With election results around the corner, should investors go long or short? This is a dilemma not only for Indian equity investors today, but also for bond investors.

As of May 28, the 10-year government security (G-Sec) — the long-term debt benchmark — yielded about 7 per cent. The 364-day treasury bill (T-Bill) yielded a slightly better 7.02 per cent.

This presents a tough choice for investors. If they invest in only short-term debt, they’ll find their returns dipping if and when rates are cut. If they go for long-term debt, they’ll have to bear the brunt of no returns or losses if rates remain on hold.

After weighing both kinds of risks, we believe that investors would be better off with a barbell strategy today. Just as you would load both sides of your barbell at the gym, your bond portfolio should have exposures to both long-term and short-term debt.

Why long-term bonds?

If you can look beyond near-term uncertainties, the outlook for long-term bonds in India is quite positive. The main driver for 10-year bond yields is the expected demand versus supply of G-Secs. Three factors point to a fall in the supply of G-Secs in FY25 while demand is likely to expand.

One, with effect from this June, Indian G-Secs are set to be included in the global JP Morgan GBI EM Index. Indian G-Secs will bag a 1 per cent weight in June 2024, with the weight climbing to 10 per cent by March 2025. With this inclusion, global passive gilt funds will find it necessary to add to Indian G-Secs to their portfolio. Ballpark estimates suggest that this could create demand for about ₹2 lakh crore worth of G-Secs this year, mainly in G-Secs under the Freely Accessible Route — 5-year, 10-year, 15-year, 20-year. The recent S&P upgrade to India’s outlook also adds to the investment case for Indian G-Secs.

Two, the ₹2.11 lakh crore dividend payout by RBI at twice the budgeted sum will aid fiscal deficit reduction, possibly reducing G-Sec supply. Three, as part of its fiscal consolidation plans, the Government hopes to reduce the fiscal deficit from 5.8 per cent in FY24 to 5.1 per cent in FY25 and further to 4.5 per cent by FY26. This is also positive for G-Sec prices. This glidepath is more likely to be attained if the NDA returns to the Centre rather than the UPA.

The above factors make a bull case for long-term G-Secs to rally, with or without rate cuts. Long-term debt investors can, however, face risks to the bullish outlook from an adverse election outcome or volatility unleashed by higher foreign participation in bonds. This argues for investments in funds holding exposure to long-term gilts and corporate bonds.

Why short-term?

Debt funds that invest in treasury bills, tri-party repos and short-term corporate paper or certificates of deposit present an equally compelling case today, for two reasons. The RBI is maintaining a tight liquidity position in the financial system. So, yields on T-Bills, certificates of deposit, commercial paper and short-to-medium term corporate bonds are very attractive today, ruling at well over 7 per cent.

Typically, the short-term debt instruments can protect your portfolio from uncertainty about the election outcome, MPC, Fed rate cuts, etc. Rate cuts by the MPC, even if they happen, look likely only after end-2024 when there will be clarity about the monsoon and its impact on food prices and the resultant inflation. This makes a case for funds with exposure to T-Bills and short-term corporate paper.

One-year CP trades at a yield of 7.7 per cent, while the one-year CD gives 7.5 per cent, and a one-year AAA-rated bond trades at 7.91 per cent yield. Three-month CPs and CDs also give yields of 7.16 per cent and 7.35 per cent, respectively, according to data from Refinitiv and CCIL (compiled by Kotak Mutual Fund).

With rate cuts some way away and liquidity still tight, it may be prudent for investors to invest on the shorter end of the curve.

In this analysis, we cherry pick two good fund options for investors to bet on both the long and short end of the yield curve.

Four funds for investors: Long-term options

SBI Constant Maturity Gilt Fund

As more foreign investors explore Indian bonds because of global index inclusion, the more liquid G-Secs are likely to be their preferred bets. The 10-year G-Sec is the benchmark for the Indian bond market and also its most actively traded bond. Constant maturity gilt funds are an efficient low-cost vehicle for investors to buy and hold the 10-year G-Sec as long as they wish.

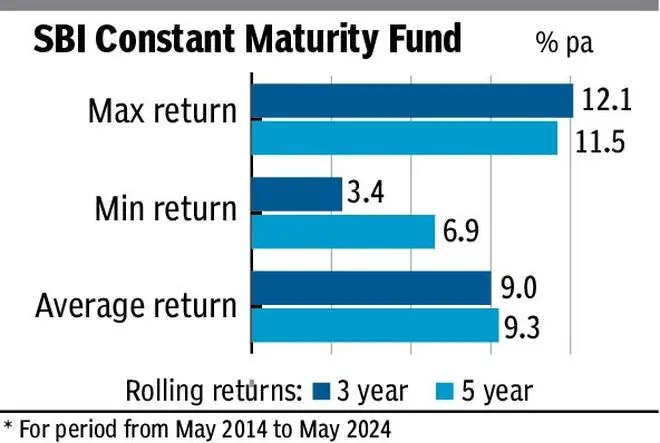

SBI Constant Maturity Gilt Fund is a good option for investors to consider because of three attributes. One, with a track record of over 20 years (launch date December 2000) the fund has navigated many rate cycles successfully, to deliver a CAGR of 7.8 per cent since launch. Two, a rolling return analysis over the last 10 years shows that the fund has contained downside better than peers in adverse phases. The fund has delivered losses less than 2 per cent of the time for one-year periods, while it managed 10-20 per cent returns 44 per cent of the time. Its one-year returns average out to 8.9 per cent in the last 10 years.

Three, as a fund that mainly buys and holds G-Secs, its annual expenses are low, at 0.31 per cent for the direct plan and 0.64 per cent for the regular plan. Expense ratios for actively managed gilt funds average 0.41 per cent for direct plans and 0.94 per cent for regular plans.

This fund is suitable only for investors with a high risk appetite, not seeking regular income. While it offers potential for high returns if rates fall, it is also likely to subject investors to higher day-to-day volatility as its returns depend more on rate movements than interest accruals.

Kotak Banking and PSU Debt Fund

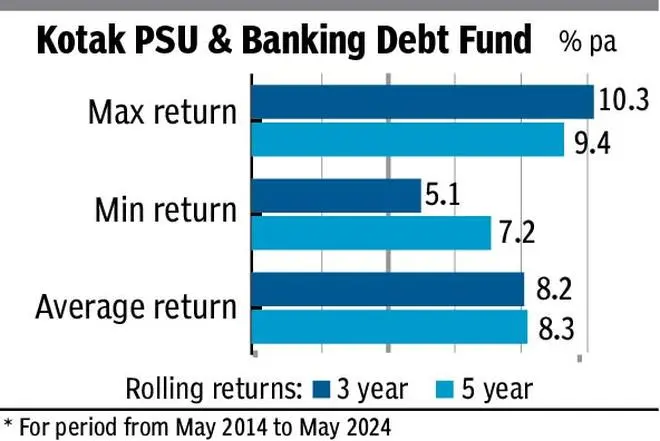

With strong credit offtake and a scramble for funds, PSUs and banks have been raising long-term debt at good spreads over G-Secs. Should market interest rates fall, these AAA-rated bonds will participate in the rally alongside G-Secs. Banking and PSU debt funds, therefore, offer investors a shot at earning higher yields than G-Secs, with possible gains if rates fall.

Kotak Banking and PSU Debt Fund is a good choice for two reasons. One, the fund’s average portfolio maturity of 8.3 years and Macaulay Duration of 4.16 years are high, relative to the category. Apart from a 24 per cent exposure to 10-11 year G-Secs, the fund has holdings in 10-year bonds from Powergrid, REC and LIC Housing Finance and 10-15 year bonds from SBI, PNB, Indian Bank and so on, which make up about 20 per cent of its portfolio. All these bonds can gain sharply from rate declines.

Two, with a 68 per cent exposure to AAA PSUs and banks, its portfolio YTM was 7.79 per cent as of April-end, about 19 basis points higher than category. Three, a 10-year rolling return analysis shows that the fund managed a maximum one-year return of 12.8 per cent and a minimum of 2.7 per cent while averaging 8.15 per cent for one-year periods. The fund’s expense ratio (0.39 per cent for direct, 0.76 per cent regular) is higher than peers’ in the PSU and Banking category.

As it carries duration risk, the fund is suitable only for investors who have the appetite for volatility in returns and are not regular income seekers.

Short-term options

At the other end of the spectrum are money market and ultra short duration funds to play the short-term game, given that yields are attractive there.

Aditya Birla Sun Life Money Manager Fund is one of the best schemes in the category, in view of the healthy balance it strikes with high safety and robust returns.

For investors looking to park a lump-sum amount that is either earmarked for emergencies or to be moved later to equity funds or stocks, the fund is a high-quality choice.

Money market funds invest in fixed income securities that mature within a year. Most funds restrict maturities to less than a year.

ABSL Money Manager invests mostly in certificates of deposits of banks and financial institutions. It also takes exposure to 364-day RBI Treasury Bills and state development loans (SDLs) that would mature in less than a year. Commercial papers (CPs) also figure in the portfolio, but in small proportions.

On a one-year rolling basis from May 2014 to May 2024, the fund has delivered 7.2 per cent on an average. Over this timeframe, it has never given negative returns. The scheme has delivered more than 7 per cent over 68 per cent of the time and over 8 per cent in nearly a fourth of the times, indicating consistent above-average returns.

CDs of Punjab National Bank, SIDBI, HDFC Bank, Bank of Baroda and NABARD figure prominently in the portfolio. RBI’s 364-day and 91-day T-Bills and SDLs of Maharashtra and Madhya Pradesh are also key holdings.

The fund has an average maturity of just 0.76 years, modified duration is 0.75 years. Yield to maturity of the portfolio (as of April 30) is healthy at 7.73 per cent.

ICICI Prudential Ultra Short Term Fund is a scheme that is ahead of most peers in terms of delivering consistent returns.

Now, ultra short duration funds invest in debt securities that mature in 3-6 months’ timeframe.

These funds, too, invest in CPs, CDs and T-Bills, apart from NCDs (non-convertible debentures) and debentures.

ICICI Prudential Ultra Short Term holds CDs of NABARD, HDFC Bank, SIDBI and IndusInd Bank among a few others. Treasury Bills also figure prominently in the portfolio. Commercial papers of Sharekhan, SIDBI and Motilal Oswal Financial Services find a place. Debentures of Bharti Telecom and Mahindra Rural Housing Finance are other important holdings. CPs and debentures of Embassy Office Parks REIT are also key holdings.

Since almost the entire portfolio comprises sovereign securities or instruments with the highest short-term ratings, there is minimal scope for any credit risk.

On a one-year rolling basis from May 2014 to May 2024, the fund has delivered nearly 8.5 per cent on an average. Over this timeframe, it has never given negative returns. The scheme has delivered more than 7 per cent nearly 71 per cent of the time and over 8 per cent over half the times. It has given more than 10 per cent returns nearly 28 per cent of the time, thus ensuring consistent above-average returns for investors.

The fund has an average maturity of just 0.49 years. Macaulay duration is 0.48 years. Yield to maturity of the portfolio (as of April 30) is healthy at 7.7 per cent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.