When investing in debt options for the long term, the main adversary to beat is, not your colleagues or social media acquaintances, but inflation. Winning this race is not easy for folks stuck in a high-inflation country like India. Last week, the government made our job a little harder by doing away with the inflation indexation benefits on debt mutual funds.

From April 1, with gains being taxed at slab rates, debt mutual funds have joined the ranks of the other fixed income options — fixed deposits, NCDs, small savings schemes and Government of India bonds — where interest is taxed at your slab rate. This raises the bar on the returns you need to get to a positive real return from debt investments.

India’s CPI inflation has averaged 6 per cent over the decade. At effective tax rates of 10.4 per cent, 20.8 per cent and 31.2 per cent including cess, you would need a pre-tax yield of about 6.7 per cent, 7.5 per cent and 8.7 per cent respectively, to match this inflation rate.

But seeking higher yields from debt instruments comes with a higher risk of default. So, can you fish for higher yields without compromising too much on the safety aspect? Yes, you can. We run through the entire gamut of debt options, to offer these actionable ideas.

Good old PPF and EPF

With the government on a mission to root out tax breaks, the pool of debt instruments that offer you a tax-free interest has been drastically shrinking. But two government-backed avenues that continue to offer tax-free interest payouts are the Employees Provident Fund (EPF) and Public Provident Fund (PPF).

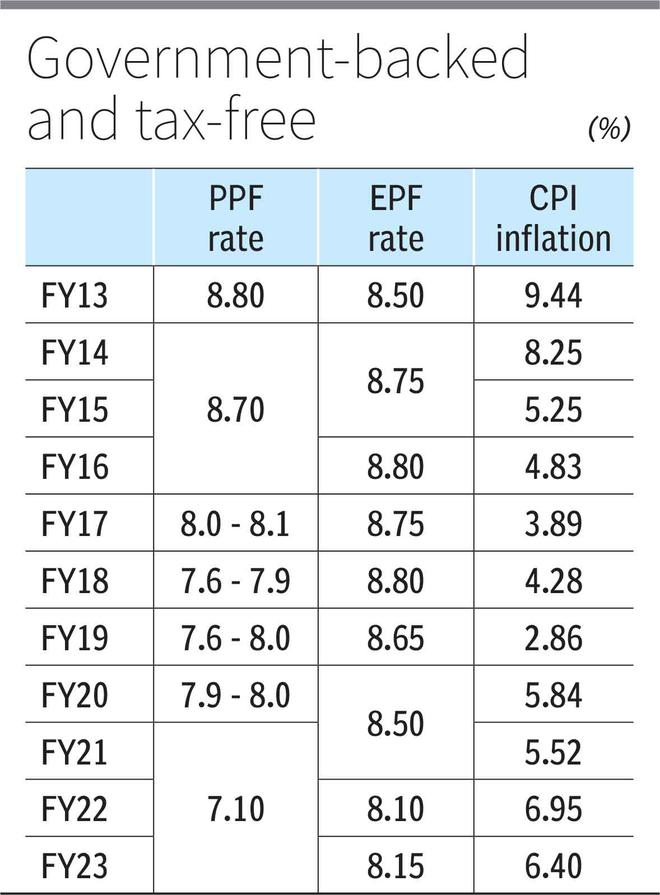

The PPF, which represents a government of India borrowing, pays interest based on government-declared rates every quarter. It currently offers 7.1 for the April-June 2023 quarter. In the last decade, interest rates on PPF have ranged between 7.1 per cent and 8.8 per cent.

The Employees Provident Fund (EPF), which invests in Central and State government securities and highly rated corporate bonds, with about a 15 per cent equity allocation, has credited interest to its subscribers at 8.10 to 8.80 per cent in the last ten years.

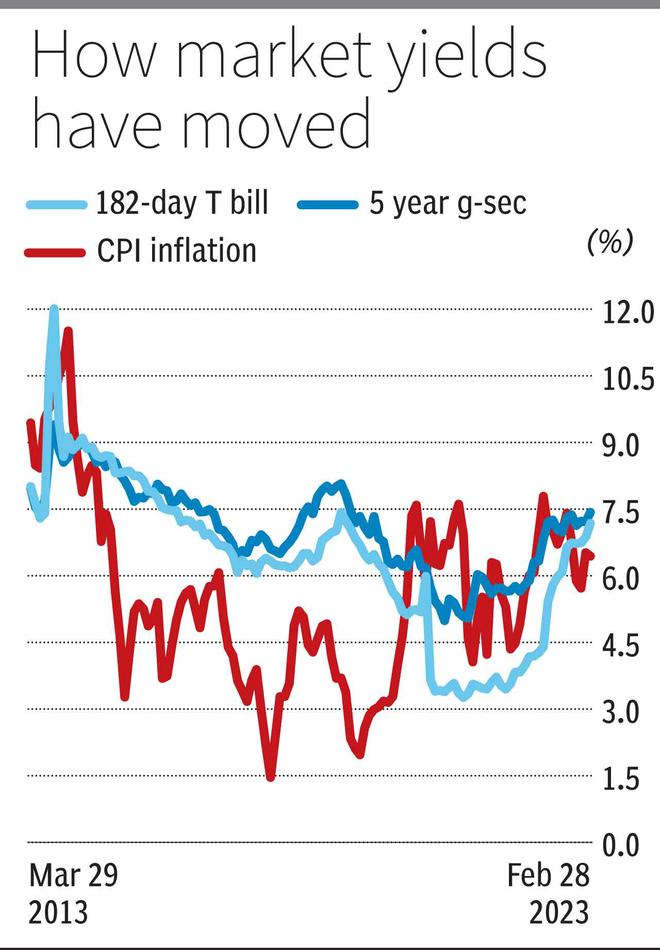

The accompanying table tells you that both options have comfortably beaten CPI inflation, in nine of the last ten years. But can they continue to do so in the future? In resetting quarterly rates on the PPF, the government strives for a 25 basis points spread over the prevailing yield on the 5-year Government of India bond (g-sec).

In the last ten years, the market yield on the 5-year g-sec has swung between a low of 5 per cent (July 2020) and a high of 9.4 per cent (August 2013), averaging 7.1 per cent. But rates on PPF have not been allowed to fall below 7 per cent even when market yields have tumbled. There has been delayed catch-up when markets yields have spiked sharply. Net-net, given the peg to 5-year g-secs, one can expect the PPF to better long-term inflation rates. With investments in market-linked instruments, EPF is on shakier ground in delivering its current 8 per cent plus return. But with the fund making equity allocations, a 7 per cent return should not be a challenge.

Can the tax-free status of EPF and PPF change in future? As the government curbs the tax break (on interest) by capping the annual investment in PPF account at ₹1.5 lakh, PPF interest is unlikely to turn taxable. In the case of EPF, the interest on employee contributions of over ₹2.5 lakh a year has already been made taxable a couple of years ago. Investors can thus invest a sum of ₹1.5 lakh in PPF and ₹2.5 lakh in EPF annually for an inflation-beating return. Do note that both options lock in your money for the long run. But the 15-year PPF account allows partial withdrawals after 7 years and the EPF allows advances for specific purposes.

NPS for debt

Most folks associate the National Pension System with equity investments for retirement. But the NPS offers flexibility to allocate to either equities (E) or corporate bonds (C) or government bonds (G). It offers both a Tier 1 (with lock-in) and Tier 2 account (without lock-in). So, investors can use NPS as a pure debt investment vehicle too.

NPS managers invest only in highly-rated corporate bonds with a 3-year plus tenure under C and g-secs with medium to long maturity under G. As the NPS management fee is just 3-9 basis points and it focusses on medium-long duration, returns on the C and G options of NPS Tier 1 have usually beaten both debt mutual funds and options like FDs. In the last ten years, consisting of both falling and rising rates, different NPS managers have delivered a CAGR of 8.4-9 per cent on the corporate bond plan and 8-8.5 per cent on the g-sec plan.

In the Tier 1 account, which is a retirement vehicle, final maturity proceeds are not subject to tax. However, 40 per cent of your final payout needs to be invested in an annuity, the income from which is taxable. This apart, the only negative with NPS Tier 1 is the requirement to lock in your money until age 58. Premature withdrawals are allowed, but capped at 25 per cent. But if you value anytime liquidity, you can explore the NPS Tier 2 account where you can invest and withdraw at any time, while enjoying a similar return at a low fee. Tier 2 does not offer any tax breaks and your returns will be taxed at slab rates. Nevertheless, it is a good high-yield option to explore.

Explore SDLs and FRBs

Until recently, Indian investors who wanted to own Central government securities (g-secs) or State Development Loans (SDLs) had to route their investments via mutual funds, insurance companies or provident funds and suffer a dent to their returns from the fees and costs charged by these intermediaries. But the advent of the RBI Retail Direct Gilt account (you can open this account here https://rbiretaildirect.org.in/#/) has given you direct access to the weekly auctions in g-secs and SDLs, without any fees or commissions.

With the opening of an RBI RDG account, you get direct access to the retail quota weekly auctions of g-secs and SDLs by RBI. This can open up two high-yield options for a retail investor. One, you get to participate in monthly SDL auctions by State governments for tenures ranging from 2 to 30 years. Recent tranches of SDLs fetched a 7.5 per cent yield for 3-5 years and 7.7-7.8 per cent for 10-year plus. But there have been occasions in the past year when SDLs offered yields of 8-8.25 per cent for 10 years. SDLs score high on capital safety as they are managed by RBI and backed by escrow arrangements.

Two, you can also look out for the occasional auctions of GOI floating rate bonds (FRBs). The interest on these bonds, paid half yearly, is reset every 6 months by RBI based on the movement in the 182-day treasury bill yield. Over a decade, the yield on the 182-day t-bill has averaged 6.4 per cent, hitting a high of 12 per cent and a low of 3.2 per cent. T-bill yields are highly sensitive to changes in market liquidity and RBI’s expected rate actions.

Therefore, when short-term yields in the market spike, rates on FRBs automatically rise. With rate hikes in the past year, for instance, the yield on the 182-day t-bill has spiked from 4.2 per cent to 7.3 per cent now. This has seen RBI sharply peg up the interest rates on FRBs. FRB 2033 has seen its coupon reset from 4.6 per cent in March 2022, to 8.51 per cent now. FRB 2028 has seen its rate reset from 4.3 per cent to 7.01 per cent in a year. To cash in on the FRB opportunity, you need to track GOI’s occasional auctions of FRBs and verify the spread offered on the tranche you’re buying. Earlier tranches of 10-year FRBs offered a 122-basis point spread over the 182-day t-bills, recent tranches offered 98 basis points.

For floating rates, retail investors can also buy GOI floating rate savings bonds 2020 from leading banks. The interest rate on this 7-year bond is set at a 35-basis point spread over the prevailing interest rate on the National Savings Certificate or NSC. Though the NSC is supposed to be pegged to g-sec yields, it had not matched market yields in recent times. This has been corrected for the April -June 2023 period, with NSC now offering 7.7 per cent. As a result, the interest on these floating rate bonds will be 8.05 per cent from July 1, making them an attractive option.

Well-timed FDs

Fixed deposits from banks and NBFCs generally earn a bad name for failing to beat inflation. But pursuing an active strategy with FDs can get you to positive real returns too, if you time your investments to the rate cycle highs. You could lock into cumulative FDs for 3-years-plus when rates exceed 8 per cent and keep to very short tenures when they drop below 6 per cent. Currently, with a scramble for deposits, some small finance banks and NBFCs (Shriram Finance, Jana SFB, Equitas SFB) are offering 8-8.5 per cent returns on FDs of 2 to 3-year tenures. Keep an eye on the Safe Investing page in Portfolio to track rates.

High yield bonds and debt funds

In the bond markets, more than in the stock market, a high return always goes hand in hand with high risk to your principal. But high interest rate phases sometimes give you the opportunity to earn attractive yields without taking on outsized credit risks.

With 5 g-secs today offering 7.4 per cent, highly rated corporate bonds can get you to a near-8 per cent yield. Currently, as per GoldenPi, AAA-rated Indiagrid Trust NCDs maturing in May 2031 offer 7.9 per cent, HDFC Credila bonds maturing in June 2024 offer 7.76 per cent and Bajaj Finance September 2024 NCDs fetch you 7.66 per cent. With many retail bond platforms up and running, accessing such bonds is no longer difficult. Listed NCDs enjoy slightly better tax treatment than other options, with interest taxed at slab rates, but capital gains enjoying 10 per cent tax after a year. But for direct investors, juggling tenure, yield and credit risk can be a challenge. With many bonds privately placed, the minimum ticket size of ₹10 lakh can be a deterrent.

Corporate bond, credit risk and medium duration mutual funds allow you to own a diversified portfolio of bonds selected by a professional. Apart from their current portfolio Yield-to-maturity (YTM), you need to select such funds based on their asset size, portfolio composition, low concentration and competitive expense ratio. In the corporate bond segment, Kotak and Aditya Birla Corporate Bond Fund with latest declared YTMs at 8 per cent and in the credit risk segment, ICICI Pru and HDFC Credit Risk with YTMs at 8.7 and 9 per cent appear good choices.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.