It is now over 15 years since the national pension system (NPS) started the all-citizens model to invest in the retirement vehicle. There may now be many who would have started investing from 2009 and possibly at the stage (after turning 60) of withdrawing one part of the accumulated corpus, while annuitising the other portion.

A lot of attention has been given to the various NPS tier-1 fund houses and the returns they have generated over the years. However, the key aspect of income generation at the time of withdrawal is the annuity part and what insurance companies offer as payouts.

We know that 60 per cent of the accumulated NPS corpus can be withdrawn free of tax. The remaining 40 per cent must compulsorily be annuitised by investors. Of course, investors can also choose to annuitise the entire 100 per cent if they wish to, in case they aren’t in a position to handle a large sum or have sufficient inflows from other sources of saving.

The annuity part is very important because that is the income-generating part of the corpus for the rest of your retired life.

Now, there are 15 insurance companies empanelled to provide annuity to NPS investors and each has different payouts. The annuity here refers to the immediate annuity product of insurers.

Depending on the type of payment option chosen (with or without return of purchase price, single or joint annuity etc), frequency of payouts and so on, the yields vary for investors.

It is important for NPS investors to make the right choice of annuity provider, as the immediate annuity payment amount is fixed for life and it is necessary to lock into the best option available.

We analyse payouts and yields of the empanelled NPS annuity providers and help you choose smartly from among the available options. From the 14 available players, we shortlist the top five in each option.

Methodology, assumptions

All subscribers of NPS are expected to annuitise 40 per cent of their accumulated amount upon turning 60.

We have assumed that the corpus earned over the years is ₹1 crore and that this amount is earned by a private sector or self-employed person. This amount is used to purchase an immediate annuity product offered by any one of the life insurance companies empanelled with the NPS.

An immediate annuity requires you to make a lump-sum payment upfront. This is the premium paid or the purchase price of the product. This amount is used by the insurer to provide you with a regular pension stream till the end of your life.

There is a GST component (1.8 per cent usually) added to your premium at the time of purchase. So, you would have to pay an additional 1.8 per cent on the ₹1 crore, which is the premium or purchase price of the annuity. The tax amount comes to ₹1.8 lakh (1.8 per cent of ₹1 crore).

This tax amount is not returned along with the purchase price in any of the options.

The main subscriber is assumed to be a male, aged 60 years, and has a female spouse, aged 57, at the time of buying the immediate annuity. He is assumed to live till the age of 85. His spouse is assumed to live for another 10 years after his death.

There are multiple annuity payment frequencies – monthly, quarterly, half-yearly and annually.

For our calculations, we have taken the annual payment option for subscribers.

We have taken four scenarios – two each with return of price and without return of purchase price.

Annuity for life and joint-life annuity options and the associated payouts are considered.

The yields (calculated based on XIRR) from the payouts based on these conditions are calculated based on the quotes given in the NSDL website.

Based on the yields calculated, we take the top five annuity providers under each option mentioned above.

Plans on offer

The options are single and joint annuity with return of purchase price (premium paid). Then, the same options are repeated without return of purchase price.

Single annuity with return of purchase price: The person opting for this choice receives pension for his entire lifetime. After his death, the premium paid is returned to the nominee of the annuitant (the person taking the annuity policy).

This option would be suitable for those individuals who are single or have no surviving spouse or children at the time of taking the policy. Nomination can also be made for charitable organisations in their name after your time.

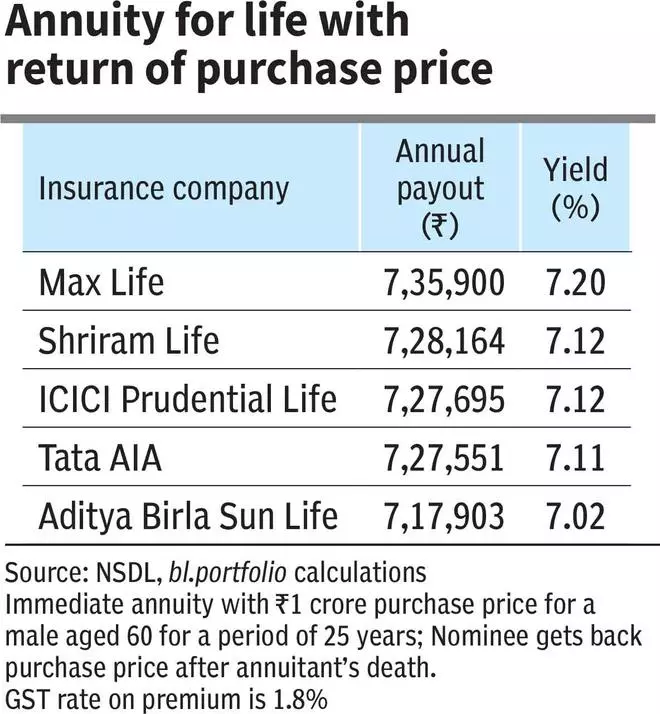

Among the annuity providers, Max Life with a ₹7,35,900 annual payout tops the chart with 7.2 per cent yield based on our criteria mentioned earlier.

Coming second is Shriram Life’s annuity policy with ₹7,28,164 annual payout, translating to a yield of 7.12 per cent.

All the insurers in the top five offer yields in excess of 7 per cent under this option.

Single annuity without return of purchase price: As the name indicates, the annuitant receives pension for life. After his time, there is nothing payable to anyone.

The option would suit those without any dependents or relatives or close ones to whom they would wish to transfer the amount.

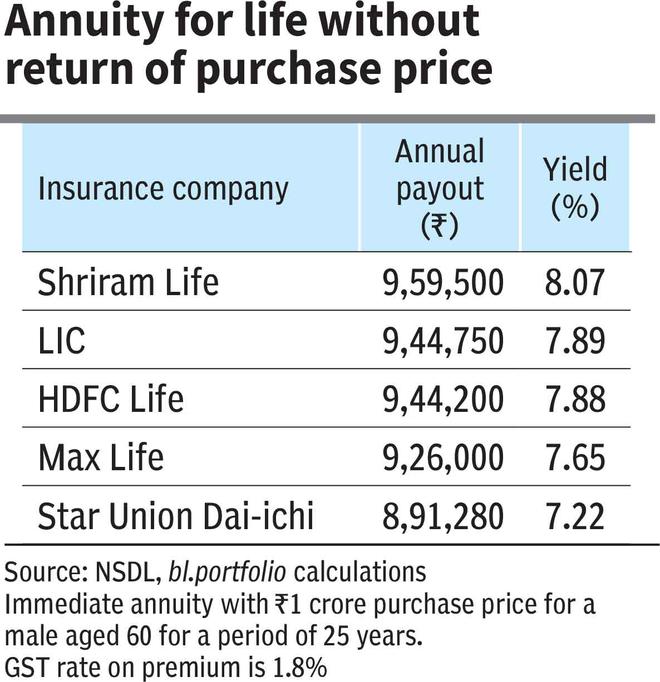

Since the purchase price is not returned, the payouts and hence the yields are higher for subscribers.

Shriram Life tops the chart with ₹9,59,500 annual payout, translating to an annualised yield of 8.07 per cent.

LIC is a somewhat distant second with ₹9,44,750 annual payout and 7.89 per cent yield, closely followed by HDFC Life’s annuity plan with ₹9,44,200 pension, translating to 7.88 per cent yield.

Joint annuity with return of purchase price: This option allows you to receive pension for your lifetime. After your death, your spouse would receive the same pension amount till she lives.

Upon her death, the purchase is returned to the nominee(s) — children, dependents or other relatives/legal heirs as the case may be.

If you feel your spouse may not be able to handle a lump-sum or if there are other sources of income for her and that the annuity would only add to her financial comfort, you can take this option.

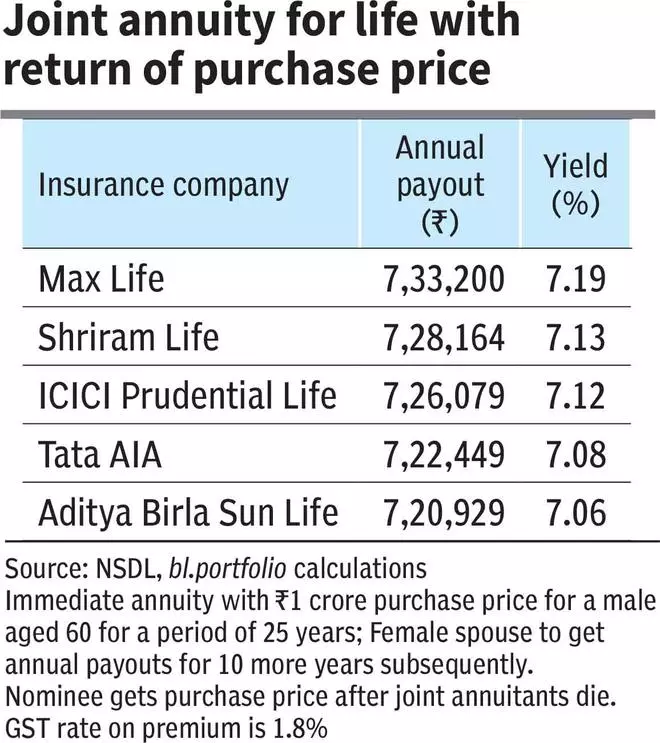

Max Life tops the list again, with ₹7,33,200 annual payout, translating to an annualised yield of 7.19 per cent. Shriram Life comes second with ₹7,28,164 annuity amount and 7.13 per cent yield followed by ICICI Prudential Life with ₹7,26,079 annual pension, giving 7.12 per cent yield.

Joint annuity without return of purchase price: You first receive the pension amounts and, after your death, your spouse gets the same pension amount. After your spouse’s death, the policy ceases to exist with no further payments to be made.

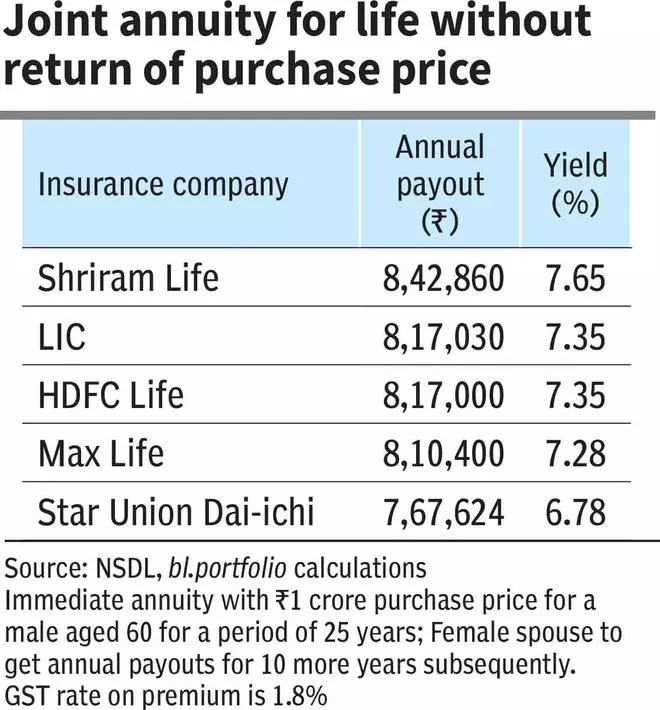

Shriram Life offers the highest payout at ₹8,42,869 under this option with yield of 7.65 per cent. LIC offers ₹8,17,030 annually at 7.35 per cent, followed by HDFC Life at ₹8,17,000, translating to the same yield.

Each of these options has to be carefully weighed before taking a decision as the payouts vary quite significantly depending on the choice you make.

For example, the single annuity without return of purchase price option pays the highest pension amount. But if you choose the option and if something unfortunate happens to you within a few years of taking the policy, a large corpus goes waste.

Also, if by being attracted to the high yield you choose the option despite having a spouse or dependent, it may lead to a financial crunch.

Depending on the category that you fall in, you must choose the corresponding option. Investors can go with the insurance company that offers the highest payout for the category they fall in.

For example, those wanting joint annuity with return of purchase price can opt for Max Life. Those wanting only single annuity for life without return of purchase price can consider Shriram Life.

There is one option which we have not discussed in the NPS immediate annuity payouts. The NPS Family Income with return of purchase price option is also available to subscribers. Taking this option will mean that a subscriber will get annuity for his life and on his death, the same annuity will be payable to his spouse for her lifetime. When the spouse also dies, the dependent mother and then the dependent father of the original subscriber will get the annuity. On death of the last annuitant, the purchase price is returned to the surviving children or legal heir of the subscriber.

Since this option is somewhat like joint annuity with return of purchase price, the payouts are also similar or same.

Another aspect to note is that of you choose a higher frequency of pension payout, say, monthly or quarterly, the yields may reduce significantly. In other words, the maximum yield you can generate is via an annual payout.

Just so that you could stay prepared, you must save and keep the expenses needed in your retirement year at 60, as the pension would get paid from the end of the first year after taking the annuity policy.

You will receive your pension amount in your savings account. Once you receive the annual pension, you can possibly move the amount to a fixed deposit with a sweep-in facility and withdraw when needed. So, you will have liquidity while also enjoying FD interest.

Interest rates, yields and taxes

Are these yields reasonable? The Reserve Bank of India (RBI) had paused rate increases almost 20 months ago, after hiking the repo by 250 basis points from May 2022. These hikes were in sync with the rest of the world with most central banks increasing interest rates to fight the post-Covid inflation.

India’s 10-year G-Sec yields peaked at a little over 7.6 per cent. Subsequently, with a steady fall in inflation, strong focus on reduction of the fiscal deficit by the Central government and inflows into bonds after India’s inclusion in a global bond fund index meant that yields eased to about 6.85 per cent levels.

Interest rates in India have peaked and rate cut expectations are running high, though the timing remains uncertain. This is especially after the Federal Reserve and European Central Bank started their rate reduction cycle a few months ago.

When we take the yields of long-dated G-Secs for comparison, it becomes clear that the yields offered by many of these insurers in their immediate annuity products are reasonably attractive. Investors can lock into these relatively attractive yields for the long term as the payouts remain unchanged irrespective of interest rate movements in the future.

For example, the G-Sec maturing in 2039 (7.23 GS 2039) trades at a yield of 6.92 per cent as of November 21, according to CCIL data. The 8.17 GS 2044 is available for 6.98 per cent yield, while the 7.09 GS 2054 trades at 7.06 per cent yield.

In summary, securities maturing 15-30 years down the line are available at 6.92-7.06 per cent yield. So, insurers offering more than these levels for similar timelines and long tenures are attractive for investors.

As things stand, all annuity income, including from the NPS, is taxable. The annuity payout is added to your income and taxed at the marginal slab applicable to you.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.