Investors buy into initial public offerings (IPOs) on two grounds – one, the belief that the IPO is valued reasonably compared to listed peers and the stock may not be available at such attractive levels post listing, and two, for possible listing pop. Life Insurance Corporation of India (LIC), which is set to become the largest listed insurance company in India and fifth largest listed insurance player globally, is positioned quite attractively if investors are to weigh the IPO against these yardsticks. At the price band of ₹902-₹949, the IPO is valued at 1.1x FY22 price to embedded value (P/EV). The valuations of private players much smaller in size is about 2.8x–4x FY22 P/EV.

For a retail investor/policyholder and/or employees, the pricing is inviting considering the discount of ₹45 for retail investors and employees and ₹60 for policyholders. Ten per cent of the issue has been specifically earmarked for policyholders. Further, there is no restriction on overlaps – that is, a policyholder can subscribe under the policyholder’s category as well as retail, and same is for employees holding LIC policies. The intent here seems to encourage participation and ensure reasonable allotment.

Importantly, LIC IPO’s pricing is a clear signal that the government has learnt from its mistakes of the past, namely IPOs of New India Assurance and General Insurance Corporation. Despite being leaders in their spheres, the IPOs didn’t take off well and the stock prices continue to lag their listing prices. The issuances were valued at a 10–12 per cent premium to the private players, which wasn’t taken by investors well.

Drawing merit from attractive valuations, large asset base, strong brand recall, trust and undisputed leadership in the life insurance space, we recommend our readers to subscribe to the IPO of LIC.

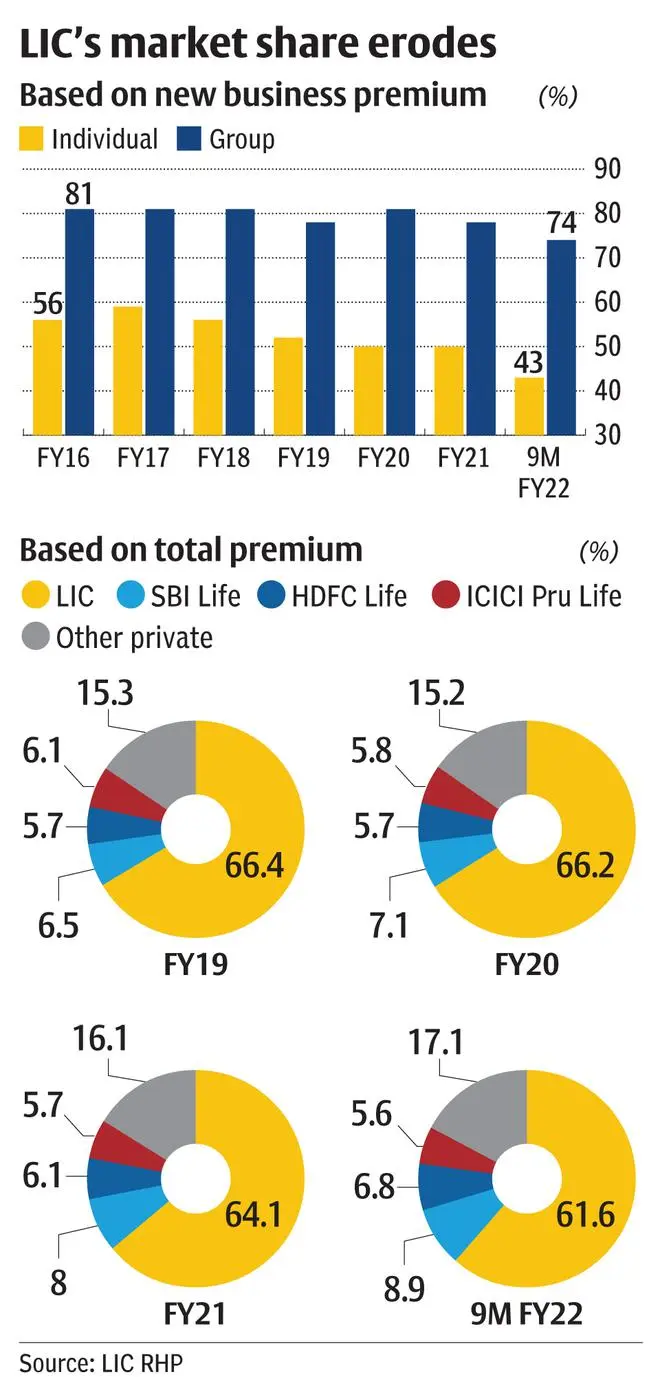

But be aware of what you are buying into. At 1.1x FY22 P/EV, the stock is factoring slower growth in premiums and profitability compared to private peers. Even in terms of market share, LIC has gradually been ceding share to private players. Heightened competition is particularly felt in the individual business, share of which to total premium for LIC stood at 64 per cent in FY21 (61. 6 per cent in 9MFY22). The impact of this is becoming more pronounced in LIC’s financials, with the corporation sweating it out to alter its product mix to resemble that of the private players in the long run.

Therefore, to begin with, in the initial years post listing, consider the LIC stock as a play on volume rather than its underlying financials and as bet on dividend (which is the case with most public sector stocks). Prior to the pandemic and IPO, LIC had a near 100 per cent dividend payout which makes it the highest among life insurers. The recent change in dividend-sharing plan, with shareholders set to get a larger pie of 10 per cent as against 5 per cent earlier, also works to the advantage of shareholders going forward. Also, considering that LIC has just begun its transformation process in terms of improving its profitability, having a long-term horizon while buying into the IPO would help as this metamorphosis may take some years to play out.

Scores on size

LIC is a household name for the Indian masses and is the first insurance option for many. Even if LIC’s policy premiums are steep compared to that of the private sector, (30–70 per cent higher across products on an average) it’s a price that one pays for the sovereign guarantee. This distinguishing factor of LIC vs its private competitors is unlikely to vanish and will remain the key reason why LIC would continue enjoying high brand recall and trust. Also, while competition may eat into LIC’s pie and a further erosion in market share for LIC cannot be ruled out (see charts), the possibility of its leadership position being threatened is highly unlikely, going by the capital constraints that the private players may be subjected to.

At ₹5.4 lakh crore, LIC’s embedded value or EV is six times larger than the top three players. If the top 10 are considered, then just LIC’s EV encompasses 84 per cent of the private players put together. Likewise, at ₹Rs 4.05 lakh crore of total premium in FY21, LIC handles 3.5x more assets compared to the top three private players put together. Therefore, private players overtaking LIC will remain just a distant possibility, unless there is a mega-consolidation among private players.

But is size alone enough?

In the old school of thought, prior to ICICI Prudential Life Insurance’s listing in 2016, size or the AUM base was a critical yardstick. But since then, the focus has shifted to profitability. I-Pru Life’s IPO at around 2.4x FY17 EV was then perceived as expensive despite the company being the largest private life insurer with an AUM base of ₹1 lakh crore. The criticism was that over 80 per cent of policies were skewed towards unit linked insurance plans (ULIPs) which are least value accretive. If HDFC Life’s IPO in November 2017 was a runaway hit, credit goes to the company’s ability to deliver top-quartile profitability or value of new business margin (VNB margin) of over 14 per cent. These margin levels were unheard of, and despite the issue being priced expensive at over 4x FY18 EV, investors didn’t mind shelling out the money for a quality franchise. Since then, the narrative for listed life insurance companies has changed and now profitability takes precedence over size.

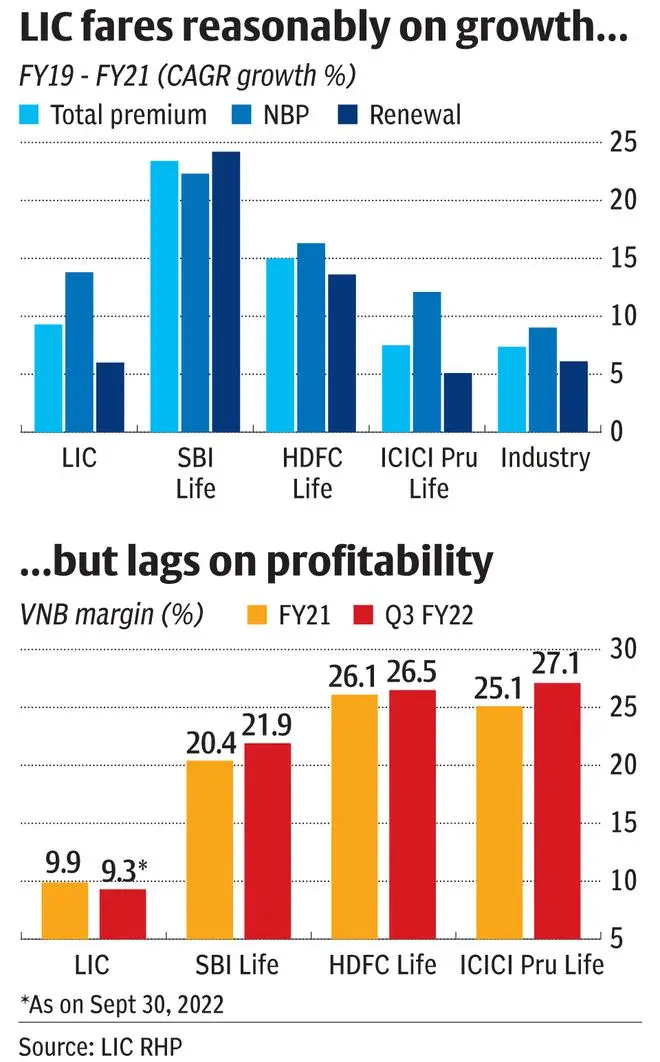

Should LIC be rated on metrics such as profitability, diversification and operational efficiencies, private players beat the giant hands down (see charts).

Business mix, a drag on profitability

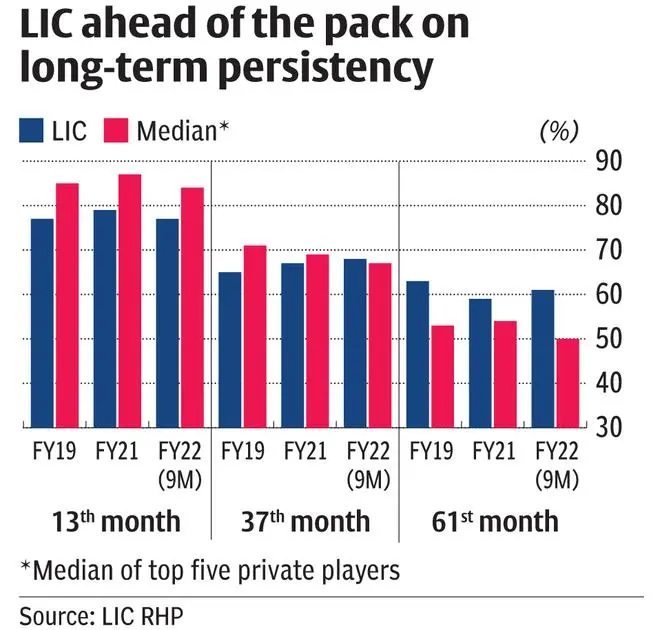

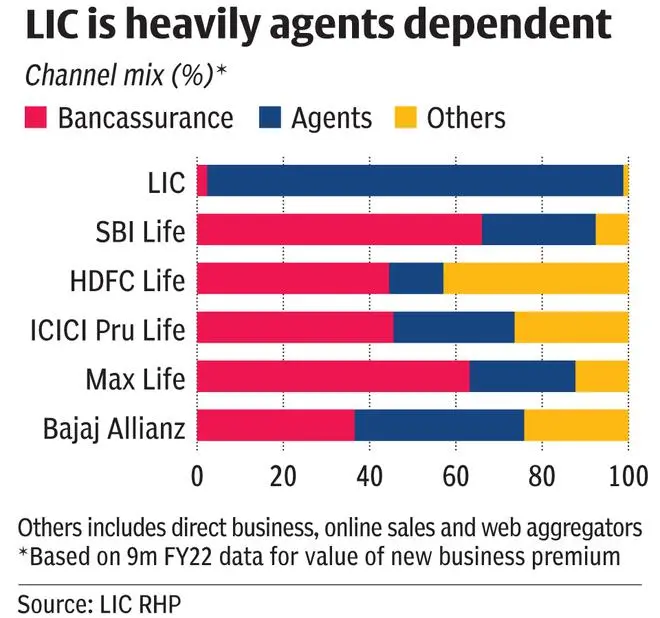

If LIC has presence in every corner of the country, it has a lot to do with the success of its agency model which accounts for over 95 per cent of its new business premiums. This has also helped the insurer do better on long-duration persistency ratios when compared to the average of its private peers (see charts).

Also, for a vast majority of LIC’s agents, this business is their bread and butter. Given the agency model’s relevance as a primary job-provider, moving away from this distribution channel may be a herculean task for LIC.

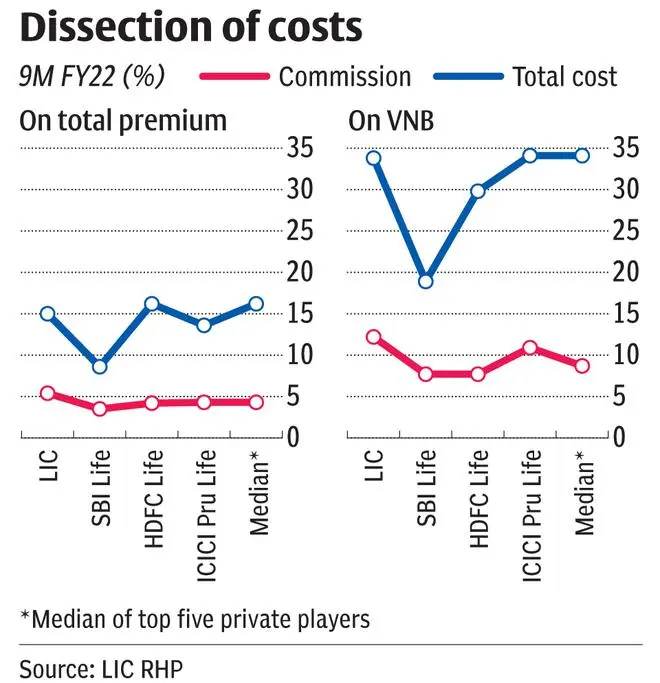

Unlike private peers who were built on the bancassurance model and were quick to adopt the digital distribution channels, LIC was late to join this party. Just recently, it has established its banking ties with IDBI Bank (its associate company) and its online modes of sourcing investors don’t add up to even a per cent yet.It also inked a very recent tie-up to list its offerings on Policybazaar. Agency commission at 12.2 per cent based on VNB or 5.4 per cent based on total premiums is a drag ion LIC’s cost structure (sum of agency commission and operating expenses) compared with private peers.

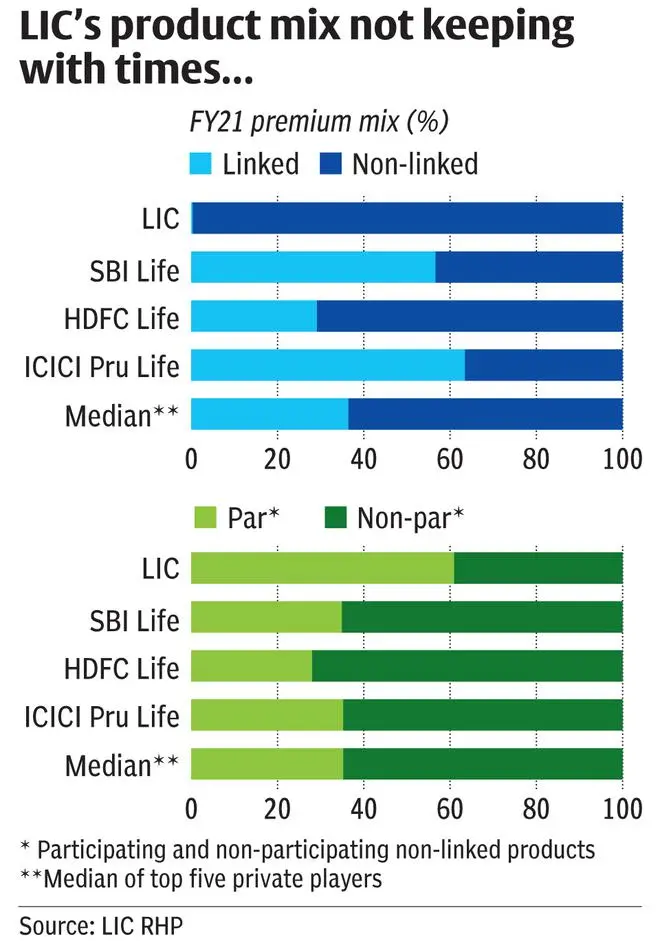

It’s also important to understand that the product profile of LIC is very different compared to private players.

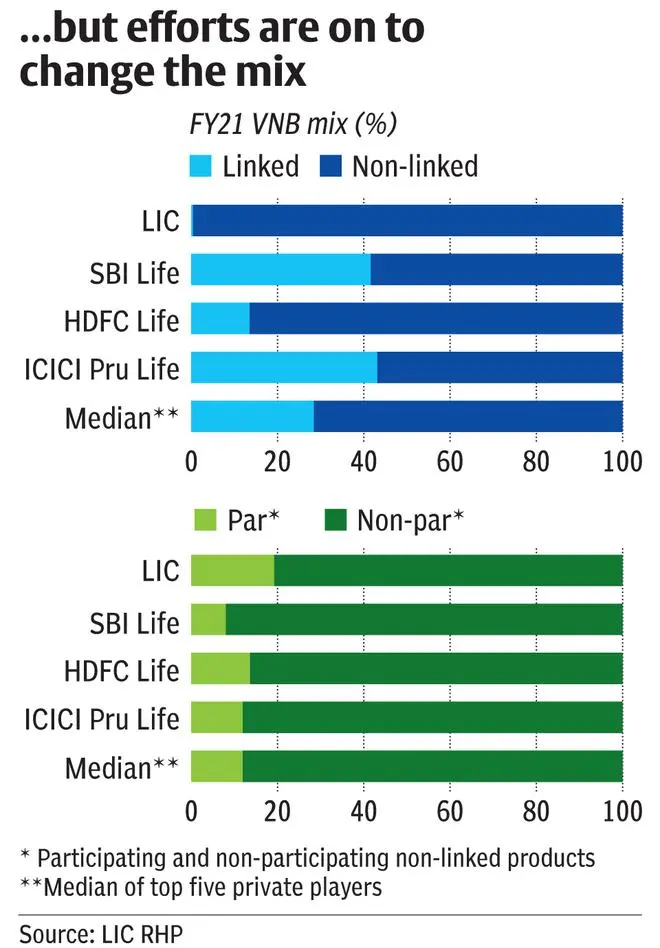

LIC operates on a 66:33 individual to group policies product mix. Its concentration on individuals business is relatively low compared to private players at over 80 per cent. But that said, at a time when private players are increasingly moving towards market-linked products, nearly 100 per cent of LIC’s business remains unlinked to market returns. What further drags the profitability is the unduly high bias towards participating (par) products. About 61 per cent of total premium for LIC comes from par products as against 35 per cent for top-five players. At 10–15 per cent gross VNB margins (based on industry average), par products are the second-least margin yielding ones, after ULIPs which offer less than 8 per cent gross margin. The high proportion of non-linked par products may continue to weigh on LIC’s profitability. While efforts are on to gradually realign its product mix in favour of non-par products, the needle here again may not move drastically, given the larger objective of covering as many people under the insurance net.

At 9.3 per cent VNB margin in September 2021, LIC has a long road to travel if the gap in profitability must be bridged with private players. The average VNB margin of top five players (around 25 per cent) is 2.7x larger than LIC’s (see charts). While LIC seeks to achieve 20 per cent VNB margin in two-three years, investors should have realistic expectations, given the aforesaid constraints.

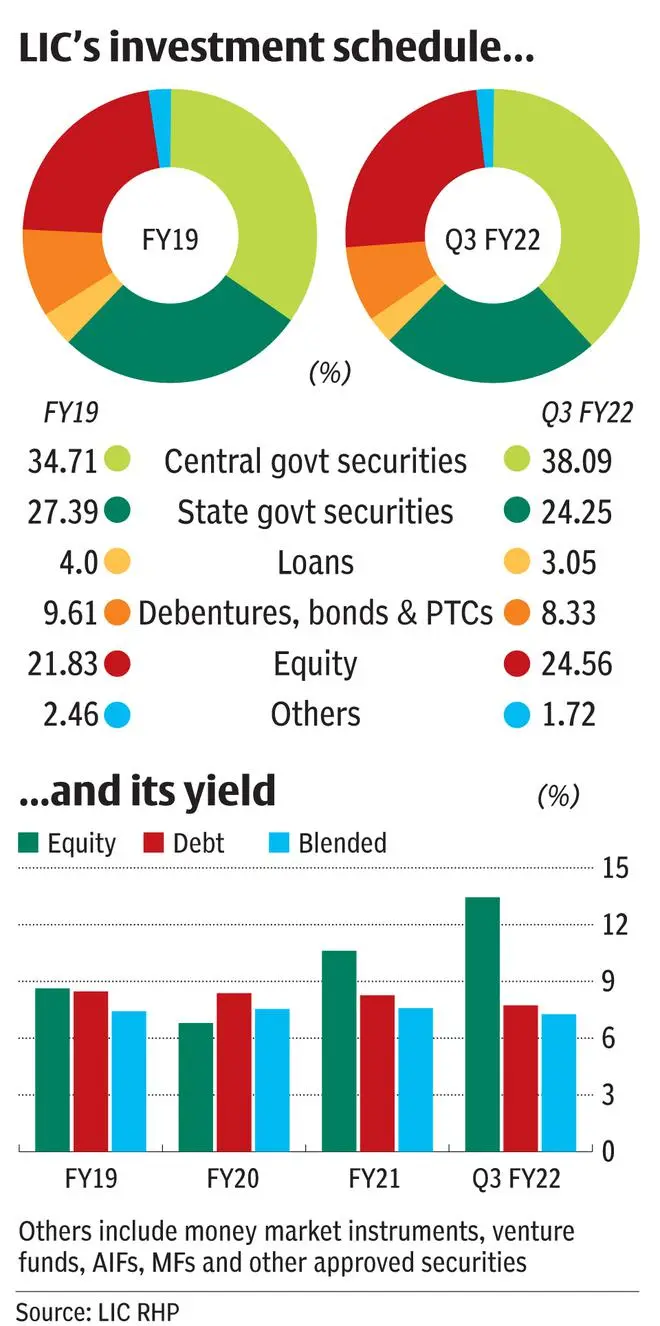

Despite high yield from legacy debt investments, LIC’s investment management hasn’t been great with relatively high NPAs in its debt book and a dominance of PSU holdings in its equity portfolio. Top three private players operate at near-zero non-performing asset (NPAs) on their debt holdings, while gross NPA of LIC stood at 7.78 per cent in FY21. As LIC writes off its bad loans, there could be a consequent drag on its financials. LIC has also played white knight to several entities in trouble, rescuing IDBI Bank and subscribing to AT1 bonds of PSU banks. Having the government as its owner has contributed to such sub-par investment decisions and public scrutiny will hopefully reduce such instances. But this may remain a monitorable even after listing (see chart on LIC’s investment book).

Points to note

At 1.1x FY22 P/EV, the LIC stock factors in some of the shortcomings discussed above. A quick re-rating of multiples for LIC to close in on the gap with private players seems unlikely.

When compared with global players, LIC is the only insurer with over 60 per cent market share in its home country. Foreign giants in the space such as Ping An Insurance, Allianz, AXA, Metlife and China Life Insurance have far less leadership position (7–21 per cent market share) in their home countries of China, the US and the UK. They trade at 0.8–0.9x P/EV as in the international context, insurance companies are viewed as highly mature businesses with a steady-state premium growth rate, usually between six and nine per cent. Therefore, their valuations are subdued compared to Indian companies which are seen as a play on under penetration and hence, growth potential.

The LIC stock is best-suited for investors with a long-term investment horizon. Owing to its size and objectives, the 25-30 per cent annualised premium (APE) growth displayed by private players in the last three years may remain unachievable for LIC. Instead, considering its scale and run rate, growing its APE by 10-12 per cent and VNB by 13-15 per cent may be the best-case scenario. Constant comparison with private players may not be a realistic approach for investors.

The listing of LIC opens the door for follow-on offers or subsequent stake dilution by the government. Therefore, in a scenario where the LIC stock may not re-rate hurriedly post-listing, the follow-on offers may present a better buying opportunity. But then, that’s not happening immediately too as for one year following the IPO, the possibility of further dilution does not arise. Markets are unpredictable as well and hence, a bird in hand is always worth two in a bush. In this context, investors can subscribe to the IPO as the pricing is realistic in today’s scenario.

Jargon Buster

Embedded value: An estimate of the consolidated value of shareholders’ interest in an insurance company. It is derived by adding the present value of future profits to the insurer’s net asset value.

Annual premium equivalent : APE is the sum total of recurring premiums plus 10% of new single premiums written during the year. The metric is used to compare sales between policies with the two different types of premiums - regular and single premiums.

Value of new business: VNB is the present value of the future earnings from policies issued during a period. It measures the additional earnings generated through the new policies issued.

Persistency ratio: Indicates the stickiness of the policy holder and what percentage of them pay their premium as per the due dates. It is usually benchmarked on 13th, 25th, 37th, 59th and 61st months.

Linked and non-linked plans: Returns in a linked plan are dependent on the performance of the market. Non-linked plans offer only insurance coverage and in some cases, guaranteed returns not linked to market performance.

Par and non-par products: In par or participating products, the insurer pays dividends to the insured. These are risk sharing plans where the insurance company shifts a portion of risk to policyholders. In non-participating or non-par products, the policyholder isn’t entitled to any dividend and accordingly premium tends to be a little lower compared to par products.

.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.