Newtons’s law of inertia states that an object will remain in motion or remain at rest unless acted upon by an external force. This law appeared to play out well when it came to growth and value stocks for most of the previous decade, wherein growth stocks continued to gain momentum and outperform, while value stocks appeared to remain at rest and underperformed. For prolonged periods, higher PE and higher P/B stocks outperformed lower PE and lower P/B stocks, something contrary to what was observed in the 20th century and first decade of the millennium, when both value and growth styles of investing had their time under the sun, with tilt in favour of value style.

This was of course till the external forces of multi-decade-high inflation in many developed economies acted upon these stock market trends. Since start of the year, there appears to have been a turnaround with growth stocks crashing in many markets across the world including India, while the value stocks seem to be gaining in favour.

For example in India, growth stocks like Zomato, which had grabbed investor craze and attention from the time of listing last year till early part of this year, is down 62 per cent year-to-date (YTD). To the contrary, a value stock like ITC, which was a laggard for years, is up 37 per cent YTD and has turned out to be the best-performing index stock. The BSE PSU index, which ideally falls in the value category, is up 2 per cent YTD, while the BSE Information Technology index that will come in the growth category is down 24 per cent during the same period. In the five years ending 2021 when growth stocks were in vogue, the BSE Information Technology index returned a whopping 382 per cent, while the PSU index returned a mere 7 per cent.

The change in fortunes is equally stark in global markets, especially the US, which has seen significant spike in inflation and northward movement in interest rates. The S&P 500 Pure Value index has held its fort well amidst global market turmoil with a decline of just 5 per cent YTD versus the S&P 500 Pure Growth index, which is down by 26 per cent. For the five year period ending 2021, the growth index significantly outperformed with 150 per cent returns versus the value index returning 40 per cent.

Thus, looking at the performance so far this year, it does appear value investors and funds, who were creeping forward like a tortoise in the previous decade, appear to be meeting up with the hare midway in their long investing journey now. The only difference here is that the hare did not take a nap that allowed the tortoise to catch up; it has instead walked a few steps backwards.

Is growth investing now in the slow lane and can value investing get its mojo back? Let us analyse.

What is value investing?

According to the ‘Dean of Valuation’ Aswath Damodaran, there is no clear consensus amongst value investors, other than the fact that value investing is buying cheap companies. And within value investing, there are multiple styles with very different views of how markets work.

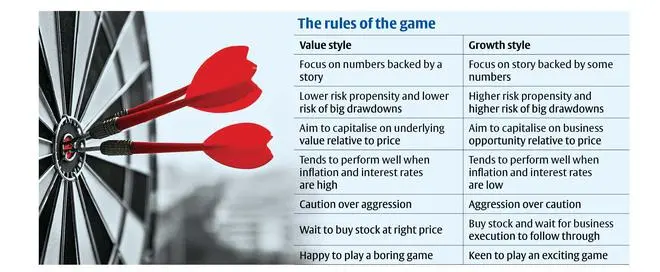

While the starting point in value investing is identifying and picking stocks based on their PE, P/B multiples, dividend yields etc, additional criteria such as management quality, balance sheet strength and predictability of future earnings etc are also added. Value investing, in general, focuses on ensuring safety of principal while targeting higher risk adjusted returns.

The foundation for value investing was laid by Benjamin Graham, wherein he stressed on buying companies trading well below their intrinsic worth — the measure of value of a company based on its assets, liabilities and discounted future cash flows. This calculation being an estimate which can go wrong due to various uncertainties, Ben Graham also stressed on applying margin of safety — buying companies that are cheap after applying a margin of safety discount to the estimated intrinsic worth.

This is a crucial difference between value and growth style of investing. Growth style of investing usually does not have a margin of safety. The focus is on the business opportunity and scope for execution in growth style of investing. A lot depends on many things going exactly as expected, in which case the payoffs can be huge, but just few things turning out to be worse than expectations — company-specific or macro — can result in significant losses. For example, when the leading social media stocks were hitting the bourses in the previous decade, the focus was on subscriber metrics and data points like monthly active users. While financials were important, it was secondary to this. Another example is the case of Netflix, which gave 50x returns between December 2011 and December 2021. The focus of investors was primarily on subscriber growth. Cash flows getting delayed to achieve higher subscriber growth was received with enthusiasm. The flip side to growth style of investing is that when the story hits a speed bump, the negative reaction can be severe. In the case of Netflix, after it missed on subscriber expectations in recent quarters, returns made over the last four years were lost in less than four months.

In value investing you expect the market will, over time, fix the pricing anomaly, while in growth investing you expect that growth prospects will play out without much deviations.

The value investing art, propounded by Ben Graham, was practised with near perfection and popularised by his student and value investing legend – Warren Buffett. While Buffett modified Benjamin Graham’s value investing philosophy to include aspects like moats, few other value investing legends like Jeremey Grantham and Sir John Templeton developed their own styles as well. Jeremy Grantham focused on a value investing style that gave importance to mean reversion — after extreme moves in either direction, stock valuations tend to revert to their long-term average or mean.

Academic research also further validated this style of investing during 1970-2000, broadly indicating that lower-valued stocks tended to outperform higher-valued stocks and had better pay-offs.

What’s changed

The decade 2010-20 is considered a lost one for value investing. While many value investors emerged as heroes during the unwinding of the housing bubble and financial crisis of 2007-08, performance of their picks started falling behind, a few years down the line. The choices of the value investor were getting overrun by new-age stocks focused on technology that were disrupting the way business was being done and scaling up rapidly. In many instances, the bets on highly-valued growth stocks was validated. This trend continued to gain traction as low interest rates pushed investors to chase growth stocks in their hunger for extra yields. Low interest rates also benefited growth stocks more than value stocks. Growth stocks had most of their cash flows back-ended. In a low interest rate regime, the net present value of these cash flows was higher due to lower discounting rates, which was based on interest rates. So much was the dominance of growth investing that even Warren Buffett did some migration to relatively highly-valued tech stocks (like Apple).

In India too, while the universe of disruptive tech stocks was few, the stocks with consistent growth profile across sectors like consumer discretionary, consumer non-discretionary, and finance (Asian Paints, HUL, Bajaj Finance, etc) outperformed and PE ratios and P/B multiples expanded and stayed well above levels that would have been deemed too expensive in the previous decade.

The reason for this trend in growth stocks outperforming value stocks varies. Some value investors believe the global central banks, especially the US Fed and ECB, overdid the monetary stimulus and there will be payback for that in the current decade. The growth investors would say the world has changed due to numerous innovations and disruptions since the start of the millennium and investing rules of the 20th century/old economy do not apply now.

Who is right? We will know sometime in the next few years, for sure! But for now, the way value and tech stocks have reacted differently to the inflation test, indicate the value investors may get their spot back at some level.

At the same time, value investors must also stay alert to prospects that some disruptive changes may have happened. Quite a few companies that have made the best use of technology to improve business performance have started dominating their industries that may ensure better stability to earnings and lower risks. In such cases, there may be a case for relatively higher PE and P/B threshold for value investors to consider.

Suitability

If you are an investor who can not stomach too much of volatility and cannot tolerate losing money, then value investing is the path for you. This does not mean you have to avoid high growth and disruptive tech stocks, but you must wait to buy them at the right price with adequate margins of safety when opportunity presents (like it did in March 2020 across the board, and now as well in some pockets ). In value investing, you may have higher equity allocations within your overall portfolio as the volatility and risk profile is relatively lower versus growth investing.

Within value investing, investors need to choose the right value investing style that is aligned with their goals, skill-sets and temperament. As mentioned above, low valuations in the form of low PE or P/B, or high dividend yield is just the starting point. Then selecting from these stocks based on moats in business, balance sheet strength, management quality, sustainability of earnings/dividends etc are additional factors to screen from based on one’s skill-sets.

Investing in mutual funds that are focused on active value investing is also an option to consider.

Avoiding value traps

In following the value investing approach, here are few key value traps to avoid.

One, cheap does not mean there is value in the stock. The Buffett maxim, ‘price is what you pay, value is what you get,’ will be a good guideline to follow. A stock could be cheap, but you could still be paying well above its intrinsic value if the company’s business model is broken and is expected to lose cash forever. Many wireless telecom companies, including Idea Cellular and Reliance Communications, appeared extremely cheap on paper based on price by book multiple when Reliance Jio entered the telecom sector. However, a bet on those companies would have resulted in significant destruction of wealth since 2017. Hence, look for the viability of the business model of the company and levels of competitive threats emerging.

Also, some stocks remain cheap for a reason. PSU stocks have remained cheap due to concerns on government interference, for instance. This is, however, not to mean that these stocks must not be bought into when they are cheap. It means higher margins of safety might need to be applied over intrinsic value before making a bet on some of these stocks.

Two, do not make concentrated bets. How much ever skilled you are on assessing a stock, you might still miss something. For example, even famed value investor Porinju Veliyath took a big hit to his portfolio in 2017-18 by taking an outsized position in LEEL Electricals, as the company appeared to be trading for a pittance when adjusted for its cash reserves. But subsequent alleged management quality issues resulted in significant wealth destruction in the stock.

Three, do not just go with PEs and P/Bs, but also assess the company’s cash flows and leverage profile. Ultimately, earnings must be reflected in the form of cash and the company must have the liquidity to pay off its debts when due. A case in point is Tulip Telecom, which was trading very cheap on PE metric in the early part of last decade with good business momentum, but its business expansion was built on extensive leverage and when it came due it did not have the liquidity to pay off its debts.

Four, heavy draw-downs in stocks from 52-week highs does not necessarily mean there is value in stocks. Sometimes, there is tendency amongst investors to consider buying stocks because draw-downs have been like 50 or 75 per cent from peak levels. This can be a trap as stocks could have been priced to irrational levels (multiple times of intrinsic value) during in a market bubble and even a 90-per cent correction might not imply value. Investments in many of the dotcom-era stocks in India and the US, infra and real estate stocks from 2007 resulted in 100 per cent losses for investors. Some even turned out to be scam companies. There may be some from the recent market cycle as well that can cause similar losses. This too needs to be factored in before zeroing in on value stocks.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.