The IPO of ACME Solar Holdings (ACME Solar), an independent power producer of renewable energy (RE), is a mix of fresh issue to the tune of ₹2,395 crore and offer for sale of ₹505 crore.

Post the IPO, the promoters will still hold a sizeable 83.2 per cent of total shareholding. ACME Solar is 100 per cent owned by ACME Cleantech Solutions Private Limited (the selling shareholder) which in turn is held entirely by the promoter group.

ACME Solar plans to utilize ₹1,795 crore to repay/ prepay, in full or in part, outstanding borrowings availed by its subsidiaries.

With in-house EPC (engineering, procurement and construction) and O&M (operations and maintenance) segments, ACME Solar develops, owns, operates and maintains renewable energy plants. The company has an existing operational capacity of 1,340 MW. The under-construction projects and under-development projects are to the tune of 3,250 MW and 1,730 MW respectively, spread across solar, wind, hybrid and firm and dispatchable renewable energy (FDRE) segments.

At the upper price band, IPO is valued at around 19 times EV (enterprise value) to revenue, as against 32.1 times of Adani Green, the only comparable listed peer in India. Adani Green though is much larger in size with 11.2 GW of operational capacity.

ACME Solar was adjusted PAT negative (adjusted for gains from sale of assets), during the last 3 FYs, while in Q1 FY25, it turned nominally positive to ₹1 crore. To give a picture of the competition intensity in the industry, the company competes with Adani, NTPC, Tata amongst others. The industry is capital-heavy, as all investments are front-loaded with break-even possibly over decades. Dependence on largely government transmission networks along with delays in collecting dues from discoms (though better after implementation of LSP Rules, 2022) continue to be overhangs for the industry.

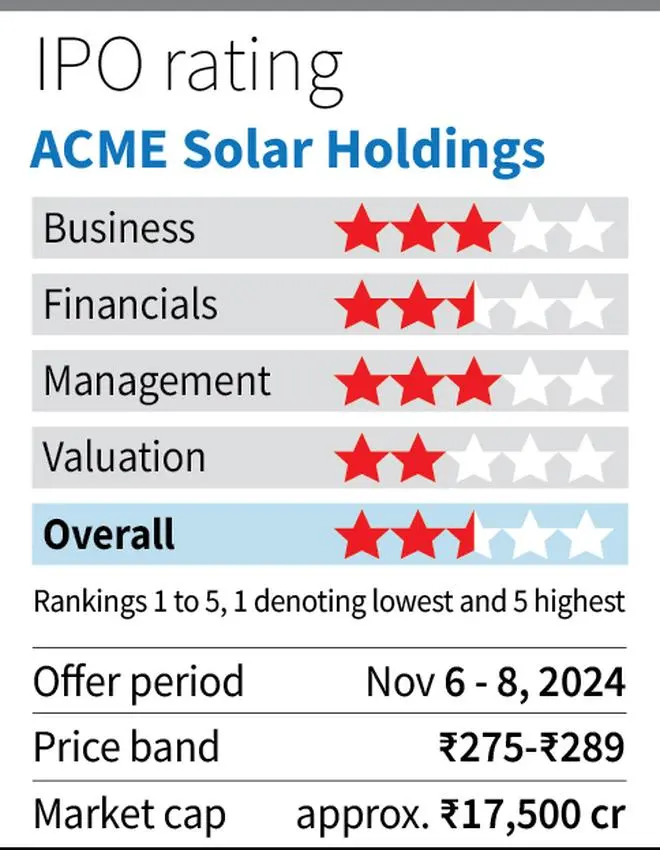

Considering the above facts, although the valuations appear cheaper than its listed peer and the industry has strong tailwinds and favourable government policies in place, investors could wait and watch before rushing to subscribe.

Business and Financials

In-house EPC and O&M capabilities result in an integrated project development approach which allows ACME Solar to keep a lid on costs and retain margins which otherwise would have to be shelled out. While these capabilities were provided by the parent ACME Cleantech as of FY24, a transfer agreement has been signed to move the businesses along with employees to ACME Solar, latest as of Nov 1, 2024.

ACME Solar generates revenue from sale of electricity and notable off-takers (customers) include NTPC, NHPC, SJVN, Solar Energy Corporation of India and Gujarat Urja Vikas Nigam, with AAA rated off-takers adding upto 65.8 per cent of total PPAs. The company has maintained average grid availability and plant availability to the north of 99 per cent since FY22, while the average CUF (capacity utilization factor) has been increasing Y-o-Y from 21.9 per cent in FY22 to 27 per cent in Q1 FY25, underlining solid operational expertise.

Management has been conservative, with the company winning bids only to the tune of 825 MW during FY22-23 on account of unfavourable return profiles of projects, while it has picked up since FY24 on tariffs turning reasonable.

This has been a prime reason for revenue and EBITDA staying stagnant (albeit nominally decreasing) during FY22-24. Although adjusted PAT has been weak, operating cash flow to EBITDA has stayed robust at greater than 100 per cent in FY23 and FY24. EBITDA margins are generally high in this business, considering most of the expenses associated with executing the projects are capitalized.

Project execution

The company has also expanded beyond solar, into wind, hybrid and FDRE projects. FDRE projects where battery energy storage systems are used to ensure round the clock supply of power, integrated with solar and wind power, are gaining traction and the company is geared-up with the required capabilities in this regard.

RE projects enjoy a shorter gestation period with projects largely operationalized within 24-36 months, while thermal, hydro and nuclear could take upto 6 / 10 / 15 years respectively, making it less risky and comparatively easier to execute.

ACME Solar predominantly leases the land for the projects, for an average tenure of 30 years with a clause to extend it. Not buying the land helps save a sizeable cost upfront. The company has a land bank of 1,200 acres, comprising both purchased and leased ones.

The company has been awarded 4,550 MW of grid connectivity, as of Apr-24. An additional 647 MW of connectivity was awarded recently, while an application for 3,300 MW has been made. This is critical for efficiently evacuating the power generated. With the industry facing shortages in respect of transmission capacity for new projects, ACME Solar is better placed with sufficient connectivity for all its projects under development.

Entering into power purchase agreements (PPA) with customers for the projects is a critical milestone for power projects. The company has contracted 97 per cent of its portfolio through long-term PPAs, typically for a period of 25 years. Weighted average residual period under the PPAs for operational projects was 19.9 years as of Jun-24. All the under-construction projects are also either secured with PPAs or in the process of the same. This provides strong revenue visibility across 20+ years. And importantly, RE plants warrant only nominal operational costs, as there are no fuel costs, thus ensuring stable cash flows.

ACME Solar has historically preferred a 75-25 Debt-Equity structuring for its projects, with tenure of the debt at around 20 years. The company also refinances the project once it commercializes them, saving around 75-100 bps on interest. Between FY20 and FY24, projects to the tune of 1,379 MW were monetized to churn and plough back capital into the business. But, post-IPO, management expects not to divest any of the assets, atleast in the short to medium term. As of Jun-24, Net Debt to EBITDA stood at 3.89 times (highest for the company since FY22). However, the IPO will help reduce the existing debt, making space for future leverage, for new projects.

The company’s ultimate holding company, MKU Holdings Private Limited (also owned by the promoter group), is also venturing into production of solar modules with a 1.2 GW facility, expected to be commercialized by the end of 2024. However, per the management, this is not meant for captive consumption and is in very nascent stages.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.