The election verdict, with a coalition government ushered in, contrary to all expectations of a simple majority, sent markets into a tailspin. While indices have more or less settled down and have started to rally, the focus of the new government may determine which sectors and themes could benefit more in the foreseeable future.

While there is no doubt about the overall GDP growth story (given that key coalition partners are seen as pro-business), the consensus among analysts and economists is that the government would move more towards increasing rural development and consumption as a whole.

The focus on manufacturing and infrastructure would still continue, though the pace may be slower as demands for special status of States, increased allocation to rural employment guarantee scheme (MGNREGA), lower GST and personal taxes may not allow much fiscal space. To be sure, the ₹11.1 trillion allocated in the interim Budget of 2024-25 itself was only a 11.1 per cent increase compared to more than 20 per cent in previous years.

From a fundamental perspective, the banks and non-banking finance companies (NBFC) segment has not rallied as much as the broader markets despite most institutions being in the best of asset quality health, with robust metrics, and still available at attractive valuations. Many top private sector banks and NBFCs have delivered almost nil returns in the last three years, despite reasonably strong financials.

Taking all these factors into consideration, investors can now look to increase the weightage to consumption-themed funds and take reasonable exposure to banking funds, while ensuring somewhat moderate investments in infrastructure or manufacturing themes.

For example, if 10 per cent of your equity portfolio is the overall exposure to thematic funds, 5 per cent could be in consumption funds, while 3 per cent and 2 per cent could be apportioned to banking & financial services and infrastructure funds, respectively.

Read on for more on these themes and specific fund recommendations.

Consumption in driver’s seat

Given that consumption accounts for over 65 per cent of India’s GDP (2023-24) — with 55.8 per cent being private final consumption expenditure — it is the major driver of economic growth.

As a theme, consumption is set to grow on a secular upward path over the next decade or so on the back of several enabling factors.

- India’s median age was 29 years as of 2021 and is set to be only 31.8 years by 2030, among the youngest in the world

- Share of population in the 15-64 years band is set to be 68.4 per cent by 2030, again among the highest in the world

- Per capita income is expected to double from current levels to $5,242 by 2031.

- The number of Indians earning more than $10,000 a year will touch 100 million by 2027, from 60 million in 2023

- Urbanisation is set to increase, from 35 per cent in 2021 to 40 per cent by 2030.

- Online shopper penetration is expected to increase from 41 per cent 2021 to 70 per cent by 2031

These are data points from Bloomberg, Morgan Stanley, Goldman Sachs, BCG and HSBC MF.

From an investment standpoint, many consumption funds are available for investors with a five-year perspective.

These thematic funds invest in companies across the consumption segments — consumer discretionary, consumer durables, FMCG, technology, e-commerce, real estate, automobiles, financials, healthcare and leisure services, among others.

Fund choices

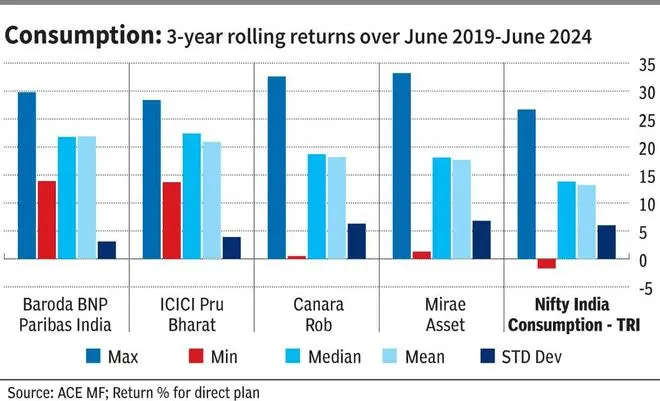

There are as many as 14 funds under the consumption theme. We considered the three-year rolling returns over the past five years. Based on three-year rolling returns, the best few in terms of mean returns were taken. Further, we benchmarked these funds with the Nifty India Consumption TRI to see how consistently they beat the index. To keep the choices more rigorous, given that the schemes are thematic, we took only funds that exceeded the returns of the benchmark at least 80 per cent of the time.

Based on these criteria, Baroda BNP Paribas India Consumption and ICICI Prudential Bharat Consumption are the best choices for investors. Canara Robeco Consumer Trends and Mirae Asset Great Consumer are also robust options.

Investors can consider small lump-sums spread over a few months.

Valuation comfort in banking

It is well-known that banks, especially many large private banks, have hardly delivered any returns over the past few years. In fact, the Nifty Bank is available at a price-earnings multiple of 15 times and a price to book of 2.89. In comparison, the Nifty 50’s PE is 21.4 times, and price to book is 3.95 times, going by NSE data as on May 31.

Given that NPAs at the net level are less than 1 per cent for most of the top public and private sector banks, and with interest cycle being at the peak, the segment may offer attractive opportunities to investors, especially as economic growth continues on a smooth climb.

Fund choices

Schemes tracking the segments invest in banks and financial services companies, though weightages can be heavy for a few stocks.

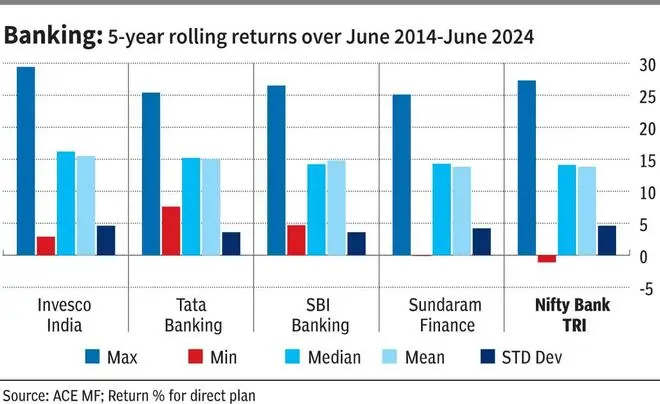

Going by 5-year rolling returns over the past 10 years — given that banking is cyclical, longer-term consistency is important — there are a few funds investors can consider.

Sundaram Financial Services Opportunities and SBI Banking & Financial Services are the best choices for investors. Tata Banking & Financial Services and Invesco India Financial Services are also healthy options.

Investors can consider small lump-sums or small SIPs over the longer term.

Infrastructure is still important

Given that growth is still likely to remain in focus for the government despite the coalition, infrastructure building will still be important. However, as stated earlier, allocations need to be tempered.

Returns from the theme tend to be lumpy and highly cyclical. Lump-sums are usually suggested for thematic funds. However, when SIPs in infrastructure funds are run for longer terms of 7-10 years, the returns have been quite rewarding.

Therefore, we considered 5-year rolling returns over the past 10 years and consistency in returns. We also took SIP returns (XIRR) over the past 10 years to decide upon the best schemes.

Quant Infrastructure and Invesco India Infrastructure are the best funds tracking the theme. Franklin Build India and BoI Manufacturing and Infrastructure funds are also fairly attractive choices.

As noted earlier, thematic or sector funds must form only up to 10 per cent of your overall equity portfolio. And within that currently, consumption must have the highest allocation, followed by banking & financial services, and a bit of infrastructure.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.