Generating a steady stream of income that is assured through your lifetime — and ensuring that the same payouts continue for your spouse after you — is a challenge many retirees face.

For an anxiety-free life in your silver years, your retirement corpus must be able to generate an income that can comfortably meet all your expenses, and even emergency needs.

Among the many options available, the one that comes with an assured level of income throughout your life is the immediate annuity plan offered by insurance companies. An immediate annuity gives you a defined pension for life. Your spouse, too, can receive a pension for life. The purchase price (or the premium paid at the start) can be returned to the spouse or any other nominee, as the case may be.

Even the National Pension System (NPS) requires subscribers to annuitise (i.e., buy an immediate annuity plan) to the tune of 40 per cent of the accumulated corpus. One way or the other, you may have to deal with immediate annuity plans at some point close to your retirement.

After hiking interest rates by 250 basis points over the past one year, the Reserve Bank of India has hit the pause button. The general consensus is that inflation has peaked, and interest rates in the economy may be at or close to their highs.

Annuities are also a function of interest rates and the yields have increased with the increase in rates over the past few quarters.

Some insurers offer pensions that compare favourably with the yields of long-term government securities as well.

Here’s more on how you can choose the right annuity product for your requirement to generate a part of your post-retirement income. We discuss the yields, taxes and competing (or complementing) options you have, so that you get the right perspective before parking your money in immediate annuities. .

The many pension options available

An immediate annuity product offered by a life insurance company requires you to make a lumpsum payment upfront. This is the premium paid or the purchase price of the product. This amount is used by the insurer to provide you with a regular pension stream till the end of your life.

There is a GST component (1.8 per cent usually) added to your premium at the time of purchase. This tax amount is not returned along with the purchase price in any of the options.

Ideally, you should take an immediate annuity after turning 60 or from the time you retire.

There are several options to choose your annuity payout.

First is the pension for life or single annuity without the purchase price being returned upon death. So, if a subscriber takes such an option, she would receive a regular income till her life time and the policy would cease after her time, without any return of the purchase price.

This would suit individuals who are single or have no surviving spouse, and no other dependents to whom they would need to leave a legacy.

Then, there is an option to take annuity of life and also have the premium returned to your nominee after your time, i.e., annuity for life with return of purchase price. If you have a spouse or a close dependent, you can mark the person as the nominee. You can also mark the purchase price for a charity organisation if you so wish, by making the entity the nominee to receive the proceeds after death.

The third variant is the option that allows you first to receive the pension amounts and, later on, after your time, gives your spouse the same pension amount — joint annuity with or without return of purchase price. After your spouse’s death, the policy ceases to exist with no further payments made.

Every married couple would find this option useful for their needs. Of course, the purchase price doesn’t get returned.

The fourth option is similar to the third, except that the purchase price is returned to the nominee after both the annuitants die.

Now, each of these options has to be carefully weighed before taking a decision as the payouts vary — quite significantly at that — depending on the choice you make.

For example, the single annuity without return of purchase price option pays the highest pension amount. But if you choose the option and if an unfortunate event were to happen to you early on in your retirement, a large corpus goes waste. And, attracted by the high yield, if you choose the option despite having a spouse or dependent, the financial crunch faced by them may be harder.

Annuity is paid periodically — monthly, quarterly, half-yearly and yearly. The older you get, the higher are the payouts made by insurers. The maximum age of entry allowed is usually 80 years.

After you buy an immediate annuity product, you can start receiving pension payments from as early as the next month after purchase.

The rate of annuity payout varies depending on the option you choose. So, if you opt for a single annuity for life without return of premium, you would get a higher payout than when you choose to give back the premium paid to a spouse or relative.

Yields from annuities improve

The interest rate hikes over 2022-23 have had a positive impact on immediate annuity yields.

Now, before getting into the actual yields on offer for subscribers, it is important to set the assumptions in place to take an informed call.

The age of the person buying the immediate annuity or the first annuitant is taken as 60. The pension is assumed to be received from the next month after purchase.

For all the options, ₹1 crore is assumed to be the premium or the purchase price. With the GST added, the purchase price becomes ₹1,01,80,000.

For all the four options, the first annuitant or the main policyholder is expected to live till the age of 85. The spouse is currently assumed to be 55 and is also expected to have a life expectancy of 85 years.

The annual payout option is considered for all choices as that ensures a bit more in terms of yield compared to other modes.

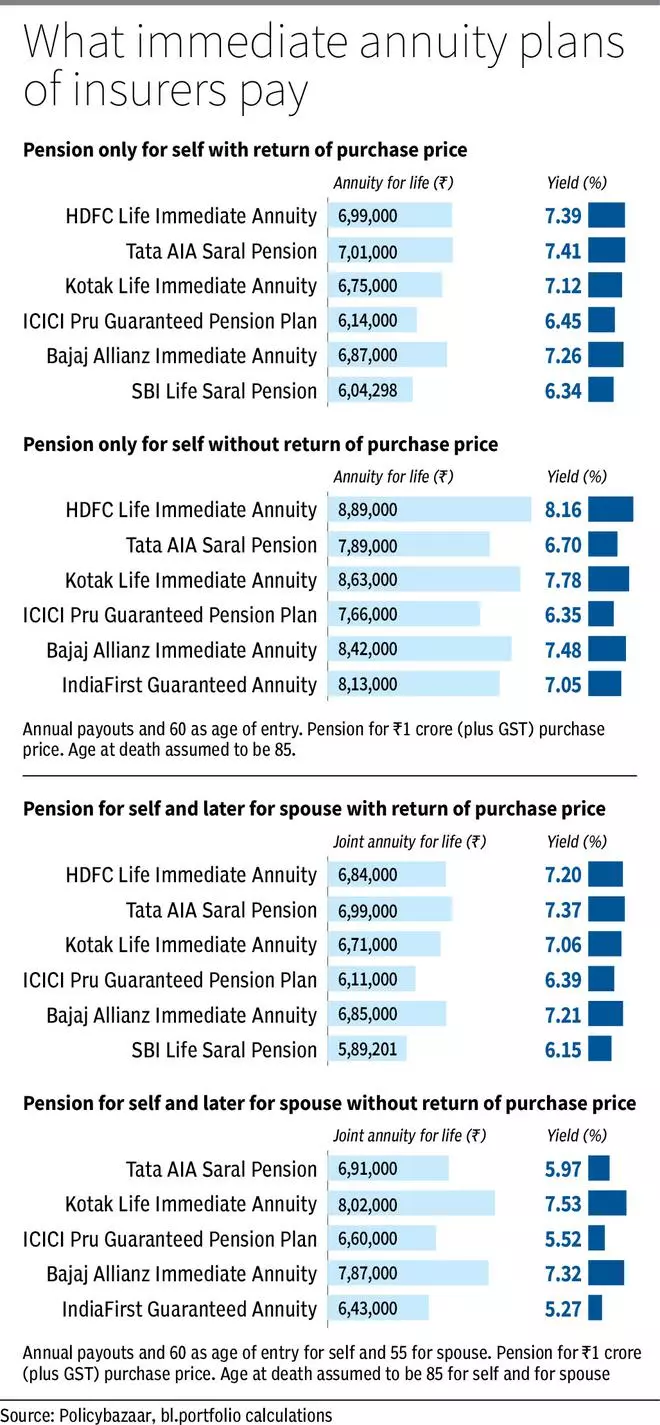

We have taken the immediate annuity plans offered by insurers such as HDFC Life, SBI Life, Kotak Life, ICICI Prudential, Bajaj Allianz and Tata AIA and IndiaFirst, to calculate the yields on offer.

Single annuity with return of purchase price: Data from PolicyBazaar indicates that for the annuity for life with return of purchase to the nominee option, these six insurance companies pay ₹6.04 lakh to ₹7.01 lakh on annual mode for a ₹1-crore policy.

Based on XIRR calculations, these payouts translate to annual yield of 6.34 per cent to 7.41 per cent. The immediate annuities of HDFC Life, Tata AIA, Kotak Life and Bajaj Allianz offer 7.12-7.41 per cent yield.

For perspective, the yield on the 10-year g-secs is at 7.06 per cent. The 06.64 GS 2035, 08.30 GS 2042 and 07.17 GS 2050 trade at 7.18 per cent, 7.27 per cent and 7.29 per cent respectively, according to CCIL data as on June 22.

Therefore, the yields on offer are comparable with g-secs of longer maturity profiles, making them attractive.

Single annuity without return of purchase price: Insurance companies pay ₹7,66,000 to ₹8,89,000 for those taking this option. While the payouts are higher, you must weigh the option carefully as illustrated in the earlier section before making a choice. The yields range from 6.35 per cent to as high as 8.16 per cent. Higher pensions are paid under this option as the premium is not returned.

Here again, four insurers are offering more than 7 per cent to subscribers.

Joint annuity with return of purchase price: The yields from the option given by insurers are in the 6.15 per cent to 7.37 per cent range. Pensions offered annually are in the band of ₹589,201 to ₹699,000. Yields are lower as there is a pension to be paid to the second annuitant and the purchase price also has to be returned.

Joint annuity without return of purchase price: The payouts range from ₹6,43,000 to ₹8,02,000 and the yields on offer are in the 5.27 per cent to 7.53 per cent range.

If inflation is assumed to be at 6-7 per cent annually, many of these policies offer yields that beat the rate of price rise.

Investors can consider HDFC Life Immediate Annuity, Bajaj Allianz Immediate Annuity, Tata AIA Saral Pension and Kotak Life Immediate Annuity in case they choose the single or joint life annuity with return of premium option. For the same options without return of purchase price, the immediate annuity plans of Kotak Life, Bajaj Allianz and HDFC Life can be taken.

Taxes and competing options

In the case of immediate annuities, the key positive factor to note is that the amount paid out is fixed and assured for life, irrespective of any change in interest rates in the future. The fact that there is certainty of cashflows as you are locked into a specific rate is comforting, especially in your retirement years. And these are safe investments, with no risk of default in pensions.

As mentioned earlier, interest rates in India are close to their peak. As with deposits, locking into annuities at relatively higher yields would be useful in the long run for income generation as the payout remains the same even if rates decline.

If you are single, with no dependents, you can opt for just single annuity without return of purchase price and enjoy a 20-25 per cent higher annual payout than you would with return of purchase price.

In case you are married, you can opt for annuity with return of purchase price. But if you doubt your spouse’s ability to handle a large sum after your time, you can opt for joint annuity for life so that your spouse continues to receive a pension.

Another key aspect to note is that you must have multiple sources of income and not just depend on annuities alone. Annuities can perhaps be used to generate 25-30 per cent of your post-retirement regular expenses.

Additionally, systematic withdrawal plans (SWPs) from debt or equity funds (as per your risk appetite), interest from bank and NBFC deposits, and small savings schemes such as SCSS (Senior Citizens’ Savings Scheme) must be part of your post-retirement portfolio for regular income generation.

But with deposits and small savings schemes, the interest rates are reset periodically by the government banks or non-banking finance companies based on prevailing interest rates (though you lock into the rate for the time period chosen under deposits and for five years under SCSS). Therefore, you face reinvestment risk during periods when interest rates are low. Your deposits would earn less than inflation.

Taxation on annuities is like how it is with regular income. All payouts from immediate annuities are added to your income and taxed at the slab applicable to you.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.