Lower reliance on capex-driven growth

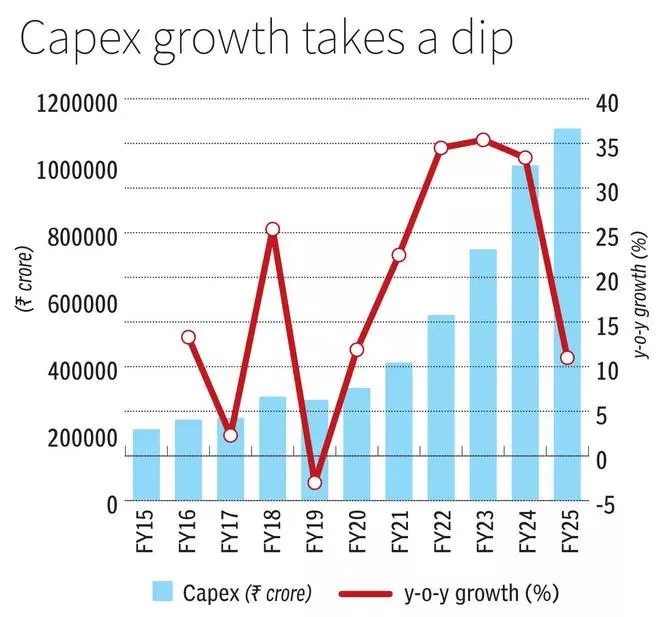

The interim Budget in early February announced a ₹11-lakh-crore capex plan for FY24-25. To build expectations on the capex front from the Modi government’s third term, it is worth noting the pace of capex in the last five years compared to the first term of this government.

From ₹3.3 lakh crore in FY19, capex allocation compounded at 27 per cent CAGR to the current ₹11 lakh crore allocation. For comparison, the allocation grew at 9 per cent CAGR in the FY14-19 period. The last five years clearly indicate a government spending push. This was aimed at dragging the economy out of Covid blues and putting it on a growth path.

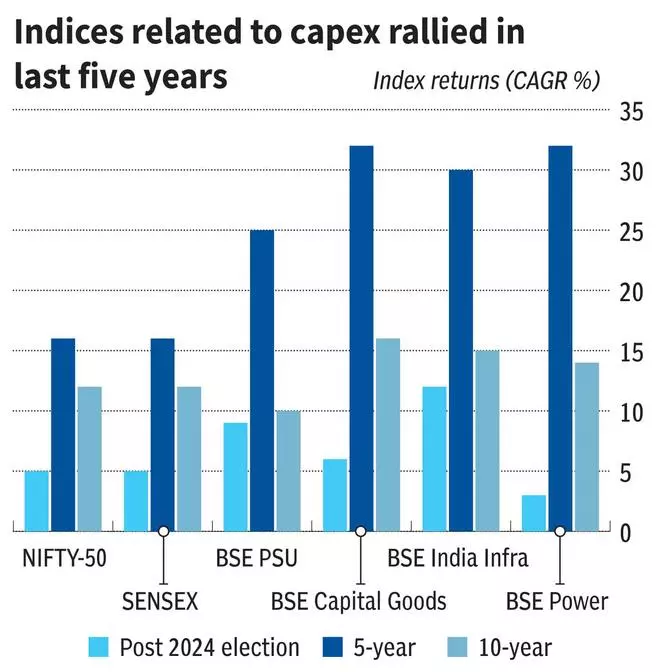

As a result of government spending, broad economic indicators are healthy — GDP growth forecast of 7 per cent for FY25, high credit demand (16 per cent YoY in May ‘24) with contained delinquency ratios (2.8 per cent GNPA in March ‘24) and strong growth in infrastructure built, which all resulted in robust equity market gains of 16 per cent CAGR in last five years for the Nifty50.

Outside of government spending, consumption and investment are other two drivers of economic activity. Given the need for the other legs of the economy to take over, government spending was widely expected to take a back seat this year and this was confirmed with a moderated 11 per cent growth in allocation for FY25 in the interim Budget. In the new term, the government may continue to lower reliance on capex to drive growth.

Investor takeaways

Considering the push to capex, all the frontline indices linked to this theme have delivered strong returns in the last five years. BSE PSU (25 per cent CAGR in last five years), BSE Capital Goods (32 per cent), BSE India Infrastructure (30 per cent) and BSE Power (30 per cent) have outperformed Nifty-50 and BSE Sensex (16 per cent). Close to half of the respective sectoral index’s performance can be attributed to valuation expansion (one-year forward PE growth/index growth) while for the Nifty50 and Sensex, this number accounts for only 9 per cent and 1 per cent respectively.

Despite signs of transition from capex-driven growth outlook, the specific indices continued to rally (average of 2 per cent outperformance to broader indices since June 7, post-election). The PE rerating has also shrunk the pockets of fairly valued opportunities amongst individual stocks.

That said, here are some pointers on what investors can look forward to in the upcoming Budget.

Firstly, the new base for spending in the future is ₹11 lakh crore, which is more than three times the amount in FY19. While the amount can contract on discretion of the dispensation, it is to be noted that the allocation saw de-growth only once — in FY18 — in the last ten years.

Among sectors, Housing allocation has grown the slowest at 8 per cent CAGR in the last five years. But in the first move post Cabinet formation, the government announced assistance for three crore homes under Awas Yojana. Considering the rural push expected, the sector may be prioritised by the government.

In the Defence space, India has locked in delivery schedules with domestic PSUs for fighter aircraft, warships, missile technologies and drone capabilities. The sector could sustain allocation momentum if the government announces new development contracts in the Budget.

With the Eastern and Western freight corridors almost completed, it needs to be seen what the next area of priority for the Railways will be.

Road Transport usually gets the highest allocation (as a percentage of total capex). It has a target of 2,00,000 km by 2037, and in this, a higher share of four lane access-controlled highways. Considering that 1,47,000 km has already been completed and that the pace of construction has slowed down recently, the sector may not see high allocations.

Looking for a much-needed consumption boost

The government’s focus on capex over the last few years and letting the multiplier effect on the economy boost demand on its own, hasn’t played out fully so far. Consumption and hence demand recovery post-Covid remains K-shaped with premium-end of consumer products and big-ticket items doing well. Maruti Suzuki is selling more SUVs than hatchbacks or compact cars and Hero MotoCorp, for whom the entry segment bikes form its bread and butter, has been focusing more on the executive and premium segment. ACs are selling like hot cakes and FMCG players are riding the preference for higher-priced detergent and dishwash liquids over the humble bar of soap.

However, with mass market left behind, the share of Private Final Consumption Expenditure as a percentage of GDP is shrinking. It stands only at 55. 8 per cent as per the provisional estimates for FY24 (at constant prices). This is the lowest in the last three years. With deficient monsoons last year and rural inflation largely being higher than urban inflation since January 2022, rural India hasn’t been able to pull its weight.

But some green shoots are visible now. Two-wheeler sales — somewhat indicative of disposable income with the rural consumer — are seeing a late pick-up, well beyond the peak of the current upcycle for other categories of vehicles. NielsenIQ’s latest report shows FMCG volume growth for rural India at 7.6 per cent in the January-March 2024 period, surpassing urban volume growth of 5.7 per cent for the first time in the last many quarters. Expectations of a normal monsoon this year is an added positive for agricultural income earners.

A shot in the arm from the Budget will be just what the doctor ordered.

What to expect

Given the uneven recovery, one of the key focus areas in the Budget could be boosting rural incomes, which could in turn have a positive effect on consumption demand. In what could perhaps be considered an indication of the shift in priority, approving the increase in Minimum Support Prices (MSP) for Kharif crops for the 2024-25 marketing season as well as the disbursal of the next instalment of the PM Kisan scheme were among the first moves of the new government last month.

Households employed under MGNREGA remain higher than pre-pandemic levels, indicating good demand for non-agricultural jobs in rural areas. However, wage growth in the last five years remains modest and below wages for agricultural labour as mentioned in a businessline report dated March 28, 2024.

The interim Budget has made a 43 per cent higher budgetary allocation for the scheme for 2024-25 over the previous fiscal and any tweaks to this number needs to be watched out for. A good rise in wages may also be in order. To put more money in the hands of the urban consumer, sops for taxpayers in the form of widening of tax slabs/reduction of tax rates, higher standard deduction are expected.

Importantly this year, despite the focus on fiscal consolidation, the government may have room to boost consumer and taxpayer sentiments given the buoyant tax collections as well as the record dividend payout by the RBI.

Along with banks and IT, the stock market has also begun favouring consumer staples since the day of the election verdict. Seen from the beginning of 2024, the Nifty FMCG index (7.4 per cent gains) still trails the Nifty 50 (12.8 per cent) by a reasonable margin. But it has begun playing catch-up since June 4 (election results day), with the Nifty FMCG index clocking 10.7 per cent gains from then on, closing in on the Nifty’s 12 per cent up move for the same period. High hopes are pinned on Budget 2024 to make the consumption recovery following Covid a more broad-based one.

Ironing out investor concerns

With the Budget just round the corner and the ceremonial halwa ceremony already behind us, all tax proposals would have already been decided by the finance ministry.

Even so, from proposals given by mutual funds (industry body AMFI) and insurance companies, some may require a closer look, given the possibility of their making it to the eventual Budget. There are a few proposals to consider modifications in the taxation of the National Pension System as well.

From a personal finance and markets angle, these are important factors that could help in better decision-making while considering assets for investments.

Mutual fund wish list

The expectations on mutual fund taxation come from both the equity and the debt sides. With respect to debt mutual funds, there is an important proposal made.

Indexation benefit was removed from debt mutual funds in the Finance Bill of 2023-24 and all realized gains — long or short-term — were added to an investor’s income and taxed at the slab applicable, thus reducing their attraction considerably. However, debentures issued by companies continue to enjoy 10 per cent taxation on gains made over a holding period of more than three years without indexation.

Thus, the request is for debt mutual funds also to be given this same tax treatment since they themselves invest in debentures of issuer companies.

Staying on with bond funds, a long-term proposal is to have debt-linked savings scheme (DLSS) on the line of equity-linked savings scheme (ELSS) for section 80C tax deductions.

On equity funds, there are two prominent proposals. One is to increase the long-term capital gains holding period from one year to three years. Further, such long-term capital gains are to be made tax free.

In the case of holding periods of 1-3 years, the gains can be taxed at 10 per cent. But the request is for the threshold to be increased from ₹1 lakh to at least ₹2 lakh; the former limit was set in 2018.

Another proposal from the equity mutual fund side is on taxability of gains while switching from an underperforming scheme to another better option. Presently, such gains, if made after one-year holding period, are taxed at 10 per cent beyond a threshold of ₹1 lakh. This makes portfolio shuffling expensive as lower sums get invested post-tax. There is a request to exempt such gains from taxes, if invested again in another equity mutual fund.

Then there is a proposal on gold ETFs (exchange traded funds). Gold is taxed differently in different forms. Sovereign gold bonds, gold ETFs and physical gold face varied taxations as well as holding periods. The request is to make the taxation as well as holding periods uniform and to restore indexation benefit for gold ETFs and gold funds.

Many of the proposals mentioned above pertain to a larger move towards rationalising taxes and holding periods across asset classes. Though it has been in the air for a while, any such proposal to make taxation uniform may require extensive consultations across a wide range of stakeholders. Given the brief time available between election results announcement and the Budget day, there is no certainty that such proposals would find their way into the Finance Bill this year, especially as much of the focus has been on demands for reducing income tax rates and increasing the slabs in the new tax regime at least.

Insurance and NPS proposals

Policyholders who take medical insurance are already faced with the twin problems of insurers not honouring claims in full as well as rapidly rising premiums post-Covid. To make things nearly a fifth costlier, there is an 18 per cent GST on health insurance premiums.

The overwhelming proposal from insurance companies and policyholders is that GST on health insurance premiums either be done away with or reduced to a low single-digit rate. Given the criticality of health insurance in availing quality medical care, this proposal may find serious consideration from the finance ministry.

Another proposal pertains to annuity policies of insurers. Right now, all annuity income is taxed at the slab of policyholders. For a country where social security is minimal for those in the private and informal sectors, there is a proposal to do away with the taxation on immediate annuity products when taken by retirees. According to a Bandhan Insurance note, the gap between needed and available retirement funds is expected to reach $85 trillion by 2050.

And annuities may play a critical role in providing steady retirement income.

In a related request, there are two proposals pertaining to the NPS. First is to do away with the requirement of compulsory annuitisation of 40 per cent of the final corpus, which allows the retiree to invest the amount suitably. If this is not allowed, then the second proposal is to exempt the annuity income from the 40 per cent corpus from taxation.

-

-

-

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.