Gold: ETFs are the ideal way

The tradition of buying gold for Diwali seems to be a well-thought-out one, considering that this asset class provides good diversification from the traditional equity and debt investments. In uncertain times for the economy, gold is a safe haven. It is also a hedge against inflation and, particularly for us, it can offer some protection against rupee depreciation as well.

For example, in dollar terms, gold has lost nearly 9.4 per cent year-to-date whereas it has gained by 5.3 per cent in terms of rupee. Therefore, it has outperformed the benchmark index Nifty 50, whose YTD gain is 1.3 per cent, doing well in a high inflation environment.

Going by the charts, from the current level of ₹50,626 (per 10 gram), the prices of gold could fall from here in the near-term before marking new peaks. But rather than being too short-term focussed, it is always better to take long-term view and hold some amount of gold in your portfolio irrespective of the market and economic conditions given its proven safe haven and inflation hedge status. And sentimentally, Diwali can be a good time to take exposure.

There are various avenues to invest in gold — such as Sovereign Gold Bonds (SGBs), gold ETFs (Exchange Traded Funds), gold funds, digital gold bars and coins.

While SGBs are backed by the RBI, it is an eight-year investment, with a lock-in period of five years. Selling in the secondary market post lock-in is allowed, but it is easier said than done due to liquidity issues. Digital gold operates in a regulatory vacuum and sometimes spreads between buy and sell prices can be very high, adding to your cost. Bars and coins are physical assets unlike the above and therefore storage can be a concern. This is where gold ETFs become a viable option for investors.

Gold ETFs have no lock-in period. Some ETFs are very liquid, charges are reasonable, and they can be held electronically. Consequently, there are no storage concerns. Above all, gold ETF is well-regulated, and comes under SEBI’s purview. It can be bought and sold online through exchanges, like stocks.

Performers, at a glance

When historical returns are considered, all the ETFs listed have produced similar performances. The three and five-year returns of these are more or less the same at around 8.7 per cent and 10 per cent, respectively. Among the ETFs, Nippon India ETF Gold BeES has the lowest impact cost of 0.03 per cent, indicating good liquidity, and it also has the highest AUM (Assets Under Management) of ₹6,532 crore as of end of September. Although the expense ratio, at 0.79 , is a bit higher compared to peers, its tracking error is the lowest at 0.18 per cent. So, this can be your primary preference. Alternatively, one can opt for HDFC and SBI Gold ETFs, which have low impact cost and tracking error with decent AUM.

Gold funds, which are basically fund of funds, offer the SIP (systematic Investment Plan) route to invest in Gold ETFs for a slightly higher charge than ETFs. This route can be used if you don’t have a demat account. Some prefer gold funds as the option of SIP ensures investing discipline. ICICI Prudential Gold Saving Fund and SBI Gold Fund, with lowest expense ratios (direct plan) of 0.09 and 0.1 respectively, can be good options.

With respect to taxation, gold ETFs and gold funds are taxed alike. Short-term capital gains (less than three years) are taxed as per the slab rate and long-term capital gains attract 20 per cent with indexation benefit.

Silver: Good avenue to beat inflation

While much of the precious metal investing focus is on gold, silver could also be a good avenue this Diwali for investors to beat inflation over the very long term. But unlike gold, which is generally known to rally more when markets turn wobbly and economic growth or macroeconomic factors stutter, silver’s fortunes are more linked to the prospects of the economy and specifically to industries that use the metal in their devices. Silver has investment, industrial and ornamental uses and therefore tends to do well in a booming economy.

In the last one year, silver prices have been volatile, and have fallen over 12 per cent (MCX Silver prices) as fears of higher inflation and slowing global growth hurt the shining metal’s prospects.

How silver can add shine to your portfolio

Silver’s price movements can be more volatile than gold’s. But it can also be rewarding over the long term in terms of getting past inflation. Some points to note for investors.

- Low correlation with the Nifty 50 TRI: The annual returns data of silver prices taken from the MCX and Nifty 50 TRI from CY2006 to YTD 2022 (from Edelweiss fund presentation) indicates that the correlation between silver and Nifty movements is just 0.36. A coefficient of 0.3-0.5 suggests low correlation between the two variables being compared. Therefore, silver would chart a somewhat independent course. In 2010, 2016 and 2020, silver prices rallied more than the Nifty 50 TRI. Silver can also have multiple years of correction and could fall more than gold for extended periods.

- Silver’s prospects robust as uses extend to fast-growing segments: The metal is used in solar cells. From 3,267 tonnes in 2021, demand for silver in the segment is set to average 4,548 tonnes over 2022-25. Silver is also used in electric vehicles, batteries and smartphones. Another key growth area is the use of silver in 5G networks.

According to Metals Focus, Silver Institute, World Silver Survey 2022, silver has a 49:51 split between industrial, jewellery uses on the one hand, and investment demand on the other.

- Demand outstrips supply: The demand for silver is always higher than the available supply. This is likely to give a certain pricing power or price momentum to silver, especially as industrial demand rises when the domestic economy moves to a high growth mode. Compared to the demand of 36,950 tonnes projected over 2022-25, the supply is likely to be only 31,369 tonnes.

- Beats inflation on a rolling basis: According to data from Bloomberg, the average five-year rolling return of silver from June 1999 to September 2022 is 13 per cent, which is much higher than the inflation rate.

What must investors do?

Investors can take the ETF route to investing in silver. Those without a demat and trading account can consider investing via silver fund of fund route. Small lump sums may be preferable over SIPs for investing in silver. Your exposure to silver must be less than what it is to gold — ideally around 5 per cent or less.

ABSL, ICICI Prudential and HDFC charge 0.37-0.4 per cent on their Silver ETFs. ICICI Prudential Silver FoF has an expense ratio of 0.09 per cent, while ABSL Silver FoF charges 0.1 per cent. Investors can choose from among these options.

Equity: Go for Nifty 100 passives

Markets have been sluggish since last Diwali, with equities at headline index level down two per cent. Global and macro headwinds have squeezed the juice out of the bulls. However, corporate earnings (Nifty 100) in the last 12 months have grown 38 per cent year on year. Earnings are anticipated to grow 19 per cent in calendar year 2023 based on Bloomberg estimates taking the base of current trailing twelve months. This shows that the fundamentals are intact.

Large-cap stocks offer a good blend of stability and defence in volatile markets. Compared to Nifty 50 and Nifty Next 50 indices, the Nifty 100 offers a more diversified substitute for investors looking at broader market exposure. Hence, long-term investors with low risk appetite can use this opportunity to deploy a lump sum such as Diwali bonus, in 3-4 tranches, to buy Nifty 100 ETFs and index funds.

Nifty 100 represents top 100 companies based on full market capitalisation (m-cap) from Nifty 500. Investors looking at large-cap passive products can consider Nifty-100 based products today for two reasons. One, compared to the Nifty 50's around 65 per cent and Nifty Next 50's 15 per cent representation of the free float market capitalisation of the stocks listed on the NSE, Nifty 100, at over 75 per cent representation, offers a much broader index representation of the diversified equity market in India.

Top weights of Nifty 100 include RIL, HDFC twins, ICICI Bank, Infosys, TCS, ITC, Kotak Mah. Bank, HUL and L&T. Corrections in Nifty 100 stocks such as Tech Mahindra, BPCL, mPhasis, Wipro, Samvardhana Motherson and Zomato, etc., now provide the opportunity to take exposure. A spirited show by 4 Adani group firms, HAL, BoB, BEL, ITC and M&M, has held the basket steady in the last twelve months.

Two, Nifty 100 is a good way to get exposure to the Nifty Next 50 stocks, without the accompanying volatility, if you went for the latter option. Do note that the Nifty Next 50 index has outshined broad-based Nifty 50 over various periods consistently on a rolling return basis, but returns have seen wilder swings (in terms of standard deviation). The focus on top-100 companies means even the last of the companies in the list will have over ₹45,000 crore in m-cap. In terms of returns, Nifty 100 has beaten Nifty 50 by 30-50 basis points CAGR across 1, 3 and 5-year periods in terms of rolling returns over the last decade. Though Nifty Next 50 index has the edge over Nifty 100 in returns, the former is much more volatile.

Prescription for growth

Nippon India ETF Nifty 100 and ICICI Pru Nifty 100 ETF offer a simple, cost-effective and liquid way to gain from the stock price movement of Nifty 100. Plain-vanilla Nifty 100 ETFs provide entry and exit facility during market hours usually five days a week, cost half as much than index fund counterparts and also have longer track records. Both the ETFs mentioned have shown reasonably thin premium/discount over NAV over the last three years, acceptable impact cost, decent three-year annualised tracking error, economical expense ratio (about 0.5 per cent), good trading volumes and an over nine-year track record.

For those who do not have a demat account to buy ETFs and want the option of hassle-free SIP route, Nifty 100 can be played via HDFC Nifty 100 Index Fund, IDFC Nifty 100 Fund or Axis Nifty 100 Index Fund. Index funds allow you to buy them at the set price point at the end of the trading day, thus removing the need to experience operational issues such as price spread over NAV, trading depth intricacies, etc.

Debt: Options aplenty with zero credit risk and attractive yields

Successive rate hikes by the RBI in the last few months have got the fixed income space buzzing. Sovereign securities, which have zero risk of default, are offering mouth-watering opportunities if you are looking to invest your Diwali bonus or incentive. And taking the debt mutual fund (MF) route to investing in these instruments comes with ease of access as well as tax efficiency.

There are three attractive options today among debt MFs to invest in sovereign instruments — 10-year constant maturity gilt funds, 5-year G-Sec ETFs/ Fund of Funds and target maturity funds (TMFs) investing in g-secs and SDLs (State Development Loans), maturing over different years into the future. You can choose to invest in these based on the time horizon you are looking to invest for, as well as the returns (called Yield to Maturity) on offer.

10 and 5-year gilt funds

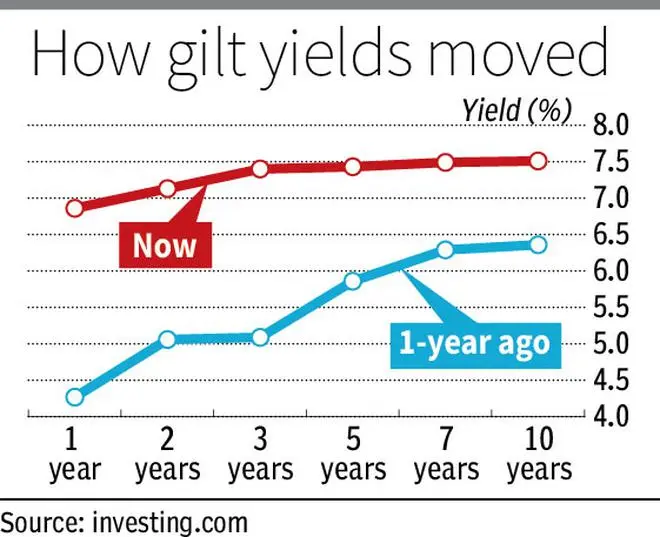

Yields on 10-year g-sec, which stood at 6.3 per a year ago, are at 7.5 per cent today. While it is difficult to guess whether yields will top out here or move further up, these levels were last seen in 2018/2019 and hence, it makes sense to take some exposure now. Bond prices and yields move in opposite direction and with yields rising, prices on the 10-year gilts are beaten down now. An investment today will help ride on the recovery in bond prices, going forward, as well as gain from interest accrual in the securities in the portfolio. 10-year constant maturity funds invest in a portfolio of g-secs such that the average maturity remains at around 10 years. This is different from plain-vanilla gilt funds which adjust duration of their portfolio based on market conditions. Thus, while 10-year constant maturity funds sport negative returns in the last one year due to falling bond prices, active adjustment of duration has helped cushion the fall for most gilt funds.

In this 10-year constant maturity category, the SBI Magnum and ICICI Pru funds can be considered for investment. As of end-September, the YTM of both these funds stands at 7.4 per cent, up from 6.2-6.3 per cent a year ago. The funds are open ended and can be exited anytime, but if you stay invested for 10 years, you will realise the current YTM, which is attractive. A study of daily rolling returns over the past 15 years for these funds shows that there are no instances of negative return if you hold on for at least three years. Besides, minimum daily rolling returns over 10 years is at 6.1 per cent for the SBI fund. For ICICI Pru fund, minimum of 7.8 per cent over 7 years (fund more recent than SBI, hence 10-year rolling return track record not available).

For those with a shorter horizon, 5-year g-sec funds are attractive today. Yields on 5-year g-secs are now at 7.4 per cent, just 10 basis points lower than the 10-year bonds. A year ago, the spread was at 50 basis points. 5-year g-secs are also less sensitive to interest rate changes than their 10-year counterparts and hence see less volatility in prices. Some ETFs are available here but liquidity may depend on trading volumes. Motilal Oswal 5-year g-sec ETF has a Fund of Fund option to override the disadvantages of an ETF and can be considered.

Target Maturity Funds

A host of TMFs investing purely in g-secs are also available to take advantage of the rise in gilt yields across tenures. What distinguishes TMFs from the above 10-year/5-year funds is that they come with a certain maturity. On maturity, you get the investment back with the yield you locked into at the time of signing up. Given the rising gilt yields, many TMF NFOs focused in this category are being launched. To lock into the current yields, you can either invest in the NFOs or in existing funds based on your time horizon as well as the YTMs of the funds. In the pure gilt funds category, IDFC Crisil Gilt 2027 and 2028 funds are good funds to tap into the sweet spot which the 5-year gilt yields is at, for instance. SDLs tend to have higher spreads over G-secs, without any higher risk. TMFs investing in SDLs sport slightly higher YTMs than their pure gilt counterparts. Many of the SDL TMF options with high YTMs of 7.5 per cent or slightly more are maturing in 2027. Fund choices in this segment are Kotak Nifty SDL April 2027 or April 2032 Top 12 Equal Weight Index Fund, Aditya Birla Nifty SDL April 2027, Axis CRISIL IBX SDL May 2027 and ICICI Pru Nifty SDL Sep 2027.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.