Rupee invoicing became a buzzword post the July 2022 RBI circular that allowed invoicing, payment and settlement of trade (exports/imports) in Indian rupee.

Now the new Foreign Trade Policy (FTP) 2023 wants to thrust exports on the wheels of rupee invoicing that proposes both trading partners raising their invoices and settling payments for their transactions on bilateral basis in rupees. The framework facilitates invoicing of exports and imports in rupee, market-determined exchange rates between currency pairs of the trading partners, and trade settlement via Special Rupee Vostro Account (SRVA).

Going by the BIS Triennial Central Bank Survey 2022, in terms of foreign exchange market turnover (daily averages), the dollar was the most dominant currency accounting for 88 per cent of the global forex turnover in 2022 , followed by the Euro (31 per cent), Japanese Yen (17), and Pound Sterling (13); the rupee accounted for a mere 2 per cent of global currency market turnover.

Similarly, as per IMF’s COFER data, the dollar’s share of global foreign exchange reserves during 2022 Q4 stood at 58.4 per cent, followed by Euro (20.5), Japanese Yen (5.5), Pound Sterling (5), Chinese Renminbi (2.7), Canadian dollar (2.4), Australian dollar (2), and Swiss Franc (0.2); India’s share was negligible.

The benefits of rupee invoicing are manifold, especially during geopolitical unrest and when economic sanctions are levied against India’s major trade partners.

Amongst the benefits, the prominent ones are lowering of transaction costs, a greater degree of price transparency, quick settlement time, promoting international trade, reduction in hedging expenses, reduced cost of holding foreign reserve by the RBI and, most importantly, internationalisation of the rupee.

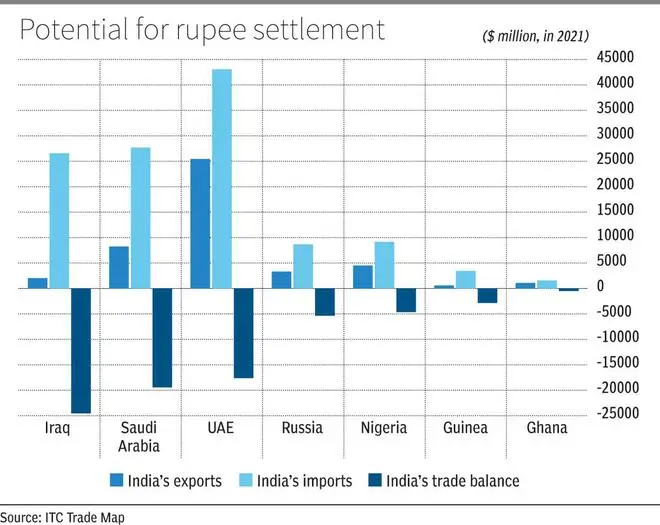

Analysis shows that invoicing in rupee would be more favourable with trade partners such as Russia, Saudi Arabia, Nigeria and the UAE, where India is a large importer and potential exists for Indian exports as well.

Some of the countries that hold potential for trade settlement in rupee are shown in the Chart.

India’s policy of facilitating trade in rupees has been gaining momentum, with the total number of SRVAs reaching 60 in a span of seven months (Rajya Sabha question on March 14). Eighteen countries have opened SRVAs to facilitate overseas trade in rupee. Of these countries, India recorded a trade deficit with eight — Botswana, Germany, Guyana, Malaysia, Myanmar, Oman, Russia and Singapore — in FY22.

The effectiveness of rupee trade, however, ultimately depends on whether India is running a net trade deficit or surplus with the participating trading partners, as well as the extent of trading in rupees in comparison to the total bilateral trade.

The writer is Senior Economist, State Bank of India

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.