Unlike other advanced economies that hiked interest rates by 400-550 basis points over 2022-23 to fight massive consumer price inflation, the RBI (Reserve Bank of India) increased the repo by only 250 points. And the last rate hike by India’s Central Bank was in February 2023.

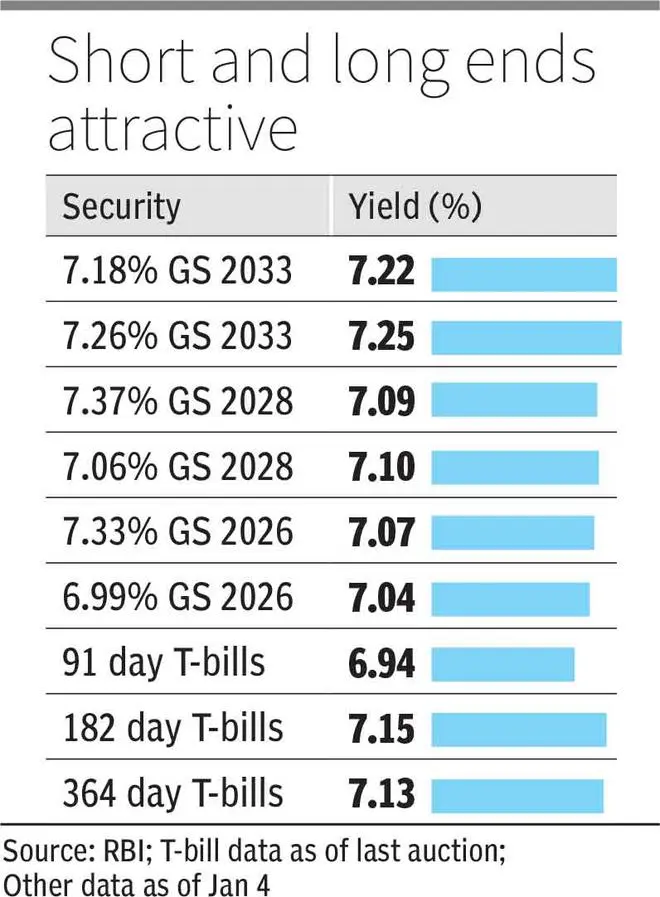

The RBI kept the repo at 6.5 per cent. However, 91-day, 182-day and 364-day securities were available at 6.93 per cent, 7.15 per cent and 7.13 per cent yields at the last auction. These are much higher than the Repo rate. RBI’s moves — such as open market operations, mandating higher incremental cash reserve ratio requirements for banks, forex sales, and variable rate repo auctions — led to controlled liquidity, thus resulting in increased short-term rates. Liquidity in the banking system has been in deficit for weeks now.

At the upper end of the curve, 10-year G-Sec maturing in 2033 trades at 7.22 per cent. We have the G-Sec maturing in 2037 trading at 7.35 per cent. In the year that saw the collapse of Silicon Valley Bank and a few others, Israel-Hamas war, massive treasury yield spikes and subsequent steady falls in the US, 10-year Indian G-Secs traded in a band of 7.1-7.4 per cent and were quite stable.

With inflation moving southwards globally, raw material costs correcting and crude oil prices cooling off, together with the bond market events on yield moves subsiding, it appears likely that we are at or around peak interest rates.

In fact, market pricing indicates expectations for the US Fed to cut rates 3-4 times in the second half of 2024.

The RBI may not immediately follow suit as rate hikes were of smaller quantum and GDP growth as yet seems on course. However, there are expectations of a rate cut later in 2024, though the amount could be low.

From here on, higher coupons available would be a plus and rate cuts resulting in bond price increases would result in decent capital gains for fixed-income investors.

One key trigger is JP Morgan’s decision to add Indian Government Bonds (IGBs) to its Government Bond Index-Emerging Markets (GBI-EM). These IGBs will have a 10 per cent weightage in the bond index, which manages about $240 billion. The addition will begin in June 2024 at the rate of 1 percentage point a month and continue for 10 months till the 10 per cent weightage in the index is reached by March 2025.

The addition of IGBs is expected to bring at least $24 billion towards index investment and $30-40 billion into the bond market over the next year or so. If other index providers such as Bloomberg, S&P and FTSE decide to include Indian bonds, there may be further inflows as well.

There is likely to be a fall in yields of G-Secs and a rise in bond prices over the course of the year.

Investing at peak interest rates

Yields at the two ends of the curve appear quite attractive at the moment. Short-term and long-term securities are available north of 7.1 per cent yields. Liquid, money market and ultra-short duration mutual funds sport portfolios with yield-to-maturity of 7.55-7.98 per cent. These are funds that invest in safe government securities, T-bills and short-term bonds that mature within a few months to less than a year, and carry virtually no credit risk.

Investors looking to benefit from the current yields can consider the following funds from the categories:

Liquid: Aditya Birla Sun Life Liquid and SBI Liquid funds.

Money Market: Aditya Birla Sun Life Money Manager, Nippon Life Money Market, SBI Savings and HDFC Money Market funds.

Ultra-Short Duration: ICICI Prudential Ultra Short Term, Nippon Ultra Short Duration and Mirae Asset Ultra Short Duration funds.

For the medium term, investors can consider quality NCDs in the 3-5-year tenor when they come up, but must ideally restrict such exposure to 5-10 per cent of their debt portfolios. Muthoot Finance NCDs, opening next week with yields of 9 per cent for 36 and 60 months, are one such option. 360 One Prime, also opening next week, offers more than 9 per cent for 24-60-month tenors.

For the longer tenure, gilt funds with maturity periods of 6-10 years seem attractive as are select target maturity funds.

ICICI Prudential Gilt and Kotak Gilt funds are good choices with 7.64 per cent and 7.66 per cent YTMs, respectively.

Bharat Bond ETFs maturing in 2030 and 2033, both with yield to maturity of 7.6 per cent, are attractive. UTI CRISIL SDL Maturity April 2033 Index (7.86 per cent YTM) and Kotak Nifty SDL July 2033 Index (7.76 per cent YTM) are options to consider.

Investors must ideally choose their options so that they coincide with a specific goal.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.