In the storied game of bulls and bears, investors are often awed by multi-bagger stocks that multiply money if held for 5 or 10 years. But spotting multi-baggers ahead of their big move and exiting them before a crash often involves more luck than skill. Instead, it may pay to look at consistent stocks, which like honeybees, do their job year after year with little fanfare.

We analysed BSE 500 stocks on Capitaline to see how many stocks could turn out a bee-like performance. We found that just 4 per cent of the stocks consistently generated positive returns 90 per cent of the time in the last ten years. If your goal was to beat the market each year, less than 1 per cent of stocks did it. If you looked for multi-baggers, that made at least two times the Sensex return in 10 years, these tested your patience and risk appetite with gut-churning up and down moves.

Consistent stocks

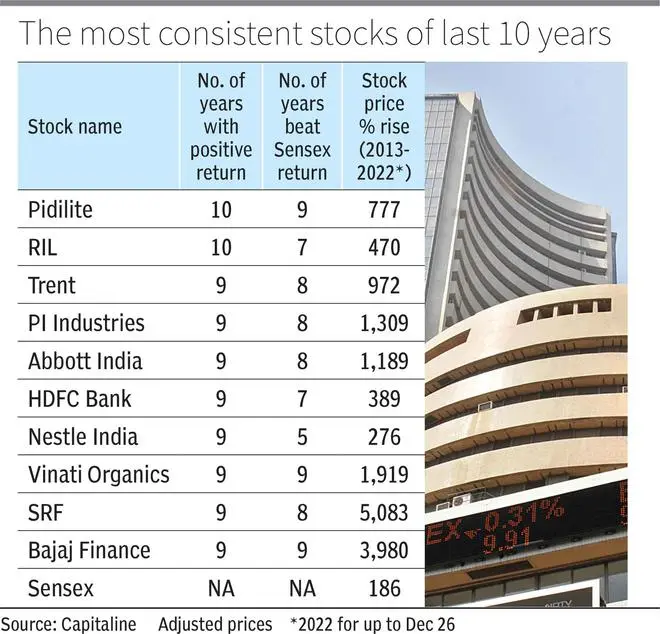

Out of the BSE 500 universe, 352 stocks had a 10-year adjusted price history. Among them, just two stocks - adhesives major Pidilite Industries and energy-to-telecom giant RIL - delivered a positive return in every calendar year between 2013 and 2022 (up to December 26). Though more than half the stocks delivered a positive return in any given year, very few stocks managed the FD-like feat of doing it year after year. The consistent show has expanded your initial investment in Pidilite nine-fold and RIL six-fold in 10 years.

Only a dozen stocks have delivered positive returns in 9 out of the 10 years. The names in this elite list are dominated by chemical, consumer, BFSI and tech sectors. The stocks are Trent, P I Industries, Abbott India, HDFC Bank, Nestle India, Vinati Organics, SRF Bajaj Finance, Atul, Sonata Software, Berger Paints and Info Edge. Losses in 2013 held Trend and HDFC Bank out of the ‘most consistent’ club. For Atul, Sonata, Berger and Info Edge, 13-30 per cent declines in 2022 spoiled a pristine record of uninterrupted gains.

Do note that in the last 10 years, the Sensex has delivered a positive return in 9 years. If you stack up individual stocks against the bellwether, there are no stocks that have done consistently better than the Sensex in the last years. Only Pidilite, Vinati and Bajaj Finance outdid it in 9 of 10 years. This makes a good case for novice investors or those with limited time to bet on index funds rather than try their hand at stock-picking.

Tracking multi-baggers

On the other end of spectrum, the multi-bagger stocks have given stellar returns in the last 10 years. Three stocks – Tanla Platforms, KEI and Borosil Renewables – have given a 10,000 per cent absolute return, turning an initial ₹1 lakh investment into at least ₹1 crore! Nine stocks, such as HLE Glascoat, Uno Minda, Navin Fluoro, APL Apollo, Deepak Nitrite and Garware Tech., have given between 5.000 and 9.000 per cent gains. With the Sensex itself has nearly trebling in value between 2013 and 2022, over 200 stocks did two times as well as the Sensex.

But while one may salivate at the returns on these multi-baggers with the benefit of hindsight, hanging on to them through their roller-coaster journeys was far from easy. For instance, Escorts Kubota fell 7 per cent in 2014 before gaining over 500 per cent between 2015-17 and then losing over 10 per cent for two straight years. Some multi-baggers also had more negative than positive years. IFB Industries made over a 1,000 per cent absolute return between 2013 and 2022, but posted losses in 7 out of the 10 years.

With penny stocks turning multi-baggers, you must brace for an annus horribilis at some point in your investing journey. Tanla Platforms, which has gained nearly 15,000 per cent in 10 years, had seen three years when it lost 20-25 per cent. In 2022, it lost a whopping 64 per cent! A four-rupee stock 10 years ago, the controversial Brightcom Group stock trades at ₹30 today, but it has spent the last 10 years either among the worst (2013, 2016, 2018 and 2022) or the best (2014, 2019, 2021) performers.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.