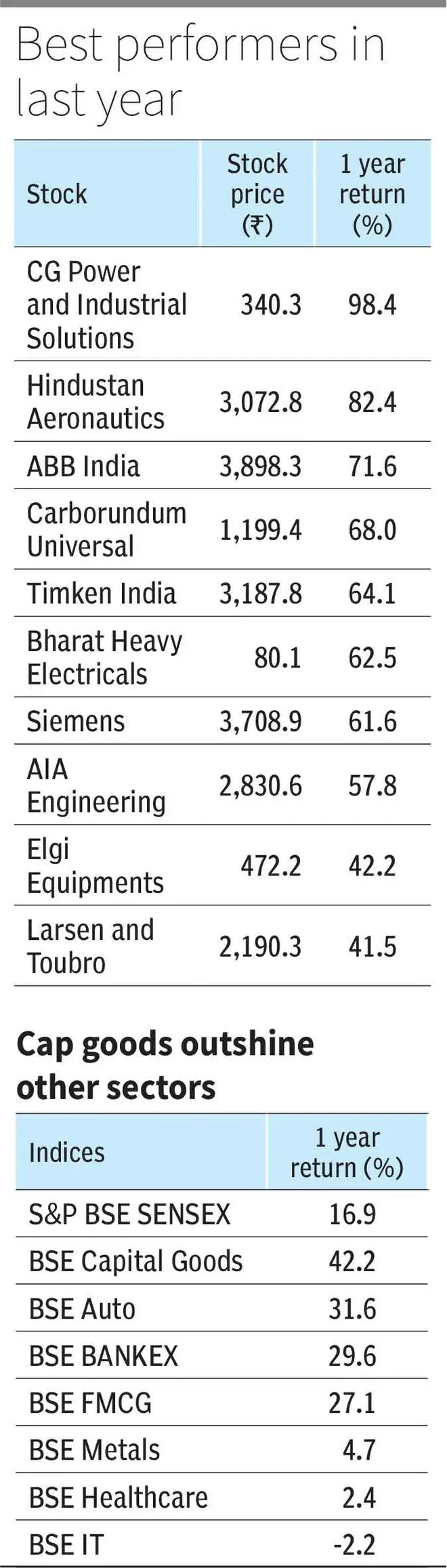

In the last year, the BSE Capital Goods Index has generated returns of about 43 per cent, not only beating the bellwether indices, but also becoming the best performer amongst all sectoral indices. Further, since its Covid lows (April 3, 2020) it has gained about 246 per cent, outperforming Sensex by more than 100 per cent. Such strong showing comes after a decade of under-performance.

During 2010-19, while Nifty and Sensex delivered an absolute return of about 135 per cent, the Capital Goods Index gained merely around 20 per cent on account of declining trends in the capex cycle. But the government’s infra spending, strong order inflows, and expectation of revival in private capex have fired up the capital good segment now.

Govt push and macros

The performance of the capital goods sector is typically linked to the overall investment activity in the economy, indicated by gross fixed capital formation (GFCF) portion of GDP. As per a Jefferies report, FY22 and FY23E have witnessed GFCF of about 29 per cent of GDP, up from around 27 per cent seen during FY21. Of course, one can argue that the same is not as high as GFCF of about 36 per cent of GDP during 2003-2008, a period of boom for the capex cycle. During 2010-19, GFCF fell from 34 per cent in 2011 to 28 per cent resulting in underwhelming performance.

In a recent webinar, Chirag Shah, Vice-President, Research, ICICI Securities, said that in the 2003-08 capex cycle, only 3-4 sectors — thermal-based power generation, oil and gas, and metals led the momentum. While the previous cycle was kind of a concentrated and an ambitious investment cycle, the current cycle appears to be more broad based. The current capex cycle appears to be driven by sectors such as power transmission and distribution, railways, defence, green energy value chain, data centres, factory automation and digitalisation.

Besides, in the current investment cycle, the Centre has taken the pole position in driving capex. The ratio of Central government capital expenditure to GDP, which was at 2.9 per in the Union Budget 2022, has been increased to about 3.3 per cent this year. This ratio averaged 2.6 per cent and 1.7 per cent in the 2003-08 and 2011-19 cycles, respectively.

Robust order books

Thanks to the government push, Indian subsidiaries of MNCs , ABB India and Siemens, have been among the best performers seeing 30 per cent and 35 per cent jump in their order inflows during CY22. These were driven by orders relating to automation, railways, power transmission and distribution (T&D) space and data centres. The stock of ABB India and Siemens rose about 65 per cent during the last year.

EPC companies such as L&T, KEC International and Kalpataru Power saw record high order inflows in 2022-23 with increase of about 19-40 per cent. These companies have order book to FY23 revenue ratios in 1.76-3.2 times range, showing their strong revenue visibility. Kalpataru and KEC saw strong traction from segments such as power T&D, railways, water and urban infrastructure.

Further, the defence theme also appears to be gaining traction on account of indigenisation and higher defence spending by the government. Backed by this, the stocks of aircraft manufacturing and maintenance company Hindustan Aeronautics (HAL), gained 82 per cent last year. HAL and Bharat Electronics have an order backlog of about 3.5-4.5 times their revenue. Larsen & Toubro also received strong growth orders from the defence space.

That said, the sustenance and growth of this capex cycle will depend on the private sector taking this forward. What can work in their favour is that corporate balance-sheets are stronger today compared to previous cycles.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.