All good things have to come to an end. Well, that’s precisely what home loan borrowers must be experiencing over the past 18 months. After enjoying record-low rates from early 2020 through till late 2021 and early 2022, when interest on home loans was at a 15-year bottom, things have changed course.

As a response to staggeringly high inflation, the Reserve Bank of India (RBI) hiked interest rates by 250 basis points from June 2022, over the next year or so.

Home loan interest rates soared — from a low of 6.7 per cent to 9.5-10 per cent — resulting in massive increases in EMIs (Equated Monthly Instalments) for borrowers.

Given that inflation has been on a downtrend, and with global tightening also coming to an end, interest rates may well be nearing their peak in India. The RBI itself has been in pause mode for the past few monetary policies. However, a rate cut may still be many quarters away.

As most of the banks and non-banking finance companies (NBFCs) would have transmitted much of the rate hikes to customers, it may be a good time to review if you can ease your EMI burden.

For one, if you find your bank charging you more than some other institution, you should consider alternatives such as a balance transfer to that institution. But before you shift your loan elsewhere via balance transfer, it may be a good idea to get a good grip on the process, charges involved and the cost-benefit payoffs before making the move. It is also important to understand how rates are set in the floating rate regime for you to take a nuanced call. Here’s more on the when and how of balance transfer.

Rate regimes

We have fixed and floating interest rates available on loans. Fixed interest rates on home loans can cost 150-200 basis points (sometimes even higher) more than floating rate ones.

However, most home loans currently are on a floating rate regime.

The RBI introduced the MCLR (Marginal Cost of Funds Based Lending Rate) in 2016, which replaced the base rate system that prevailed till then.

Now, this MCLR system continues to be available.. As the name suggests, the MCLR depends on the marginal cost of funds of the bank or NBFC. Additionally, it is dependent on factors such as the bank’s cost structure, G-Sec yields, liquidity in the banking system, operating costs, cash reserve ratio requirements, and so on. It is an internal benchmark set by the lending institution itself.

A margin is added to this MCLR and charged to the home loan borrower. Whenever interest rates changed, MCLR also changed. But the transmission usually takes six months or even one year at times, as there are factors other than the repo itself that determine the rate.

Besides, MCLR isn’t very transparent as arriving at the final rate is not an easy exercise, and retail borrowers may not be able understand it readily.

To overcome these shortcomings, the RBI came up with an external benchmark regime to determine interest rates. The RLLR (Repo Linked Lending Rate) was introduced in 2019 and linked directly to the repo rate. Banks then added a margin (credit risk premium and so on) to the repo rate. So, it became easier for borrowers to get a sense of the interest rates charged.

And given that rates had to be reset quickly after a monetary policy decision on increasing or decreasing interest rates, the reset happens almost every quarter.

Of course, RLLR cuts both ways — when interest rates fall, borrowers get to enjoy the benefits within the next quarter, but rising rates would mean paying higher EMIs from the reset period.

Typically, bankers charge the repo rate plus another 250-350 basis points, depending on the loan size, tenor, credit score of the borrower, among other factors.

So, at the present repo rate of 6.5 per cent, banks charge 9-10 per cent. Some banks and NBFCs go up to 10.25-10.5 per cent.

Retail borrowers would be better off with RLLR-based loans for the most part, if they do not mind the occasional volatility in rates.

Easing EMIs via balance transfer

When rates are increased, typically, banks increase the tenor of the loan so that your EMI remains the same. You must negotiate with your present bank or NBFC to see if you can get a better deal. If the institution is unrelenting, you can consider switching.

Before switching out, you must satisfy some basic eligibility criteria for a balance transfer. Some banks and NBFCs insist on your having serviced at least 12-24 months of EMI with your previous lending institution. Then, most prefer financing only ready-to-move-in houses or properties where possession is taken in case of a balance transfer.

These are apart from the salary eligibility, credit score and other requirements.

After you make up your mind on balance transfer, you must understand the math of how much you are likely to save by switching lenders, to take an informed call.

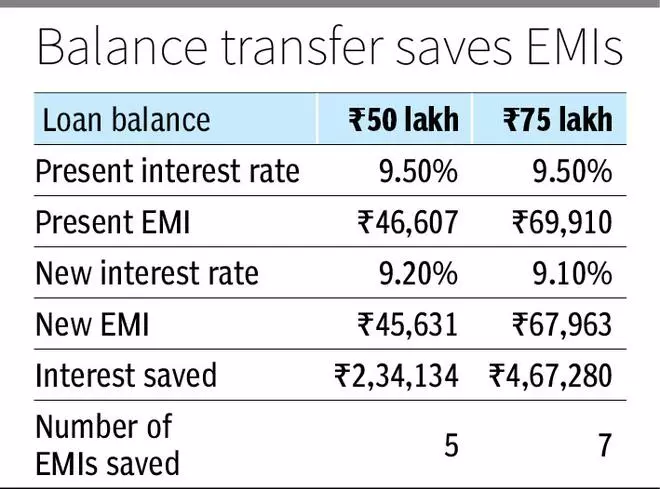

For example, if you have a loan balance of ₹75 lakh and a remaining tenor of 20 years, your EMI at 9.5 per cent would be ₹69,910. But if you opt for a balance transfer and your new lender chooses to give you an attractive offer of 9.1 per cent, you will save a lot of money. Your new lender may offer better terms due to your improved credit score or better earnings capacity and strong repayment record or just as a means to attract new business.

In the above case, your new EMI will be ₹67,963. Over a 20-year period, you will save ₹4,67,280, which translates to around 7 EMIs. So, you will repay your loan seven months earlier than if you had stayed with your previous lender.

Higher the reduction in interest rate, the better your savings. Many lenders, such as ICICI Bank and State Bank of India are offering lower rates with smaller mark-ups over the repo till December 31 of this year.

It would make sense for you to switch loans when you get 25 to 50 basis points lower interest rates. If rates do start to decline over middle or late 2024, you would benefit from additional fall in interest.

Being mindful of charges

If you are on a fixed interest regime, switching to a new lender can indeed be quite expensive. Your present lender can charge 2-4 per cent of the outstanding loan amount for prepayment.

But when you are on a floating rate regime, you can switch to another lender without any prepayment charges as RBI expressly prohibits levy of prepayment charges on floating rate loans.

However, there are many other charges that you will have to incur while making a balance transfer.

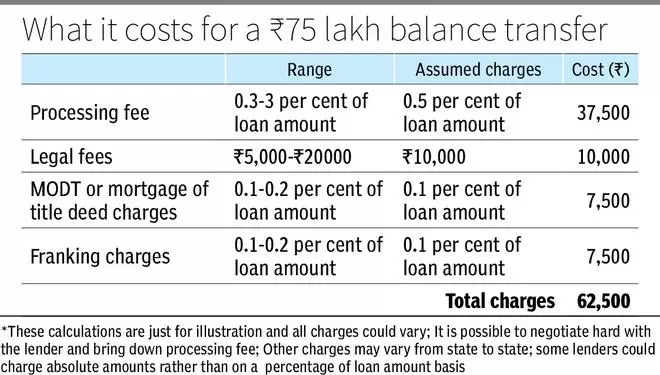

The first is the processing fee charged by all banks and NBFCs. Most private banks charge about 0.5 per cent as processing fee. Some public sector banks charge nothing, while others have zero fee for ready-to-move-in houses and balance transfers. New-age banks and some NBFCs could charge up to 3 per cent as processing fee.

However, these are stated numbers on their websites. You could visit these banks or NBFCs and work out a much better deal. Based on your negotiation, you can reduce or even do away with processing charges.

Legal and technical assessment charges come next and could range from ₹5,000 to ₹20,000. But, here again, some banks include these in the processing fee, and so you can negotiate harder as there would have been a legal opinion taken even while applying to your existing lender.

Then there is the memorandum of deposit of title deed (MODT). It indicates that you have handed over the property’s documents to the new lender. This deed has to be registered. MODT charges also range at 0.1-0.2 per cent of the loan amount and are not negotiable. They vary from State to State. Some States have a flat fee or percentage of loan amount in the same range mentioned earlier for mortgage of title deed (the equivalent of MODT).

Franking charges are also incurred. The property sale document and the loan agreement have to stamped or franked at the sub-registrar’s office. These charges are levied by the respective State governments. The charges typically range at 0.1-0.2 per cent of your loan amount and are paid while changing lenders. Franking charges are non-negotiable.

For a ₹75-lakh loan balance transfer, you could end up paying ₹62,500 as charges under various heads. By negotiating hard on process and legal fees, you can bring it down substantially.

Despite these charges, you would still be saving a tidy sum after the balance transfer. (see tables)

All these balance transfer offers are for normal home loans that borrowers avail. But if they wish to move their loan balances to another lender with overdraft features, then the interest rates applicable would be higher to the tune of 0.3-0.5 per cent.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.