‘A million dollars isn’t cool, you know what’s cool? A billion dollars!’ This iconic quote from Sean Parker to Mark Zuckerberg, in the movie The Social Network, highlights the significance of a billion dollars in the corporate world. Needless to say, this holds good for Indian corporates as well. A billion dollars is a milestone whether in terms of market value or revenue or profits.

Recently, three midcap IT companies — Coforge , Persistent Systems and L&T Technology Services (LTTS) — achieved this milestone in annual revenues as the release of their Q4 FY23 results showed. How cool is that? Let’s assess.

The original $1-b club

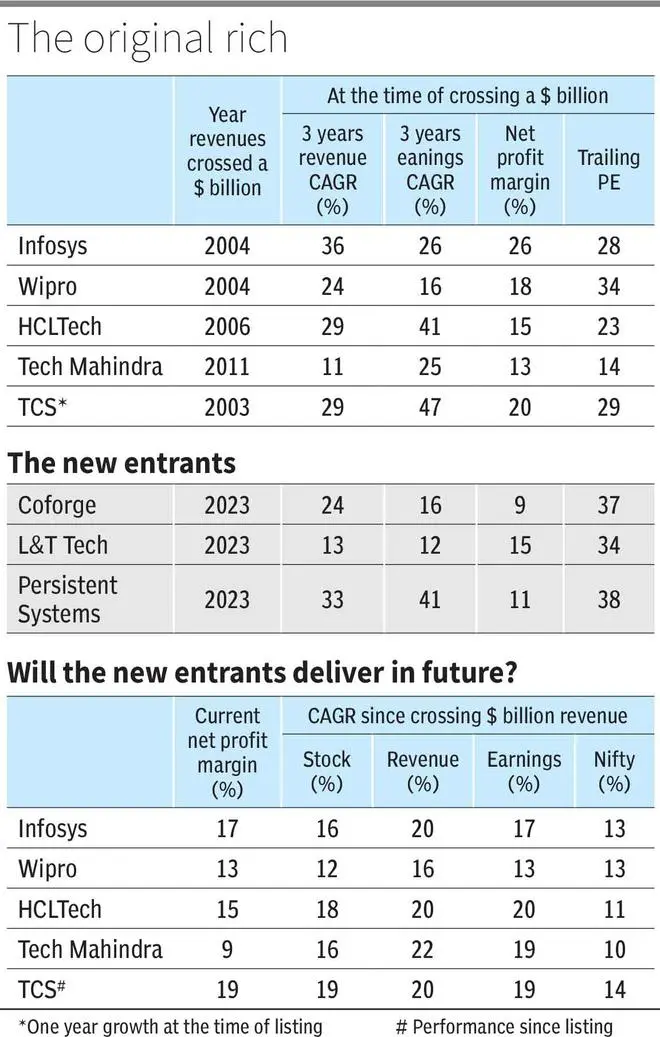

Infosys crossed a billion dollars in revenue in the year FY 2004 and as did the IT services business of close peer Wipro. TCS, which was unlisted then, had crossed the milestone a year earlier in FY 2003. HCL Tech followed suit in 2006. Thus, by 2006, the Big Four of Indian IT majors had scaled this milestone. India’s fifth largest IT company then, Tech Mahindra (now overtaken by LTIMindtree post merger), crossed the milestone in the year 2011.

How cool has it been for these companies after crossing a billion dollars in revenue?

With the exception of Wipro , the returns have been quite good. For example, TCS has given CAGR returns (since listing) of 19 per cent versus Nifty 50 returns of 14 per cent. Tech Mahindra stock has given annualised returns of 16 per cent, nicely outperforming the Nifty 50 CAGR of 10 per cent.

HCL Tech has been the standout though, with stock CAGR of 18 per cent, significantly outperforming Nifty 50 CAGR of 11 per cent. Wipro alone has underperformed Nifty 50 returns from the time it crossed billion dollar in revenues.

THEN vs NOW

Compared to these, what can one expect from the new entrants? Maybe not-so-cool ?

While how exactly the future will play out is anyone’s guess, there are reasons to believe the returns from the new entrants may not match the past returns of the original members of the billion dollar club.

To begin with, TCS, Infosys , HCL Tech and Tech Mahindra were all trading much cheaper than Coforge, Peristent Systems and LTTS at their respective times of crossing the billion $ mark. The one company that was trading at that time on par with the new entrants now, Wipro , has been an underperformer.

There is more. The best of tailwinds for industry is probably behind them. Back then, the Indian IT services industry was a hot emerging sector. The Indian software and services sector industry was growing at close to 30 per cent in FY2004. Compared to that in FY23, it the Indian tech sector is likely to have delivered a growth of 8.4 per cent, per initial Nasscom estimates.

While some mid-cap companies like Persistent Systems and Coforge , too, have delivered strong revenue growth rate, going forward they may lack the support of industry tailwinds or the strong global growth period of 2004-07, which is considered one of the best phases of global economy since World War II.

Margins down

The profitability was also much superior then with net profit margins mostly in the high teens to low 20s percentage range. The net profit margins for the new entrants are much lower, in the range of high single digits to low double digits percentage range.

Lower margins indicate high competitive intensity in the industry. With many players upping their game in the last two decades, there is a large group of quality companies vying for the same pie. Thus, margins may not reach those high levels of earlier times. In fact, the Big Four players have themselves seen margins shrink in the last two decades, although they remain better than that of the mid-cap companies. The irony being, margins have shrunk when during the same time the rupee has depreciated from about ₹40 to a dollar then to around ₹80 now.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.