Indian equities closed last week on a weak note, recording a 1.5 per cent decline for the five-day period. Out of the 500 stocks that are part of the S&P BSE 500 Index, about two-thirds of them saw their stock prices tumble last week. Even as global recessionary concerns were sentiment negative for the broad market, yet there are stocks that have had a fabulous week, rewarding their investors with spectacular returns.

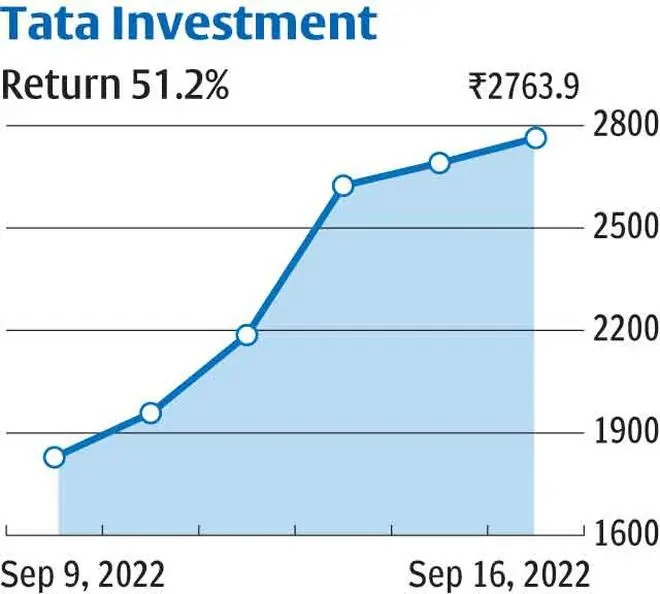

Topping the list of winner stocks last week is that of the investment arm of the Tata Group- Tata Investment Corporation, with a whopping 51 per cent gain over the past week. The company holds 32 per cent stake in Tata Asset Management Company and 24.61 per cent in Amalgamated Plantations and 50 per cent in Tata Trustee Company.

The company’s investment book stood at ₹20,892 crore as of March 2022, while the current market cap of the company stands at ₹14,000 crore, implying a holding company discount of about 32 per cent. In a little over a one year time frame, the company has seen its holding company discount shrink from around 60 per cent to 32 per cent now, and thus has outperformed its investee companies.

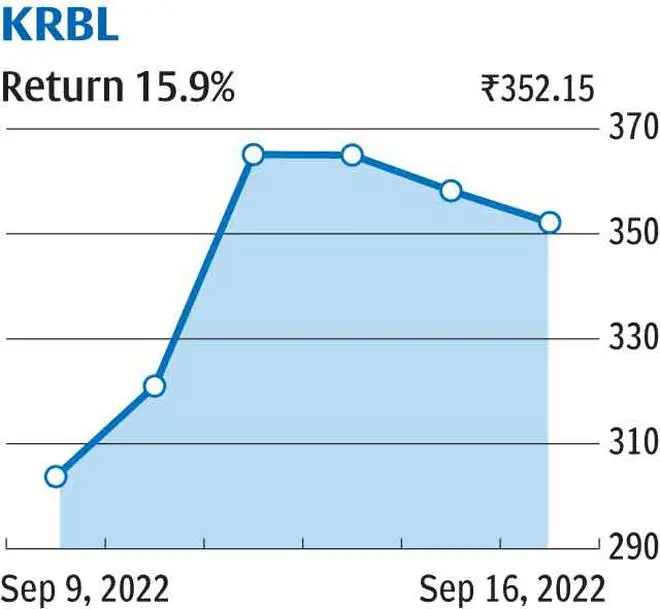

The stock of India’s largest basmati rice producer KRBL rose 15.9 per cent, last week. Over the last six months the stock has gained over 68 per cent. Last week, Government imposed 20 per cent export duty on several varieties of non-basmati rice such as unmilled, milled, totally milled and husked brown. In addition to this, the Government imposed a blanket ban on broken rice, due to dwindling supplies in the home market.

Also, the uneven distribution and unseasonal rainfall has been a key concern, particularly in rice belts such as Bihar, Tamil Nadu etc, as this will have a bearing on the crop output. That, basmati rice, has been kept out of the export duty net is possibly some news to cheer, for KRBL. Given the adverse weather condition and scanty rainfall in several countries such as China, Europe etc, the prices of food grains and agri commodities is expected to trend higher in the near term. This should better the prospects for export-oriented agri players such as KRBL. The company reported 21 per cent revenue growth to ₹1228 crore in 1QFY23 on a year-on-year basis, while profit grew 16 per cent to ₹164 crore. The stock currently trades at 17.1 times its trailing twelve-month earnings, compared to 41.8 times for the industry.

Third in the gainers’ list is the stock of leading tyre maker, Ceat Ltd which gained 15.8 per cent last week. The stock has rallied by an impressive 62 per cent in the last six months. The recent correction in natural rubber prices and softening global crude oil prices will likely lead to margin improvement for tyre makers. Further, the ability of tyre manufacturers to pass on the price increases in the after-market should further help margin improvement.

The stock currently trades at 99 times its trailing twelve-month earnings, over three times higher than the 28 times for the industry. The high trailing PE is due to the over 80 per cent Y-o-Y decline in net profits, the company reported for FY22. The decline was due to cost pressures and primarily in raw materials. Thus any softening in natural rubber and crude prices, bodes well for the company.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.