversion leading to portfolio reallocation in search of risk-adjusted yields and diversification opportunities — are facilitating access of sub-Saharan African countries to international capital markets.

“First-time or repeated issuance by those countries is also seen by many observers as recognition of sub-Saharan Africa’s high return potential, owing to its natural resource wealth and improved macroeconomic policies and development prospects.”

But foreign currency bonds may not be the best channel to mobilise resources for a number of reasons. To start with, unlike the case with borrowing in domestic currency, foreign borrowing requires debt service commitments to be covered in foreign currency.

Debt distress

Any external shock that affects foreign currency earnings or receipts, can precipitate debt distress. Moreover, in the event of any unexpected depreciation of the domestic currency, the debt servicing cost in local currency would spike and add to the servicing burden.

Moreover, when debt takes the form of bonds, it becomes easily tradable with important implications. Since bond issues are made through the market, such issues can be picked up by sundry investors in search of high yields. Such speculative investors are likely to exit at the slightest sign of uncertainty, including in markets from which they mobilise their capital.

Thus, the ongoing effort of developed country central banks to hike interest rates and limit or draw out excess liquidity from money markets is triggering an exit of bondholders from less developed countries. This pushes down bond prices and raises interest rates, worsening debt stress. It also raises the cost of contracting new debt, often needed to service past debt. Finally, as observed in the Sri Lankan case, if debt distress reaches levels where default is imminent, the presence of multiple bondholders in the community of creditors delays or prevents resolution, as some of them hold out for better terms. Sri Lanka has been sued in the US by bondholder Hamilton Reserve Bank Ltd, which holds more than $250 million of Sri Lanka’s International Sovereign Bonds that fell due on July 25.

Hamilton holds more than 25 per cent of those bonds and can block any effort at restructuring. This would prolong the period of pain and even make resolution near impossible. While borrowing in foreign currency is a ‘sin’ in itself, doing so by issuing foreign currency bonds is to court the devil at the heart of private financial markets.

Despite these problems, the IMF has supported foreign currency bond issues by less developed countries, so long as they are accompanied by ‘sound’ macroeconomic policies. What is missed here is that choosing to issue sovereign bonds in foreign currencies may itself be imprudent from a macroeconomic policy point of view.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.