This article examines the export share of India’s top exporting industries from 2017-18 to the first quarter of 2024-25, covering both pre- and post-Covid years. Data from the EXIM database of the Ministry of Commerce is used for the analysis, highlighting the sectors that have gained, lost, or remained unchanged over this period.

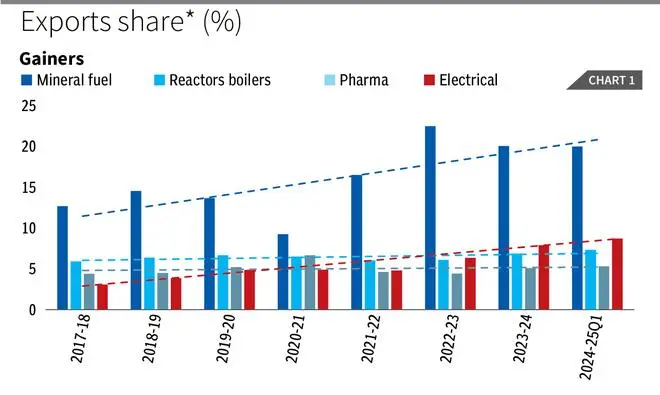

Four sectors stand out as gainers: fuel, pharmaceuticals, electrical equipment, and nuclear reactors/boilers (Figure 1). Mineral fuel has seen the most significant growth, while pharmaceuticals and electrical equipment have gradually increased their export shares.

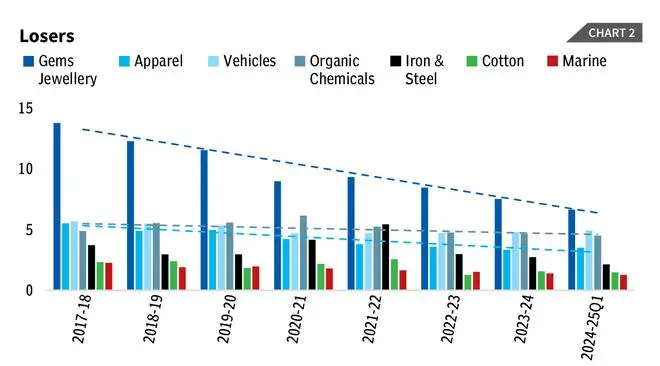

Notably, the electrical sector’s export share (as a share of total merchandise exports) rose from 3 per cent in 2017-18 to 8.6 per cent in the first quarter of 2024-25, a remarkable achievement. In contrast, the reactors/boilers sector has remained relatively stagnant, with a modest increase in export share from 6.8 per cent last year to 7.3 per cent this fiscal quarter. Among the sectors that have seen a decline are gems and jewellery, apparel, vehicles, organic chemicals, the marine sector, iron and steel, and cotton (Figure 2).

Gems and jewellery, in particular, have steadily lost export share, dropping from 13.7 per cent in 2017-18 to 6.6 per cent by the first quarter of 2024- 25. Auto exports (excluding railway vehicles) also fell from 5.6 per cent to 4.7 per cent between 2017-18 and 2023- 24, with a slight uptick to 4.9 per cent in the current quarter.

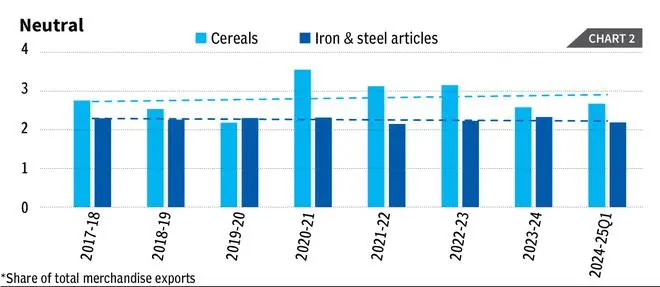

Similarly, organic chemicals declined from 4.8 per cent to 4.5 per cent, and marine exports dropped from 2.2 per cent to 1.2 per cent over the same period. Meanwhile, sectors like cereals and iron and steel articles have remained relatively stagnant or shown only minor fluctuations in market share (Figure 3). Value-added petroleum products have seen significant growth in recent years, driven by the availability of cheap crude oil imports from Russia.

Skewed growth

This rise, however, has skewed India’s export growth, as the increase is largely concentrated in this category and does not reflect substantial growth across other sectors. On the other hand, the electrical equipment and machinery sector has experienced steady export growth due to a consistent rise in global demand for products like power cables, generators, and turbines. Several sectors have experienced a decline in export shares due to various factors. These include reduced global demand in the auto industry, loss of competitive advantage in textiles, gems and jewellery, and infrastructure challenges in the marine sector.

Each of these issues requires careful examination, as there is no single solution that fits all. The constraints are specific to each industry and must be tackled with deeper insight and analysis.

Diversify exports

In conclusion, India’s export landscape has undergone significant shifts between 2017-18 and 2024-25, with certain industries emerging as clear gainers while others have seen declines or stagnation. The fuel sector, driven by mineral fuel exports, has been the standout performer, alongside steady growth in the pharmaceuticals and electrical equipment sectors.

While these sectors have capitalised on evolving global demand, industries like nuclear reactors and boilers have seen only marginal improvements. Despite being a late-comer to the technological revolution, India has achieved remarkable strides in achieving competitiveness in sectors such as electrical machinery, automobiles and pharmaceuticals. At the same time, India needs to develop sectors such as marine exports, that have potential for higher growth. To ensure long-term resilience, there is a need for export diversification across and develop a focused approach to sustain growth in high-performing sectors while addressing challenges in those that are lagging.

The writer is Professor of Economics & MBA Chair, IFMR Graduate School of Business, Krea University

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.