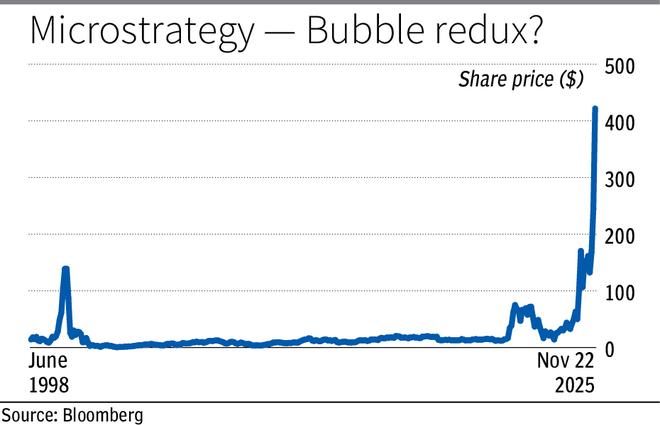

An old proverb goes: ‘Those whom the gods want to destroy, they first make them mad.’ Bitcoin bears would argue, investors in the stock of what was originally a software company — MicroStrategy (MSTR) are in that category. But why so?

You would have of course heard of Nvidia and many other AI stocks that have rallied through the year riding the AI boom. But MSTR, which in the last one month is up by nearly 80 per cent, has beaten all AI stocks this year with YTD returns of 515 per cent, and 2,682 per cent in last five years. It is not up because of anything to do with software. Its upside has all to do with the bitcoin frenzy in recent years and more specifically with the FOMO rally, following Trump’s election victory which is viewed as positive for cryptos.

Just around the time when Covid-19 struck, MSTR’s founder and Executive Chairman – Michael Saylor — became a bitcoin bull and repositioned the company as what it calls a ‘Bitcoin Treasury Company.’ Effectively it pivoted from being a software company to focus on accumulating bitcoin from equity and debt issuance over the years. Michael Saylor seems to have not cared much about the software business since. Last week it crossed $100 billion in market cap ($94 billion now). Its annual software revenue is around $450 million. So neither do investors seem to care about it as well. MSTR is all about bitcoin.

Outperforming Bitcoin

Anyways, given its bet on bitcoin one might ask what is the issue with its rally since bitcoin too has rallied. Here comes the crazy part. While bitcoin has rallied 157 per cent YTD, MSTR has rallied 515 per cent. How is that possible for a company that is just an indirect way to buy bitcoin, outperform bitcoin by so much? Well, as long as investors are willing to buy its shares that way, it can.

Today MSTR trades at 195 per cent premium to the worth of its bitcoin holdings. To explain in simple terms that means, you can either directly buy 1 unit of bitcoin by paying X or buy MSTR shares at 2.95X to get an indirect ownership of 1 unit of bitcoin. Justifications for this by Michael Saylor and few others belies logic including giving explanations that sound like sophisticated finance for the gullible and bizare for others.

One explanation given is how using leverage at low cost MSTR will be able to buy more Bitcoin and profit. But that assumes that Bitcoin will continue to only go up. What if it falls big, which has happened many times in the past?

Investors would do well to remember how a levered ETF on crude futures wound down when the prices of crude oil went negative in March 2020. Anyways for now MSTR bears, are pointing out to how it crashed after the dotcom boom.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.