The multi-cap fund category has seen a spate of launches in the last one year. Canara Robeco Mutual Fund is the latest one to throw its hat in the ring with ‘Canara Robeco Multicap Fund’. The new fund offer (NFO) period opens July 7 and closes July 21.

Instead of focusing on one m-cap segment such as large-cap or mid-cap, multi-cap funds invest at least 25 per cent each across large-cap, mid-cap and small-cap stocks — thus offering continuous exposure to all segments. But with 19 existing fund choices in the multi-cap fund space, how can Canara Robeco Multicap stand out? Here’s a lowdown.

What is a multi-cap fund?

The history of multi-cap funds is interesting. Initially, multi-cap funds simply had to invest 65 per cent of their assets in equities.

Following the modifications made to the scheme characteristics by SEBI in September 2020, the multi-cap funds in their current form came into existence from January 2021. In the current form, multi-cap funds invest minimum 25 per cent each in large-cap, mid-cap and small-cap stocks — 75 per cent of total assets. They are free to invest the rest in any manner they want.

The constant combination of large-caps (top 100 stocks), mid-caps (101st to 250th stock) and small-caps (beyond 250 stocks) may result in a balanced portfolio that can weather the cyclical nature of markets and where winners keep rotating.

Simply put, investors in multi-cap funds constantly are exposed to at least 25 per cent large-caps, mid-caps and small-caps. This is true for up markets and down markets. In general, mid-cap and small-caps can swing more than large-caps.

Why multi-caps

One may note that multi-cap funds have lesser flexibility than flexi-cap funds, which need to invest atleast 65 per cent in equities and hence, are free to take relatively higher fund manager tilt on market-cap allocation against diversified strategies.

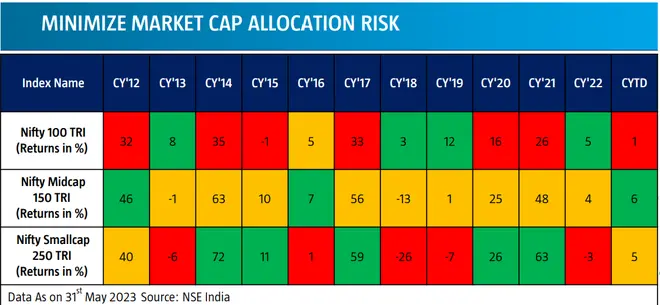

At the same time, multi-cap funds minimise market-cap allocation risk. See the chart below to see how Nifty 100 (large-cap), Nifty Midcap 150 and Nifty Smallcap 250 performed annually from 2012 till now. Notice how during different years the three buckets have performed differently. A multi-cap fund combines all of them and thus can bring diversification across market, avoid the need to time the market. In a flexi-cap structure, the job of predicting which market-cap segment/sector would do better than others is difficult and hence a majority of them are seen sticking more to large-caps.

The balance 25 per cent (beyond 75 per cent minimum allocation across m-caps) gives the flexibility to multi-cap funds to be overweight in any of the three buckets. Historically-diversified funds have been tilted towards the large-cap allocation. In market upturns where mid-cap and small-cap pockets fire better, multi-cap funds are in a position to reduce the opportunity cost of missing upturns.

How Canara Robeco Multicap will invest

The new fund aims to achieve portfolio stability through exposure to leaders/dominant players across market cap, allocation to stocks with earnings growth compounding steadily with high visibility and with resilient businesses that can better withstand downturns.

Canara Robeco Multicap aims to generate alpha from leaders and challengers across market cap, and higher mid-/small-cap weight in high conviction sectors.

Given the constant exposure to mid-caps and small-caps, the fund is focused on risk management process through portfolio diversification, taking care, however, not to dilute returns in the process.

The fund shall avoid stocks with the following:

* Ambiguity on integrity of promoters and capital misallocation

* Lack of Free Cash-flow (FCF) through cycles

* Low ROE and ROCE businesses through cycles

* High growth with unacceptable high leverage companies

* Very high working capital cycles

The fund shall have 1 per cent exit load if redeemed/switched out within 365 days from the date of allotment.

The benchmark of the fund is Nifty 500 Multicap 50:25:25 Index TRI. Shridatta Bhandwaldar and Vishal Mishra will be the fund managers of this scheme.

Our take

Quant Active Fund, Nippon India Multi Cap Fund and Mahindra Manulife Multi Cap Fund are the best performers in the one-, three- and five-year time periods. They have beaten category average as well as the benchmark consistently.

Investors who are looking for one-stop solution with constant exposure to large-caps, mid-caps and small-caps as a part of their asset allocation, can go for multi-cap funds. Given the market levels and valuations of mid-cap and small-cap stocks, SIP is the better way to invest in multi-cap funds today. For those wanting to broaden their investment template outside large- and flexi-cap funds, multi-caps can be a good starting point.

Though this is a new product with no historical track record, Canara Robeco MF has more than 15 years of strong track-record of investing across market capitalisation. If you believe Canara Robeco Multicap can deliver top-end/quartile performance, you can consider it.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.