If you believe India’s financial sector is poised for growth, DSP Mutual Fund’s new offering, ‘DSP Banking & Financial Services Fund, ’ will pique your curiosity. An open-ended scheme that offers investors an opportunity to partake in the long-term structural opportunity in the banking and financial services space, the new fund offer of DSP Banking & Financial Services will close for subscription on December 4th, 2023.

Apart from banks, the usual BFSI stock universe consists of NBFCs, including Housing Finance Companies, Life Insurance, Non-Life Insurance, AMC, Exchanges & Depositories. All have grown at a faster rate than India’s nominal GDP in the last 15 years. This is why the financial sector is amongst the biggest investments across the MF world. With nearly 50 existing focussed schemes, including quite a bit of NFOs, already targetting financial space, how does DSP Banking & Financial Services differ? Here is a lowdown.

Sector returns, prospects

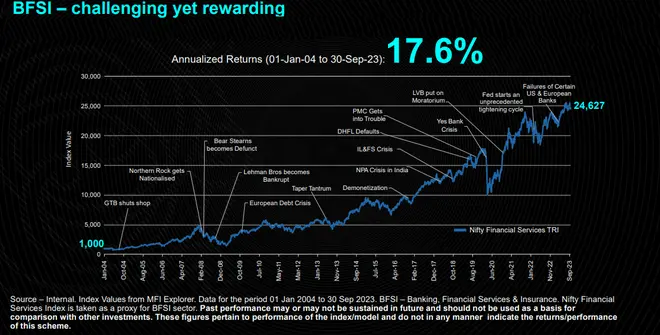

The BFSI sector stands out for its significant profitability compared to other industries, with a growing profit pool attributed to the addition of diverse businesses such as insurance companies, mutual funds, wealth management firms, technology platforms supporting the industry, and payments and fintech services. Lenders, leveraging raw materials, undergo cycles of volatility. Notably, stocks in the BFSI space have recently experienced corrections, offering investors an increased margin of safety. While the financial stocks over the years have been on an upswing, there have been sharp corrections in between (see table below). DSP Mutual Fund believes the NFO launch is happening at a time when valuations are ‘reasonable’.

The Nifty Financial Services TRI has delivered over 12 per cent return in 90 per cent of times over a 7+ year timeframe compared to 52 per cent for Nifty 50 TRI. Right now, Banking, Financial Services and Insurance (BFSI) forms 38 per cent of the profit pool of the Top 500 companies in India but is just 26 per cent of the market cap. This is the gap DSP Banking & Financial Services wants to target. Supporting this thesis is the fact the underperformance of BFSI shares versus Nifty 50 TRI in the last four years brightens the possibility of a reversal.

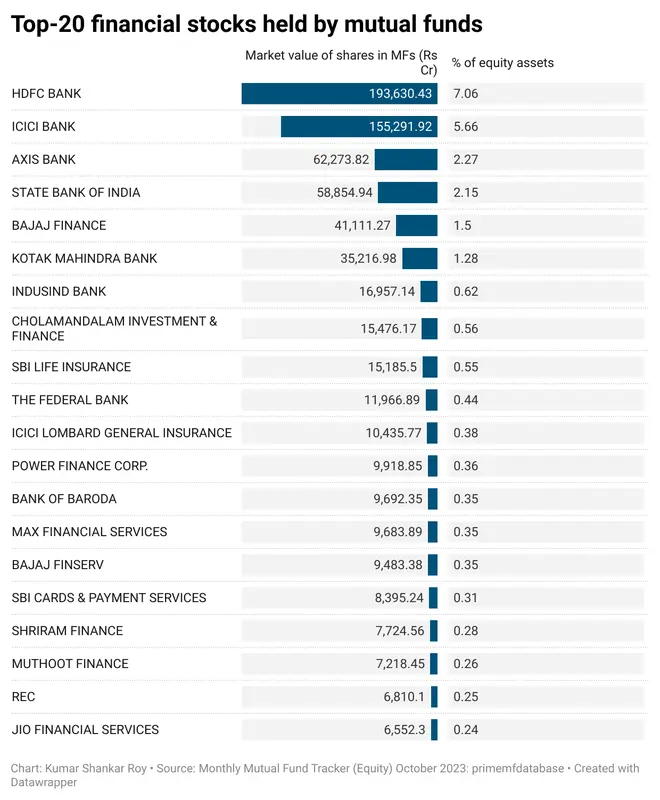

Also, banks’ balance sheets have grown stronger with lower NPAs. This could aid a sustained pick up in credit growth, helping valuations re-rate. See below to check out the top 20 financial stocks held by mutual funds.

Strategy difference

DSP Banking & Financial Services will follow a stock-specific approach favouring business fundamentals over market outlook and will attempt to have a high active share compared to the benchmark. It also has the flexibility for Global Investments where the Fund Manager can invest in selective, fundamentally sound businesses internationally, which is not available in India.

Under normal circumstances, the asset allocation of DSP Banking & Financial Services Fund would be between a minimum of 80 per cent to a maximum of 100 per cent in equity and equity-related securities of companies in the Banking and Financial services sector, up to 20 per cent in equity and equity related securities of other companies, up to 20 per cent in debt and money market instruments and up to 10 per cent in units issued by REITs and InvITs.

DSP Mutual points out that a median flexicap fund holds 70 per cent (August-2023) of the financial services investments in banks. Therefore for a better participation in opportunities outside of banks, a focussed BFSI Fund can perhaps help.

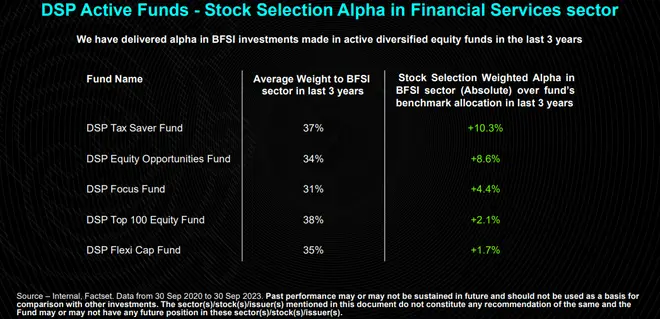

DSP MF has delivered stock selection alpha (see table below) in Banking & Financial Services in the last 3 years in its active, diversified funds such as DSP Tax Saver, DSP Equity Opportunities, DSP Focus, DSP Top 100 and DSP Flexi Cap.

Risks to know

DSP Banking & Financial Services Fund operates as a sector fund, exclusively offering exposure to the Banking & Financial Services sector. This specialization introduces a concentration risk at the sector level. With an aim to maintain a portfolio of approximately 20 stocks, the fund also exposes investors to stock-level concentration risk. Consequently, the fund may demonstrate increased volatility and drawdowns compared to diversified equity funds. It’s important to note that, in the short term, this fund might underperform in comparison to diversified equity funds.

Our take

Equity funds have deployed nearly 30 per cent of their assets in banks and financial stocks.

With banking and financials already being a good portion of most diversified equity funds, the jury is unsure what kind of extra return it may add to your portfolio. Taking additional exposure to banking and financial services through an exclusive fund will mean increasing risks (for potential rewards) for your overall portfolio. This is avoidable.

If valuations are indeed reasonable and are re-rated positively going forward, existing diversified funds will also benefit.

bl.portfolio current ratings for DSP Focus and large-cap offering DSP Top 100 are both 1-star. DSP Tax Saver (4 stars) and large & midcap offering DSP Equity Opportunities (3 star) are relatively better. So, if you want to go for DSP MF schemes, invest in the better-rated funds for financial exposure but in a diversified way.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.