2022 is a tale of two perspectives for Indian markets. Amid a challenging global macro environment, Indian equities, with about 4 per cent gains, have significantly outperformed world (MSCI World down 18.6 per cent YTD) and peers (MSCI EM Asia down 21.9 per cent). At the same time, the S&P BSE Sensex, after three successive years of double-digit returns, has failed to cross that high-water mark in 2022, unlike in the 2003-07 or 1988-1994 bull runs.

While Indian stocks benefited from resilient fundamentals and de-coupling from global sentiments, the market was held together by year-to-date domestic institutional flows. This counterbalanced the heavy outflows from risk-averse foreigners ( ₹1.22-lakh crore), according to NSDL FPI data, after the US Fed’s most aggressive interest-rate hike in a generation.

For investors, this year will be bitter-sweet, and not because of the looming fears of a redux Covid. At one end, domestic indices, including most of the sectoral ones, have touched new highs. But at the same time, equity portfolios will lack the same pomp and enthusiasm, given the unequal participation from all stocks. Here is a nuanced look at how the year shaped up for market pockets, best performing stocks, as well as the disappointing laggards, the IPO segment, and much more.

World-beaters

If there is one word that personifies Indian stock markets in 2022, that has to be RESILIENCE. The geopolitical tension triggered by the Russian invasion of Ukraine in February, ensuing oil price rise, rising cost of debt thanks to US Fed’s inflation fighting and copious outflows failed to drag Indian benchmark indices down.

While India’s outperformance has been driven by government policy and a structural rise in the domestic equity saving pool, corporate earnings have helped too. At an aggregate level the 900-odd companies in BSE AllCap index have shown 28 per cent y-o-y rise in 12-month net sales and 15 per cent y-o-y jump in reported PAT, according to Capitaline data.

While the valuations of benchmark such as Sensex at price to earnings of 23.4 times (trailing) is more expensive than global markets and its own 10-year average (22.6 times), as per Bloomberg data, healthy earnings have helped to cement the India outperformance story.

This apart, better macros have helped Indian authorities such as RBI to run monetary policy that is less sensitive to the US Fed, and this has also aided in reducing the equity market’s sensitivity to global growth conditions and oil prices.

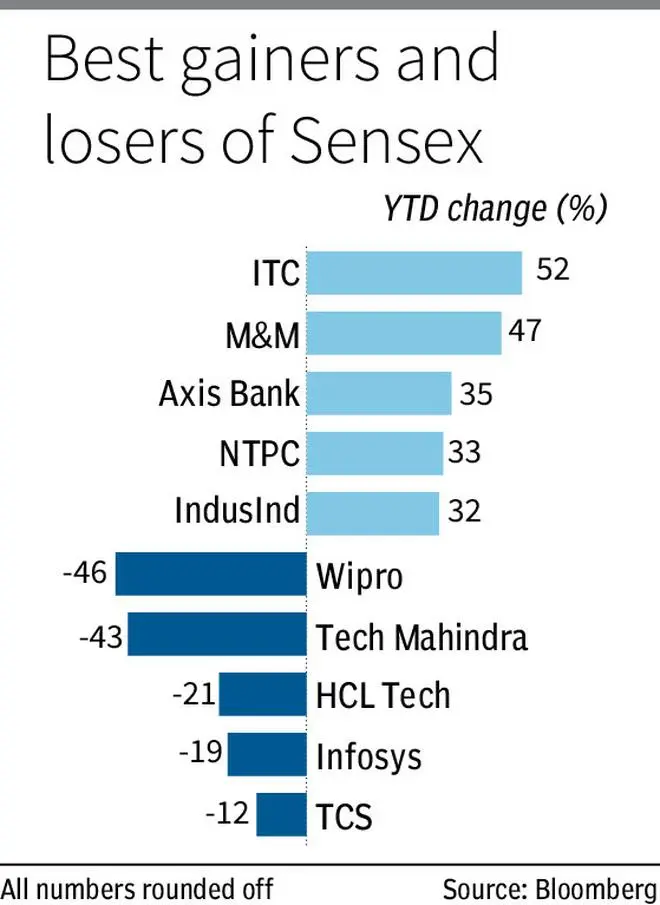

Helping Indian benchmark indices (Sensex) maintain their outperformance were the market movers, which included ITC, M&M, Axis Bank, NTPC and IndusInd. Had it not been for the laggards such as tech pack, India gains would have been bigger.

Market at highs, but not all stocks

The Indian market has managed to stay in the green with 4 per cent rise this year (up to December 21) and this is the seventh straight calendar year of gravity-defying gains. However, unlike the bull runs of previous years, there were no fireworks in mid-cap and small-cap space. The BSE Midcap index has gained 1.3 per cent YTD while BSE Smallcap actually fell 3.5 per cent.

Unlike 2021 when ‘ATH’ or all-time highs gained currency for both stocks and indices, 2022 wasn’t similar. The Sensex (on a closing basis) hit ATH 9 times out of 242 sessions this year, a slice of what it had done in 2021. This serves as a broad representation of what was happening underneath, where many stocks faced a similar fate. So, stock selection did pay off.

As a basket, large-caps i.e., the 100 biggest stocks in terms of market cap, saw 20 per cent hit respective all-time highs this year compared to 75 per cent in the preceding year. Examples include SBI, ITC, M&M, Eicher Motors, Cipla, Tata Power, Indian Hotels and Ashok Leyland.

In the mid-cap space i.e., 101st to 250th in mcap, just 15 per cent of stocks — including Linde, Vinati Organics, CRISIL, Grindwell Norton, Sundram Fasteners, Blue Dart, CUMI, Elgi Equipments, Radico Khaitan — zoomed to their all-time highs. This compares to 69 per cent in 2021.

The lack of buoyancy was evident in small-caps too. Less than 1 in 10 small-caps, such as HBL Power, Automotive Axles, Unichem, India Glycols, Sandur Manganese, Dhampur Sugar, Goodluck and Everest Industries, hit life-time highs in 2022. In 2021, nearly 5 out of 10 small-caps hit life-time highs. This represents the risk-averseness that set in and investors playing in this low-liquidity bucket of the market.

Valuation a differentiator

For those investors investing purely based on valuation metrics such as Price to Earnings (P/E), 2022 had a clear direction. Given that the market mood was cautious amid heavy selling by foreigners, stocks with high PE didn’t do as well as stocks with low PE. Value-investing made a comeback of sorts.

For instance, the basket of 200 stocks with highest PE (average PE 126) in 2022 gave an average return of -2.5 per cent while a group of 200 stocks with lowest PE gave an average return of 15.1 per cent. So, there was a sharp outperformance of over 17 percentage points in favour of low PE stocks (average PE of 8).

Low PE stocks such as CPCL, Bengal & Assam, Jindal Drilling, West Coast Paper, Rail Vikas, JK Paper, Mazagaon Dock, GE Shipping, HAL, Apar Industries etc. doubled investor money. Overall, 53 per cent of low PE stocks clocked positive returns.

Though high PE stocks such as Adani group scrips, TajGVK Hotels, Hindustan Foods, JMC Projects, Tejas Networks, Mahindra Holidays etc. have done well in 2022, 65 per cent of the 200 most valued stocks made losses this year. The biggest losers in this list are Deep Polymers, Tanla, Metropolis, Gland, FSN E-Commerce, Nazara, Quess Corp.

Investors in loss-making companies (based on 2021 numbers) Future Consumer, Sintex Plastics, Dhani Services, Gayatri Projects, Xelpmoc Design, One 97, Sadbhav Engg. and Zomato were the worst-hit in terms of YTD losses.

Aatmanirbhar market strengthens

2022 is an year where FPIs, a dominant force, were net sellers for 8 months out of 12. In total, they sold ₹1.22 lakh crore of equities i.e. ₹10,000 crore a month. This indicates a much soured mood compared to 2021 where they poured just ₹25,000 crore and ₹1.7 lakh crore in 2020.

A troika of factors such as Fed’s rate hike missives, historically high valuations in Indian stocks and profit-booking may have led the foreign hand to weaken its hold. But what stands out is the resilience shown by domestic institutions, led by massive show of confidence by domestic investors in products such as mutual funds. This is Aatmanirbhar Bharat effect! Note that in 2008 FPIs pulled out over ₹52,000 crore and Sensex fell 52 per cent.

Even as FPIs sold Indian stocks in droves, equity funds in India received aggregate net flows of ₹1.53 lakh crore or ₹13,900 crore odd each month. This has helped counterbalance the relentless selling by FPIs throughout the year. Mind you, the MF inflows are only a part of domestic institutional investments as pension funds, insurance money in equities is not captured in these figures.

Latest shareholding data for also confirms the strengthening DII trend. FPI ownership, in terms of value, fell by 169 basis points (bps) from 20.72 per cent in December 2021 to 19.03 per cent in September 2022, according to an analysis covering 1,776 NSE-listed stocks by primeinfobase. During the same period, DII ownership rose by 158 basis points from 13.21 per cent to 14.79 per cent, driven by both MF and insurance ownership gains. However, direct retail investor holding stayed flat at 7.33 per cent.

Best and worst

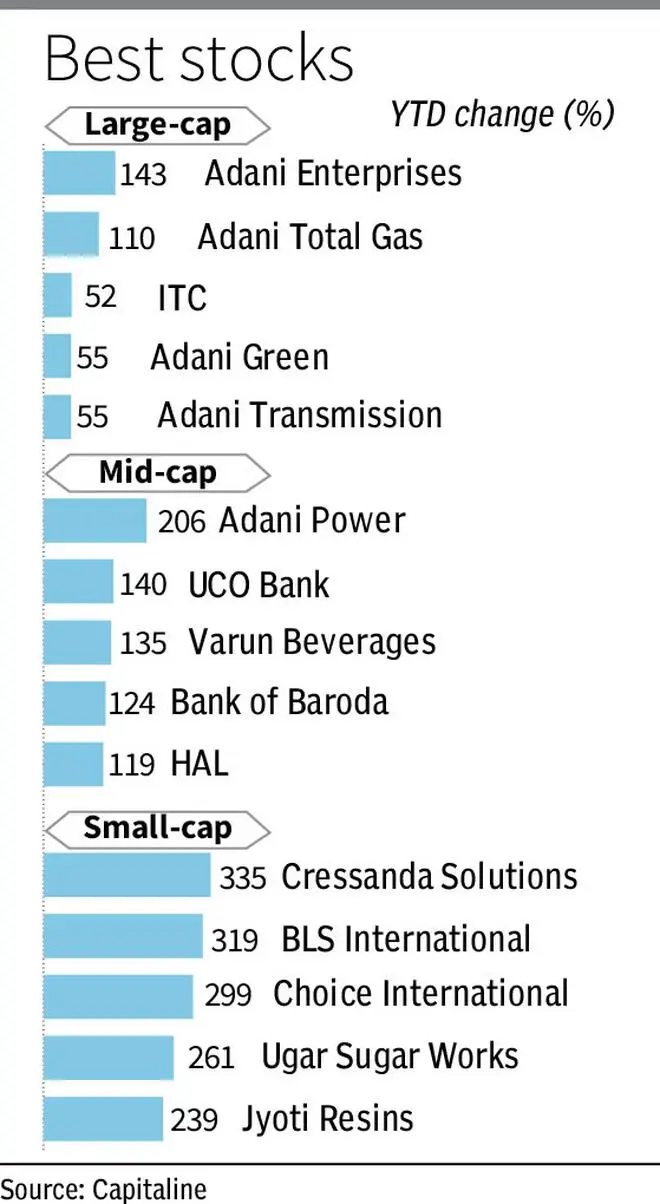

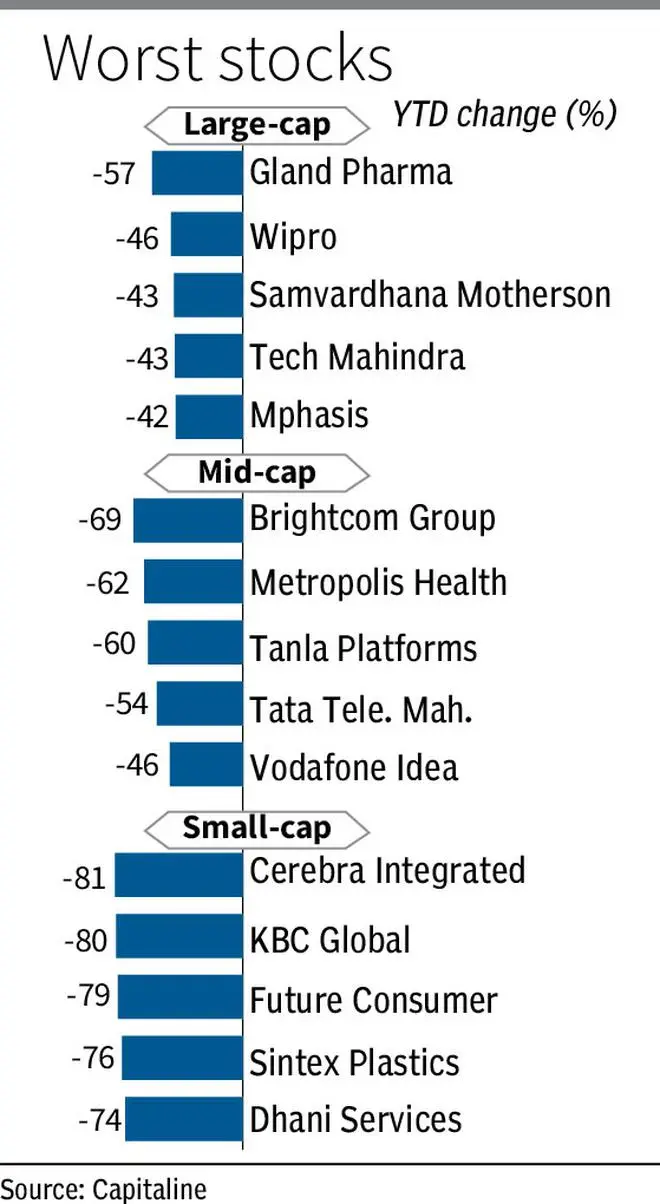

If you look at the BSE Allcap index that has about 1,070 stocks, investor wealth increased by over ₹16 lakh crore or 6 per cent in 2022. This compares with 35 per cent in 2021. Adani group stocks led the large-cap winners list, while pharma and tech names lead the laggards.

Mid-cap winners list was led by Adani Power, UCO Bank, Varun Beverages, BoB and HAL, Indian Bank and Union Bank. Mid-cap laggards were led by Brightcom Group, Metropolis Health., Tanla Platforms, Tata Tele. Mah. and Vodafone Idea. The selling was much more pronounced in mid-caps compared to large-caps.

Small-caps form the largest basket in BSE Allcap, with over 800 stocks. At a total investor wealth level, small-caps did not add anything material this year. This shows the uneven nature of gains of the domestic market. Given that small-caps are most risky in cap spectrum, the number of stocks that have doubled in 2022 stood at over 50 compared to over 200 in 2021. Best performers include Cressanda Solutions, BLS International, Choice International, Ugar Sugar Works, Jyoti Resins, Mazagaon Dock, and Vadilal Industries. About 400-odd small-cap stocks destroyed investor wealth in 2022.

Even though Indian markets saw their largest ever public issue (LIC), total fund-raising from IPOs this year dropped by over 50 per cent to ₹55,146 crore (Jan-Nov 2022) compared to ₹1.18 lakh crore in 2022. Newly-listed stocks did not do that well. Of the about three dozen newly-listed stocks on BSE mainboard, about one-third are trading below their respective IPO price. The best performers include Adani Wilmar, Venus Pipes, Hariom Pipes, Veranda Learning, Vedant Fashions and Prudent Corporate Advisory. IPO stocks such AGS (down 61 per cent), Delhivery (-32 per cent), Inox Green (-30 per cent), LIC (-28 per cent) and Dharmaj Crop (-16 per cent) lost big.

But, SME IPOs saw their best time in four years, with a total of ₹1,660 crore mopped up in 2022 via 96 offerings. This is more than double of nearly ₹750 crore garnered in 2021. The best-performing SME IPOs this year have been Rachana Infra (up 716 per cent), Varanium Cloud (up 646 per cent) and Cool Caps (up 596 per cent). But over two dozen SME IPOs are trading below their respective issue price, with the biggest laggards being Pace E-commerce, Ishan International, Global Longlife Hospital, Silver Pearl Hospitality and Naturo Indiabull.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.