The IPO of OTA (Online Travel Agency) company Le Travenues Technology, popularly known by the umbrella brand name ixigo, takes flight on June 10. With the company having a reasonably strong balance sheet (similar to other OTAs), the issue size of ₹740 crore is primarily an offer for sale of ₹620 crore by the founders and early private equity investors in the company. The balance is fresh issue of ₹120 crore, which will be utilised by the company for meeting working capital requirements, investments in technology and related aspects, strategic initiatives and general corporate purposes.

The OTA space in India is set for a decent growth path for the long term for two reasons — one, the consumption theme in India, of which travel and tourism is a part, is set to grow well as standards of living improve; two, digitisation and use of OTA apps continues to expand into every nook and corner of the country, resulting in OTA players growing faster than the overall travel industry.

On the flip side, the Indian OTA space is a bit crowded, with more players than what one would see in developed economies. ixigo would be the fourth listed player in this space, if one includes MakeMyTrip, which is the industry leader in India and is listed in the US. There are a few unlisted players as well. Given competition and companies investing in growth, margins are also low. Thus there are pluses as well as minuses.

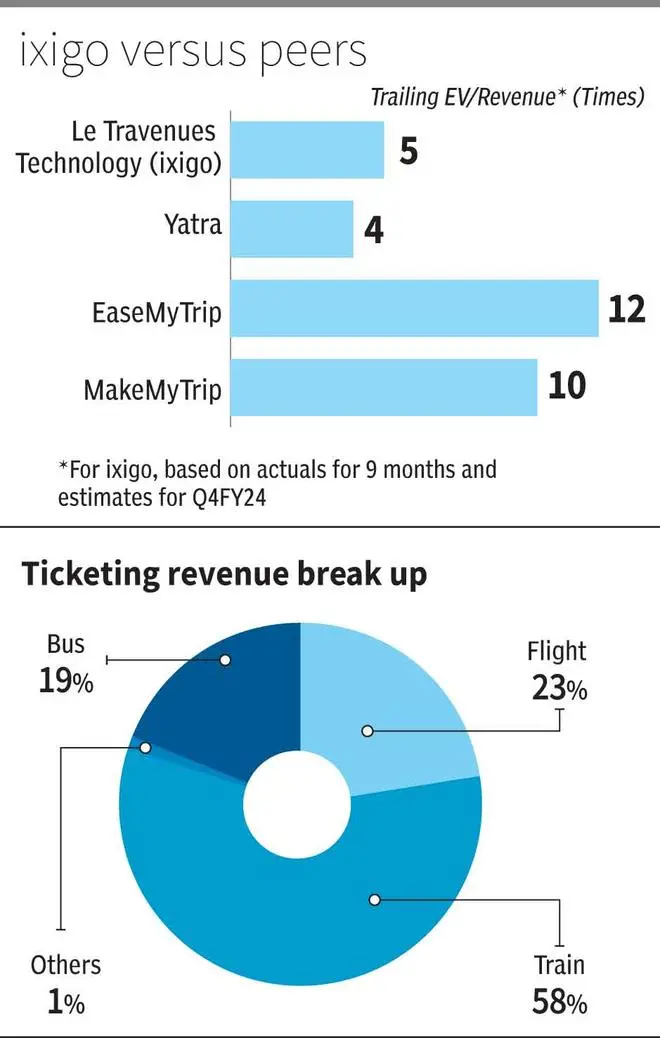

In this backdrop, ixigo IPO hits the street at a valuation of 5 times EV/Revenue. The revenue here is estimated FY24 revenue based on actuals for nine months and 4Q estimates adjusted for seasonality. The valuation, while not cheap, is not excessive either. Considering the growth prospects and good scope for margins to improve, investors with a long-term perspective of 4-5 years can subscribe to the issue, but in small quantities, given the uncertainties related to how the competitive environment will pan out over the next few years.

Value creation is contingent on margins expanding. ixigo following a differentiated strategy by having higher share in rail tickets booking, focus on Tier II/III city travellers and other value added services may work to its advantage in the long run.

Business

ixigo, which initially launched as meta search websites for flights in 2007, is today a full-fledged leading OTA in India offering consumers booking facilities across trains, buses, flights, hotels and cabs. It follows a multi-app strategy under the ‘House of Brands’ approach under which its different apps — ixigo flights, ixigo trains, Confirm Tkt and Abhibus — offer a spectrum of travel offerings, each uniquely catering to target groups for those respective apps. It also offers valued added services for extra fee, which include services like 100 per cent refund for bad quality of service for buses, free change of date for flights/cancellation.

ixigo has followed organic as well as acquisition-led approach to growth. Today, it is the market leader amongst private OTAs when it comes to train ticket bookings, with a market share of 52.64 per cent for the 9M FY24 period. It had a 12.99 per cent share in the bus ticket booking space and 5.3 per cent in flight ticket booking space. Its foray into hotels booking is in early stages, with the company’s own platform having been launched only in December 2023 (earlier it used to redirect hotel bookings to Booking.com).

ixigo is attempting to differentiate and position itself as the leading OTA for the next billion users with a focus on localised content and app features that aim at solving problems of Tier II/III with 94.39 per cent of its transactions in FY23 driven by smaller towns and cities (either as source or destination). As per company filings, ixigo is the largest private OTA in terms of cumulative app downloads as of September 2023 at 288.4 million, with next largest private OTA at 249.2 million and third largest private OTA at 19 million. It scores well on monthly active users (MAU) — the latest data given in its filings for the month of September 2023 shows ixigo had MAU of 83 million, versus the next OTA at 81.5 million, with the third player much lower at 4.4 million.

Thus it’s clear ixigo scores very well in terms of user engagement. However, it also needs to be clearly noted that its average transaction values are much lower versus peers, given focus on train and bus bookings. So, to understand this, investors must bear in mind that the revenue differential between ixigo and the third player in the industry with much lower app downloads and MAU is not significant. But the advantage here for ixigo is that it has huge potential to keep mining its huge customer base as they move up the spending curve. Its long-term success, to a great extent, will depend on this.

At a broader sectoral level, the online travel market in India is estimated at ₹2,079 billion in fiscal 2023 and is anticipated to grow faster than the overall travel market at 13 per cent CAGR for the forecast period of fiscal 2023 to fiscal 2028 and reach ₹3,895 billion by fiscal 2028. Within this, the OTA industry’s booking value is expected to grow at a CAGR of 18 per cent. This is as per data in IPO filings of ixigo. A competitor’s IPO filing a few months back estimated the OTA industry net revenue growth for the same period at around 15 per cent. So, investors need to factor for such variations.

Ixigo market share of the booking volume of OTA market was at 6.52 per cent for 9MFY23.

Financials

ixigo has reported good growth over the last year with revenue for the 9MFY24 at ₹491 crore, up by 34 per cent versus 9MFY23. EBITDA was at ₹34.3 crore, up 15 per cent Y-o-Y. EBITDA margins declined from 8.19 per cent to 6.99 per cent as the company spent more on advertising and promotion in current fiscal. Take rate (ticketing revenue/gross transaction value) was at 7.7 per cent. It has ranged at 7-8 per cent in recent years.

It is profitable at bottom line as well, but only marginally, with net profit for the period at ₹65 crore boosted by exceptional items and tax credits.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.