To be in a situation where everything is working in one’s favour is everyone’s dream. But those who have seen market cycles know that it does not take much for the tide to turn. This somewhat sums up the state of the equity markets as we look at what is in store for 2024.

While the exuberance comes from multiple domestic tailwinds, our analysis indicates that the margin of safety is lower this year, with current valuations as well as earnings expectations leaving no room for error.

Looks rosy

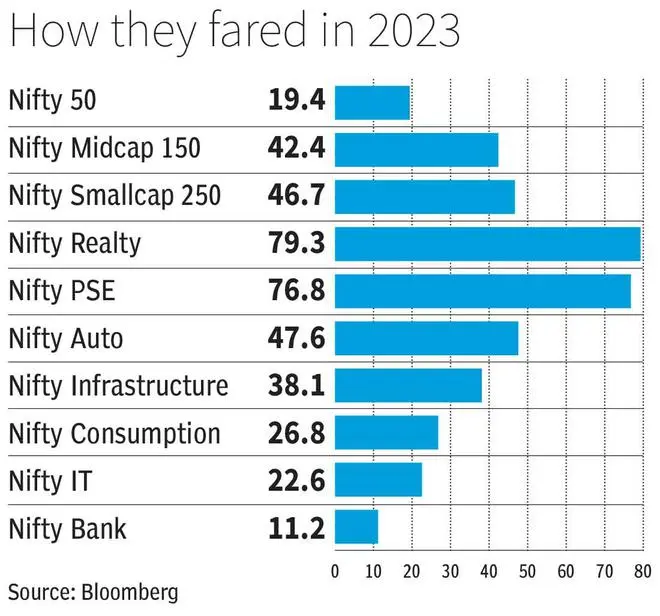

The benchmark Nifty50 index dusted off a seemingly contagious banking crisis and later a rally in bond yields in the US, as well as a war in West Asia, with panache, clocking a near 20 per cent gain in 2023.

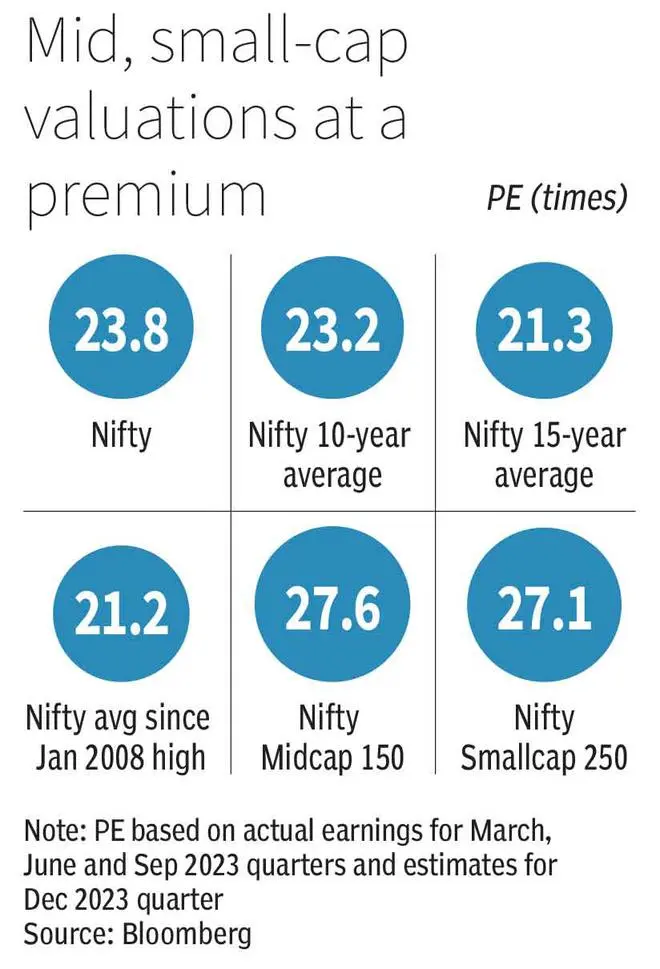

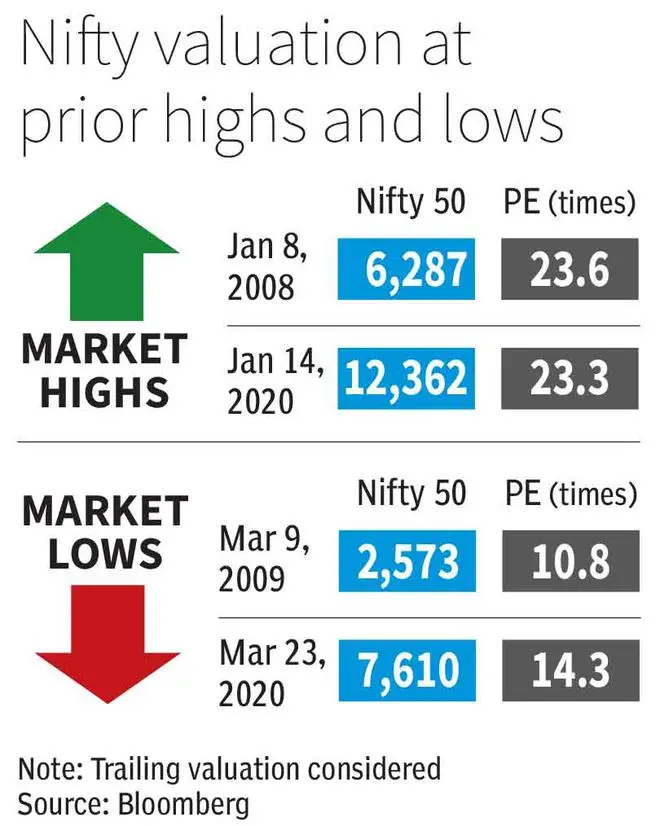

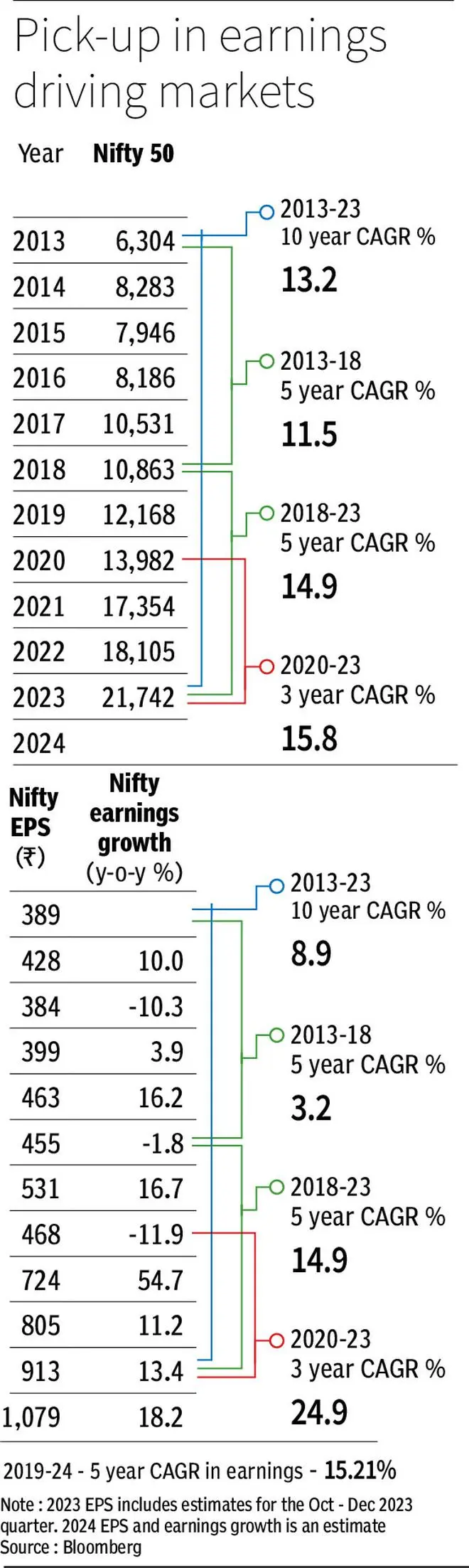

The confidence in the march this time around was different from a diffident 2022, where the bellwether touched its post-Covid low in June and ended the year up just 4 per cent. The 2023 rally has taken Nifty valuations to 23.8 times now, which is almost the same as it was in the January 2008 bull market peak. However, on the face of it, also appears only marginally above the average of the last ten years (23.2 times). Bloomberg consensus estimates now forecast a Nifty EPS of ₹1078.44 for 2024, growth of 18.2 per cent over 2023.

Applying the expected earnings to the 10-year average PE indicates a 15 per cent return on the bellwether this year, taking it to just over 25000 levels. But the two variables determining the Nifty target — the historical average PE and the earnings expectations, deserve more attention.

The skews

For one, the 10-year average is slightly distorted by the Covid impact on earnings, which drove up valuations. Also, the last decade has been characterised by the Nifty moving up on high expectations (10-year CAGR of 13.2 per cent) and earnings falling short (10-year CAGR of 8.9 per cent), thus pushing up the PE. The PE over a longer 15-year period or the average since the January 2008 market highs stands at a lower 21.2/21.3 times. Applying this PE to the expected earnings of 2024 puts the likely gains at a more subdued 5 per cent this year, implying a Nifty level of 22900-23000.

Earnings, the other variable, is driven by demand and the operating leverage that comes from it as well as cost control. Recent quarterly results in 2023 have been characterised by modest topline growth due to subdued demand in some sectors, but very healthy overall profit growth arising from margin expansion due to low input costs, among other things.

For example, in the nine months ended September 2023, companies part of the Nifty and the Nifty midcap 150 clocked revenue growth of only 9 per cent but a much higher profit growth of 22 per cent (Nifty) and 42 per cent (Nifty midcap). A bl.portfolio analysis of the results of broader India Inc in the last two quarters, shows only a mid-single digit to flat topline growth. Hence, in 2024, the demand scenario will be a key monitorable for markets.

Profit growth for India Inc in 2023 got a heft from raw material costs cooling off vs 2022, where they spiked due to the Russia-Ukraine war. While a slow China and subdued growth expectations in developed economies in 2024 could keep commodities in check, Bloomberg estimates show margin assumptions will be at historically peak levels in 2024. Nifty EBIT margins for 2024 are assumed at 17 per cent, a level last seen in the 2007 bull market. The figure for 2023 stands at 15.7 per cent.

Coming off an already low base of input prices in 2023, any increase in costs could be a dampener and the bigger push to margins may need to come from the demand side this year. With the scenario for export-oriented companies far from healthy, a pick-up in rural demand, a domestic consumption boost and a heating up of private sector capex will be what the doctor ordered.

The last word

While the first half of the last decade was characterised by markets moving up on earnings expectations and being disappointed, the earnings have picked up in the second half. Post-Covid, the market has been a slave to earnings. In this scenario, the current Nifty valuation — coming on the back of high earnings and poised at a premium to long-term average — leaves very little headroom for any earnings disappointment.

What should investors do?

To be clear, things definitely are a lot different and better as compared to 2007 when Nifty traded at current valuations and operating profit margins were at peak (as is estimated for 2024 also). So there is not much of a case for pessimism, but there is ample case to approach with caution at current levels from a fundamental investing point of view.

Keeping this in mind, investors can approach markets in 2024 in the following ways.

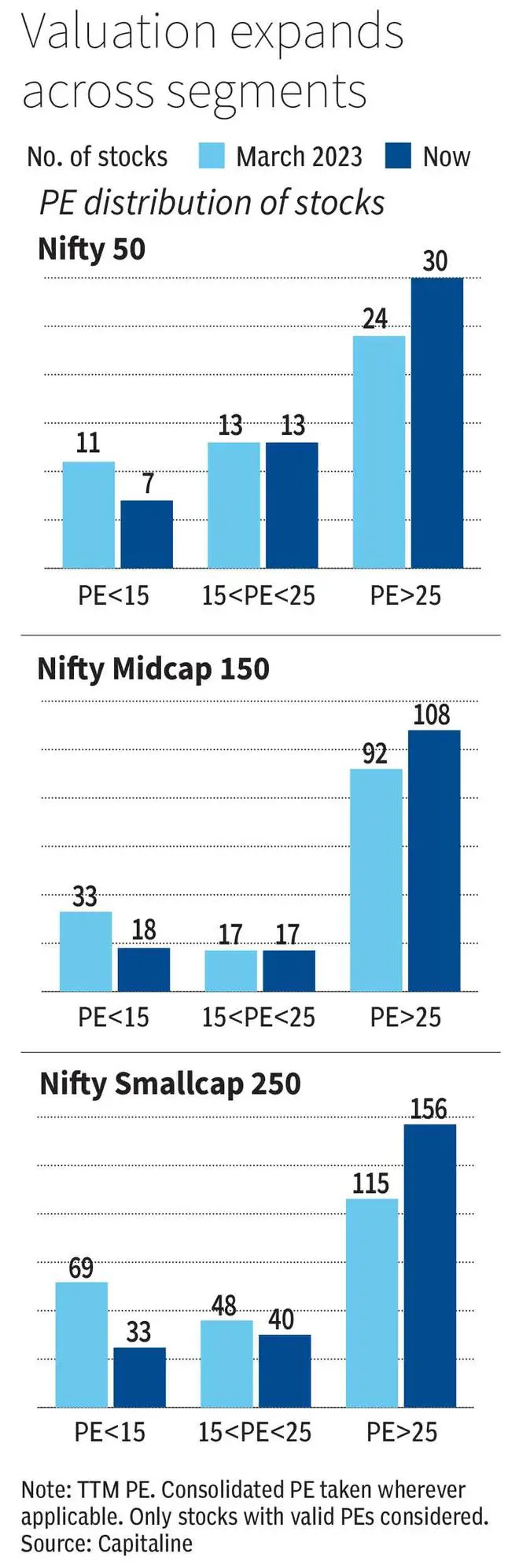

One, while valuations have expanded across marketcap segments, large-cap index valuations are at a discount to mid and small-cap indices and may make for picks with a margin of safety at this juncture. Look out for companies with strong balance sheet, good cash flows and high quality managements. This is, of course, a cliched approach. However, sometimes a boring process is what is required to ensure discipline in investing, when risks are higher.

Two, while at the headline level mid- and small-caps look expensive, investors can follow a bottom-up approach to look for stocks with reasonable valuations, as well as decent financials and prospects. As the accompanying table shows, there are mid- and small-cap stocks in the lower PE bands. At bl.portfolio, following a bottom-up approach, we had picked many quality PSU stocks between July 2022 and June 2023, as it indicated substantial value in these stocks then. This theme has played out well in 2023. Similarly, investors must now look for quality opportunities where valuation comfort is available.

Three, investors can play the sector rotation. The Nifty Bank has been an underperformer in 2023 despite being in the early to mid-part of the credit cycle and enjoying good asset quality, for instance.

Four, keep an eye on themes with a long runway — such as manufacturing, Make in India (electronics, industrials, defence) — and use dips to take exposure.

Five, keep some powder dry for corrections. Corrections are endemic to markets. For example, in 2022, markets corrected following the start of Russia-Ukraine war and in 2023 markets corrected following the US banking crisis in March. This year, there are many global uncertainties arising from how growth and inflation pans out in key economies. Markets can also show volatility due to upcoming general elections. So keep an eye out for similar opportunities in 2024 also to buy stocks.

Finally, with yields on the debt side also at decent levels, do allocate some portion of your savings to debt to have a well-balanced portfolio.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.