Investment options in the passively managed mutual funds space in India continue to multiply. Currently there are two new index funds open for subscription, namely Kotak Nifty 200 Momentum 30 Index Fund; and UTI Nifty50 Equal Weight Index Fund.

Index mutual funds are savvy investment vehicles that aim to mirror the performance of a specific market index, and they do this at a fraction of the cost of an actively managed fund. But Kotak Nifty 200 Momentum 30 Index Fund and UTI Nifty50 Equal Weight Index Fund are positioned at the extreme ends of the spectrum due to their inherent strategies. Let us find out more about them.

Kotak Nifty 200 Momentum 30 Index Fund

Momentum investing is about buying stocks that are rising and selling them as soon as they show signs of dipping.

Kotak Nifty 200 Momentum 30 Index Fund is an open-ended scheme replicating/tracking the Nifty 200 Momentum 30 Index. The NFO closes June 8.

Nifty 200 Momentum 30 Index aims to track the performance of the top 30 companies within Nifty 200, selected on the basis of their normalised momentum score. This score is determined by six-month and 12-month price return, adjusted for volatility. This selection offers investors exposure to momentum stocks across market capitalisations and diverse sectors.

The Nifty 200 Momentum 30 Index is largely a large-cap index, with over 75 per cent of exposure to large-caps. Mid-caps form the rest. Compared to actively managed momentum investing, the index-based route to momentum investing offers a clearer rule-based entry and exit mechanism at low cost (expense ratio for regular plan: 91-100 bps; direct plan: 31-42 bps) and lower turnover (semi-annual rebalancing of index).

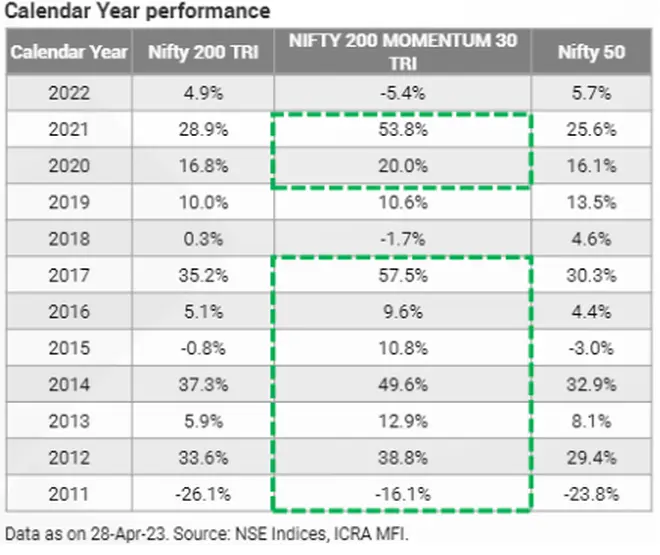

As the table below shows, Nifty 200 Momentum 30 Index (total return index) has beaten Nifty 200 and Nifty 50 nine out of 12 calendar years.

But do remember that high returns seldom come without high risk. Across various time periods such as one-, two-, three-, five-, seven- and 10-year, the standard deviation of Nifty 200 Momentum 30 Index is consistently 200-500 bps more than Nifty 200 and Nifty 50. So, one should keep in mind that momentum investing can be volatile.

While momentum stocks continue to change as per market dynamics, the Nifty 200 Momentum 30 Index’s top holdings include ITC, NTPC, ICICI Bank, Bank of Baroda, M&M, Sun Pharma, Bharti Airtel, SBI, Axis Bank and Eicher Motors. In terms of sectoral exposure, financial services is the weightiest (close to 30 per cent), followed by capital goods (16 per cent), automobile and auto components (12 per cent), FMCG (6 per cent), consumer services (6 per cent), and so on.

Our take

Kotak Nifty 200 Momentum 30 Index Fund is a new addition to the existing line-up consisting of Bandhan Nifty 200 Momentum 30, ICICI Pru Nifty 200 Momentum 30, Motilal Oswal Nifty 200 Momentum 30, and UTI Nifty 200 Momentum 30.

Momentum-based index funds are ideal for investors with a portfolio where other factors such as value, quality, momentum, and size have historically enhanced relative portfolio returns, while minimum volatility has consistently reduced relative risk.

UTI Nifty50 Equal Weight Index Fund

Equal weight is a type of proportional measuring method that gives the same importance to each stock in a portfolio, index, or index fund. So stocks of the smallest companies in the basket are given equal weight as the largest.

UTI Nifty50 Equal Weight Index Fund is an open-ended scheme replicating/tracking Nifty50 Equal Weight Total Return Index (TRI). The NFO closes June 5.

In Nifty50 Equal Weight Index, the basket’s total value is determined by the value of each stock, with all of them seen as carrying equal importance or value in the calculation of the index. Equal weight strategies are among the tested concepts across the global smart-beta landscape. An equal-weighted index provides more diversification than a market-cap weighted index.

The UTI Nifty50 Equal Weight Index Fund aims to provide investors with exposure to the Nifty50 Index companies but with an equal weight, namely 2 per cent to each stock. This compares to Nifty50, where the 10 biggest holdings carry weight of 3-10 per cent individually. The equal index funds undergo quarterly rebalancing, regardless of the size of each index company.

The Nifty50 Equal Weight Index is, in total, a giant/large-cap index. There are currently a few index funds based on Nifty50 Equal Weight (TER of regular plan: 88-106 bps; direct plan: 35-40 bps). Compared to Nifty50 plain-vanilla index funds, the equal-weight variants are more expensive. One of the reasons for this could be the more frequent churning of portfolio in the case of equal weight index funds.

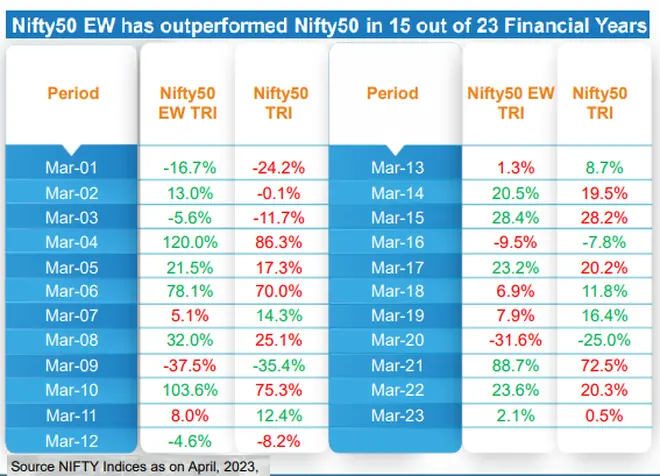

Investors looking for balanced and anti-momentum ways usually consider equal weight index funds. In India, we have equal weight index funds tracking Nifty50 and Nifty100. Comparing market cap and equal weight indices does throw up a clear winner if you look at them financial year-wise (see table below).

Note that each index outperforms the other in different market environments. Given the fact that equal weight index has performed better than market cap index in the last few years, a mean reversion could be on the cards.

Our take

When a stock or sector performs well, it becomes a larger portion of the index if market capitalisation weighting is used. More weight to the historical winner stocks exposes a portfolio to higher risks. In contrast, smart-beta products such as UTI Nifty50 Equal Weight Index Fund offer an anti-momentum, forced buy-low-sell-high mode of investing that clearly comes with lower risks from stock and sector concentration.

For risk-averse investors, equal weight index strategy is suitable. However, do remember that equal weight strategy, with in-built auto profit-booking, may underperform if the influential winners in the plain-vanilla index continue their streak. So, ideally, one should mix and match market cap and equal weight index funds for portfolio diversification.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.