Benchmark indices have surged to new highs ahead of the upcoming Union Budget. Will the Budget keep the market momentum going?

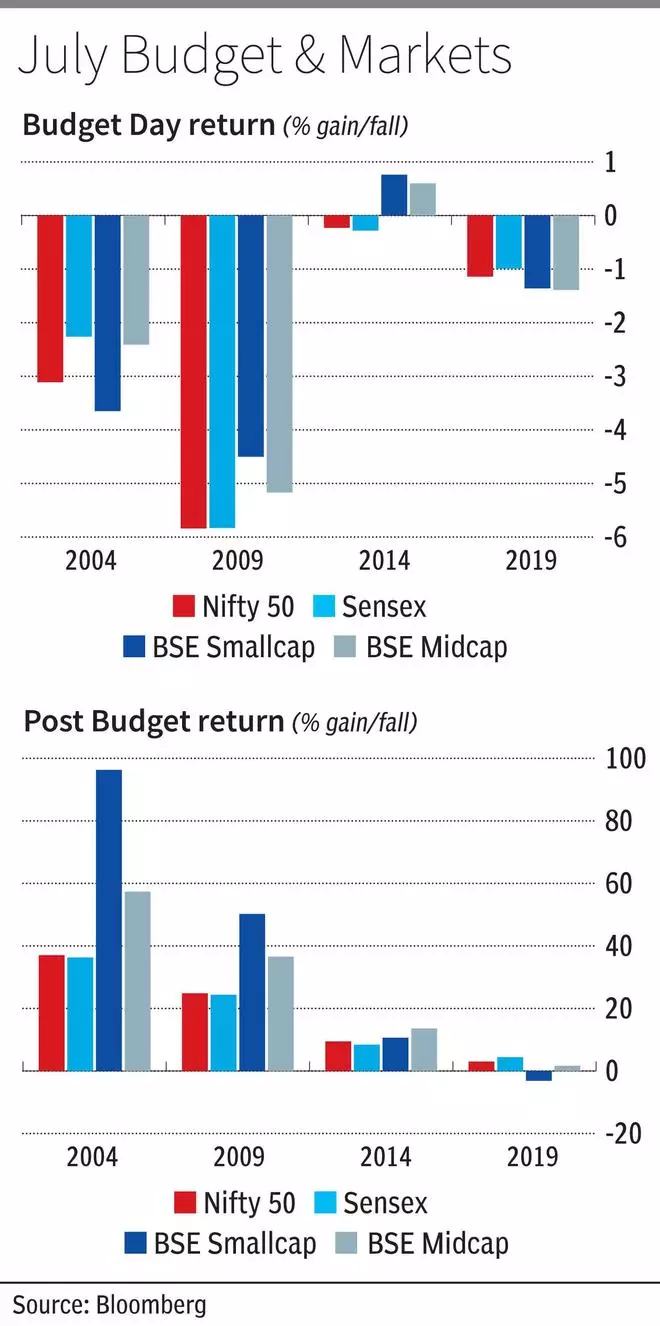

A study of four Budgets tabled in July after the formation of a new government shows that benchmark indices, the Sensex and the Nifty 50, have fallen on Budget Day. However, post that, the rest of the year has always been good, with the benchmarks making a strong rally. Here’s more.

Budget Day

Since 2004, Budget Day in July has not-been-so-lucky for the indices. Of the four Budgets, the benchmark indices fell the most in 2009 and the least in 2014. The sharp fall in 2009 was triggered by the high fiscal deficit projected for 2009-10. The then government announced that the fiscal deficit may rise to 6.8 per cent of GDP, up from 6.2 per cent in the previous year.

According to reports in the public domain, the deficit number announced in that Budget was the highest since 1994. The BSE Smallcap and BSE Midcap indices also moved in tandem with the benchmark indices. The year 2009 was the worst among the four when the BSE Smallcap fell by 4.5 per cent, and the BSE Midcap declined by 5.17 per cent.

Sectoral Indices

Sectoral indices have also largely followed the benchmarks on Budget Day, with a few exceptions. For instance, in 2009, the BSE FMCG index was the lone sector to end the day marginally higher by 0.27 per cent, reaffirming the sector’s tag of being a defensive bet in uncertain times. All other indices were beaten down badly that year. The BSE Bankex crashed 8.17 per cent.

In 2019, the BSE FMCG and BSE Bankex were up 0.18 and 0.14 per cent, respectively, when the other indices were in the red. The average return on the previous four July Budget days shows that the BSE Metal index fell the most among various sectors. The index saw an average fall of 4 per cent. This is followed by the BSE Oil & Gas, BSE PSU and BSE Bankex indices. They declined by 3.18, 3.13 and 3.05 per cent on average, respectively. Mid- and Smallcap indices have declined 2 per cent each on an average. For the Sensex and the Nifty, the average fall was 2.34 per cent and 2.58 per cent, respectively.

Post Budget rally

Although the Budget Day has been negative, the rest of the year has always been very good for the equity markets. In 2004 and 2009, the benchmark indices surged about 36 and 24 per cent, respectively. In those years, the BSE Smallcap index skyrocketed 96 and 50 per cent, respectively. The BSE Midcap index rose 57 per cent in 2004 and 36 per cent in 2009. That said, of the four years, gains in 2019 alone was moderate, with the Smallcap index even showing a fall.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.