The International Sustainability Standards Board (ISSB, a part of IFRS Foundation) has issued two standards under the IFRS Sustainability Disclosure Standard programme — IFRS S1: ‘General Requirements for Disclosure of Sustainability-related Financial Information’; and IFRS S2: ‘Climate-related Disclosures’.

IFRS S1 is the core framework for disclosure of material information about sustainability-related risks and opportunities across an entity’s value chain. Value chain in this context is the ecosystem in which an enterprise operates.

The objective of IFRS S1 is to require an entity to disclose information about all sustainability-related risks and opportunities that could reasonably be expected to affect the entity’s cash flows, its access to finance or cost of capital over the short, medium or long term. This information is useful to primary users of general purpose financial reports in making decisions relating to providing resources to the entity. Sustainability-related risks and opportunities that could not reasonably be expected to affect an entity’s prospects are outside the scope of these standards.

The words ‘financial information’ in the context of IFRS S1 mean information about factors critical. If water is a key resource, depletion in supply or quality deterioration will impact the operations of the company. Appendix A defines ‘sustainability-related financial disclosures’ and Appendix D discusses elaborately the qualitative characteristics of useful sustainability-related financial information.

ISSB has drawn a lot from the accounting standards of IASB (International Accounting Standards Board, a part of IFRS Foundation). The definition of ‘Materiality’, the discussion on ‘Reporting Boundaries’ makes it obvious. And so in the case of judgments made in preparing the disclosures, the estimates, significant uncertainties involved in the amounts reported, correction of errors, etc.

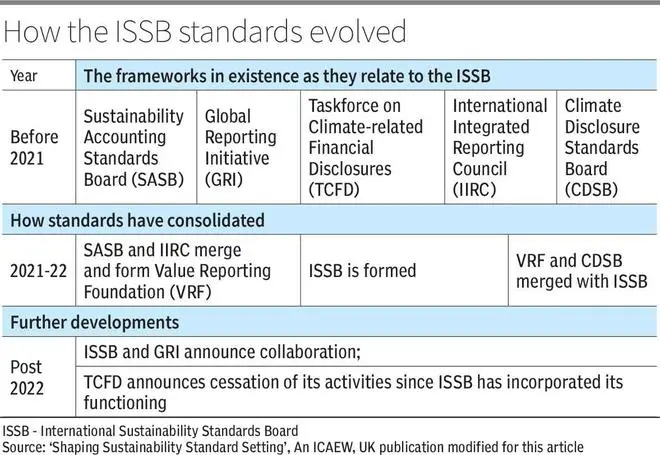

The chart demonstrates the evolution of ISSB.

How ESRS differs

The comparable standards for the European Union (EU) are the ‘European Sustainability Reporting Standards’ (ESRS), piloted by the European Financial Reporting Advisory Group (EFRAG). While ESRS had benefited by collaborating with GRI (Global Reporting Initiative), ISSB has started the process of aligning with the GRI.

Another difference is that the applicability of the ISSB standards is limited to the ‘primary users of general purpose financial statements’ whereas the ESRS extends beyond that to other stakeholders. A significant difference is the concept of ‘double materiality’ approach by the ESRS. Where the ISSB focused on the financial impact of environment on the entity’s financial position, additionally, ESRS requires the impact of the entity on the environment to be disclosed.

The ISSB standards are built around the core content of: (a) governance, i.e., how the organisation and the management will control the monitoring and managing of risks and opportunities; (b) strategy adopted for managing the risks and the opportunities; (c) risk-management for identification, assessment, prioritisation and monitoring the risks and opportunities; and (d) metrics for measurement and targets for goals. One can see the influence of the TCFD (Task Force on Climate-related Financial Disclosures) in structuring of the core content.

The report of disclosures should be coterminous with the financial statements covering the same period. Comparative information is to be provided. As in the case of IFRS financial statements, an explicit and unreserved statement of compliance is to be provided.

Paragraph 34 merits a special consideration. Per clause (a), an entity is expected to disclose ‘the effects of sustainability-related risks and opportunities on the entity’s financial position, financial performance and cash flows for the reporting period (current financial effects)...’ There could be situations where it could become difficult for an auditor to ignore the impact of the disclosures on the financial statements giving rise to extending the examination to the possible effect on the financial statements.

Back in 2019, Nick Anderson (an IFRS staff member) demonstrated in an article how the current IFRS accounting standards were adequate for accounting for climate-related disclosures. Though the IFRS Foundation also issued a guidance note, this line of thought was not pursued since there was no framework for disclosures by companies and hence accounting for these disclosures would necessarily be dependent on what managements chose to disclose.

Conclusion

Many commentators have raised concerns about the ‘interoperability’ of three of the main standards viz. ISSB, ESRS and the US Securities and Exchange Commission (issued in 2024). An entity with operations in the three jurisdictions will need to fulfil the reporting requirements in all three jurisdictions.

A key requirement will be the assurance of disclosures in order to lend credibility.

Taskforce on Nature-related Financial Disclosures (TNFD) prepared in the mould of TCFD has issued a framework for nature related financial disclosures which will have a considerable impact on sustainability reporting standards in future.

ISSB standards have not yet been adopted officially by any jurisdiction including India, whereas the ESRS is part of the EU legislation. Currently, the requirement in force is the Business Responsibility and Sustainability Reporting (BRSR) issued by SEBI.

However, in July 2023 the International Organization for Security Councils (of which SEBI is a member) had endorsed the ISSB standards as appropriate to serve as a global framework for capital markets which gives the ISSB standards a high degree of acceptability.

The developments in this space are now gathering critical mass.

The writer is a chartered accountant

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.