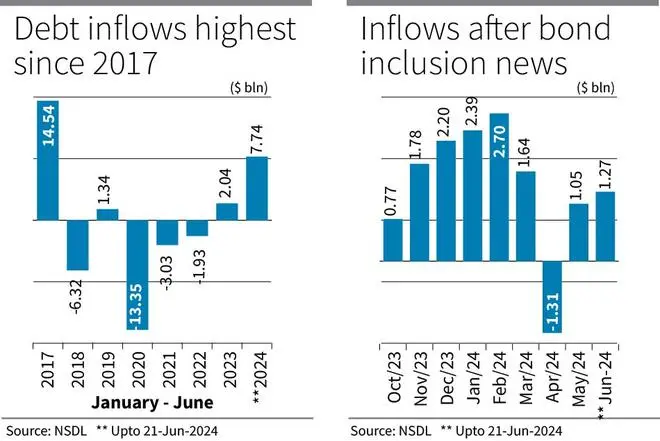

After inflows of $14.54 billion in the first half of CY2017, it is only now that foreign flows into debt is gathering pace.

According to the data from the National Securities Depository Limited (NSDL), the debt segment has seen a net inflow of about $7.74 billion so far in 2024 (up to June 21) from Foreign Portfolio Investors (FPIs). Four out of six intervening years saw net outflows with only 2019 and 2023 seeing some inflows (see chart).

Foreign money inflows into the debt segment gathered momentum ever post the announcement on India’s inclusion in JP Morgan’s Government Bond Index - Emerging Markets. The inclusion comes into effect in the comingweekend (June 28).

Flows can sustain

India will get a total weightage of 10 per cent in the index. It will begin with 1 per cent weight and the total 10 per cent weightage is likely to be reached by March next year. So, the inflows can continue and are likely to pick up more pace once the inclusion happens.

Amit Goel, Co-Founder and Chief Global Strategist, Pace 360, says that active fund managers started putting in money prior to the inclusion date and passive fund managers will start once the inclusion happens. He also sees India’s political stability and good macro-economic conditions as strong supporting factors for the foreign money flows to continue. “The fiscal conservatism of the current government is liked by the bond market,” says Goel.

Dhawal Dalal, President & CIO, Fixed Income, Edelweiss MF, says, “Based on passive funds beginning to invest around 1 per cent weightage on a monthly basis, we should be able to get $1.5-2 billion a month for the next ten months from them assuming that there is no change in the macro-economic landscape.”

Another supporting factor is the vote of confidence that comes after being included in a benchmark, says Pankaj Pathak, Fund Manager, Quantum Asset Management. “Earlier, global players were shying away from India. But. now, since we will be a part of the benchmark, global players will prefer India”

That said, a few factors can be a risk and cause some disruption in the foreign money flowing into India.

Risk factors

Firstly, an economic slowdown in the US or a recession, which is still a possibility can trigger money outflows. “The chances are high for a recession in the US in the next year. If that happens, the dollar index will go up and there will be foreign money outflows from India,” says Amit.

Secondly, the risk of a surge in crude oil prices on the back of the geopolitical tensions especially in the Middle East will be another event risk that will need a close watch.

Lastly, better opportunities outside India can shift foreign investors’ focus to alternative options. “Indonesian yields have been hardening recently whereas the Indian government bond yields are falling. They are one of the competitors for yields in Asia. If they become sufficiently attractive then a portion of foreign fund flows could be diverted there,” says Dhawal.

However, though the above-mentioned factors can slow down foreign flows, experts believe that it will only be a temporary phenomenon.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.