India is today standing, in a Goldilocks fairy tale like quandary, at the threshold of 5G spectrum auctions. We have a history of several unsuccessful e-auctions and it is estimated that consumers and economy have lost more than ₹5 lakh crore due to nearly 60 per cent unsold spectrum since 2010.

Add to this the fact that we are about two years behind other major nations in introducing this powerful new technology with huge benefits for several industry verticals and the overall economy. It therefore becomes very crucial to have a successful 5G spectrum auction now and this, in turn, is predominantly linked to the correct setting of the reserve price in the auction.

Like Goldilocks, the TRAI faces the unenviable task of picking the value that is “just right” for consumers, industry and India. Obviously, a change from past practice would be called for. More of the same past medicine will not help.

5G is anyway a vastly different technology and requires a different approach compared to 2G, 3G and 4G. Since 2010, the TRAI has based the e-auction reserve price based on four theoretical models of spectrum valuation, each based on some assumptions.

One could argue till the cows come home as to which of the four is more appropriate for telecom and what weightage to assign to each and whether to fix the mean or median value. All these valuations are subjective to a great extent and could be faulted.

Spectrum, a public property

While changing from past practice, we have to appreciate that TRAI has to firstly take care of the paramount requirement of a defensible method that stands the scrutiny of authorities like CAG. It may be useful to recall the landmark Supreme Court judgement of March 1995 held that air waves (spectrum) constitute “public property” and must be utilised for the public good.

Several robust studies have established a direct correlation between higher mobile penetration (from use of spectrum) and growth of the economy as shown by GDP (Gross Domestic Product). As stated earlier, unsold spectrum from earlier auctions represent losses to consumers and economy. Clearly, sub-optimal pricing of 5G spectrum would cause ineffective usage, missed or delayed implementation of 5G and consequent irretrievable losses.

All spectrum valuations being subjective to greater or less degree and outcomes being arguable on validity, it might be advisable that the new approach be based on actual findings from auctions in other countries since two years of experience is now available, i.e., a price based on international norms.

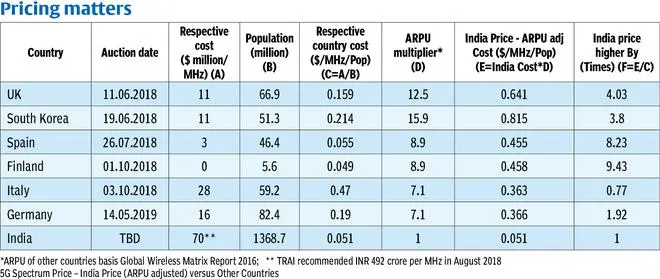

The present 5G Reserve Price for the main spectrum of 3.5 GHz band as recommended by TRAI ₹492 crore/MHz ( $70.29 million) and this is out of line with international norms. In absolute terms, this price is at least six times higher than other countries. Given significant differences in the per capita income and consumption patterns between countries, the variance needs to be factored to bring in parity.

Role of ARPU

Generally, Purchasing Power Parity (PPP) is used as an adjustment factor but since spectrum is not a product available in the open market and its use is licensed to the operators, the purchasing power of the operators has to be considered. This is driven by the revenue generating potential of spectrum, i.e., Average Revenue per User (ARPU) and hence, ARPU adjusted cost needs to be used to bring in parity.

For example, since the ARPU in the UK is 12.5 times of ARPU in India, a mobile user in UK contributes 12.5 times more than Indian user. Accordingly, the Indian spectrum price ($0.051) rises to $0.641 by applying the ARPU multiplier, which in this case stands at 12.5. As a result, the real price per MHz per population of 5G spectrum is about four times higher than $0.159 in the UK. Similarly, Indian price is about four times of South Korea, eight times of Spain and nine times of Finland.

Basis median value which helps to put away outliers’ effect, it is about four times more. So, to align India spectrum price to International norms, it needs to reduce to one-fourth of the current price, i.e., down to about ₹120 crore.

It is possible is to make our e-auctions successful and yield the desired outcome. The starting point for that of course is setting a Goldilocks Price, a price that is neither so high as to deter serious players from bidding nor so low as to encourage entry of non-serious entities.

Time is not on our side; we cannot afford to keep experimenting with a trial and error technique. India would do well to take the learnings from other countries and adopt a practical methodology instead of assumption-based theoretical models.

It should be noted that the adoption, as India’s Reserve Price, of the weighted mean final clearing price from other regimes, would itself be a very stringent level for our bidders.

The writer is Hon. Fellow of IET (London) and President of Broadband India Forum. Views are personal. Research inputs by Garima Kapoor.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.