Bitcoin, a decentralised digital asset, shot up to astronomical levels in the latter part of last decade. Bitcoin is built on the blockchain concept and the advent of blockchain technology, a ground-breaking phenomenon. The blockchain is a public ledger that records all the transactions and is implemented as a chain of blocks, where each block contains a cryptographic hash of the previous block.

The applications of blockchain in the finance domain is truly innovative and has been widely used in the mining of cryptocurrencies. There are thousands of cryptocurrencies, but Bitcoin is the most well-known. In 2011, the price of a Bitcoin was around $0.30, and it took several years to capture the investing fraternity’s attention. It was around $998 in 2017 and by December 2017 touched a high of $19,783. Bitcoin continued to gyrate, and it is interesting to note as to how volatile the crypto markets (including Bitcoin) have been recently.

In this article, we try to investigate if there is a method to the madness. The idea is to explore if the Bitcoin prices can be captured using one of the valuation approaches proposed by the industry players/academicians. There are several valuation approaches, but we stick to the one proposed by Adam Hayes.

The argument of this model is that even though Bitcoin is an intangible asset, it has an intrinsic value and has similar attributes like mining commodities. The model relies on the concept of marginal cost of production which implies that the Bitcoin prices should not deviate from its marginal cost. In other words, Bitcoin production can be visualised as a competitive market and thus the miners are expected to mine to a point where the marginal costs equal the marginal price.

In essence, the model argues that the Bitcoin price is a function of following: (a) hash power; (b) energy efficiency; (c) energy cost; (d) relative difficulty level (mining algorithm difficulty), and (e) block reward

Based on the work of Hayes (2019), the assumed dollar cost of energy is $0.135 per kWh. The estimated average energy efficiency over the period of 2014 to 2021 is 0.09 J/GH. When Bitcoin was first launched, each block mined had a reward of 50 Bitcoins. This reward was halved every four years and based on that the current block reward is $6.25.

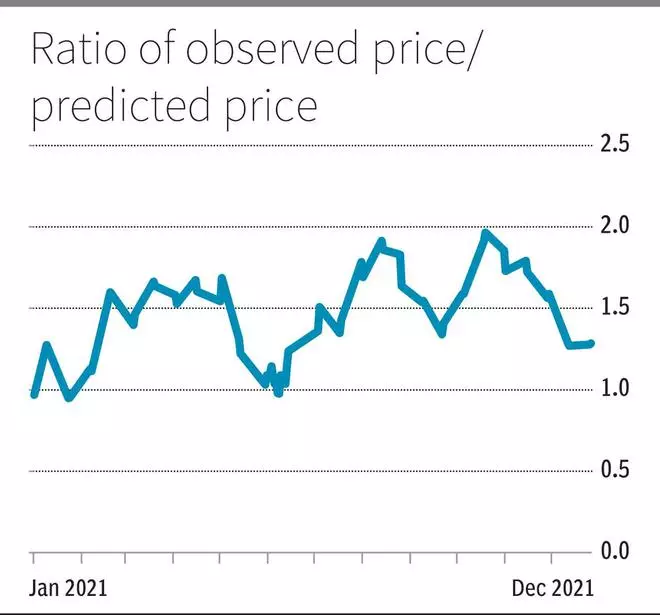

The difficulty level has been sourced from www.blockchain.com/ charts#mining. The difficulty level changes only every two weeks and hence we only make use of data of those dates. By using the above model, we try to predict the value of Bitcoin and then compare it with the actual observed price. The time-period for this study is January1, 2021, to December 31, 2021.

The forecasted price from the model has been compared with the actual observed price. The results are plotted in the Figure and it can be observed that the observed price does not deviate much from the predicted price.

Historically, it has been observed that it has been extremely difficult to value any new financial asset. For instance, the valuation of dotcom companies in 2000 was quite difficult as the business model was completely new as compared to the then existing business models. Similarly, cryptocurrencies, non-fungible tokens (NFTs), etc., have caught investors’ attention and the financial market would take some time to value these new financial assets.

Azmi and Subramanian are on the faculty of Thiagarajar School of Management. Views expressed are personal

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.