The performance of Portfolio Management Service (PMS) providers continues to impress, especially when compared with mutual funds. While PMS offerings are targetted at wealthy investors, given the minimum ticket size of ₹50 lakh compared to ₹100-500 for mutual funds, the differential in returns is noteworthy. One could reasonably argue that PMS offerings are much more concentrated given the relatively unconstrained investment mandates they run vis-a-vis true-to-label mutual funds, but if financial returns are a parameter, PMSes are eating MFs for lunch. In this article, we will let the following infographics do most of the talking.

Largecap ladder

In the last year, ending August 2022, markets have registered about a 3.7 per cent rise. Largecap PMS funds, as a category, posted 270 basis points extra return than large-cap mutual funds in the same period. The PMS category average returns were boosted by the performance of Agreya Exposure Equity Index Strategy, Pelican PE Fund and ACE 15. While the category’s extra return narrows over 3- and 5-year periods, PMS large-cap funds managed to hold their fort against MFs (see below).

Midcap march

In the longer term, i.e. 3 and 5-year gains logged in by midcap stocks have been good (see below), despite the volatility. As a category, PMS funds play the midcap theme, including return leaders such as Centrum PMS’ Good to Great and Multibagger, Unifi’ Blended Rangoli and Insider Shadow strategies reported a good lead over midcap MFs. However, it is midcap mutual funds, led by Motilal Oswal Midcap, Quant Mid Cap and SBI Magnum Midcap, that stole the march over PMS rivals as a whole in one year , with a 285 basis-point lead in terms of category average return.

Smallcap show

In the smallcap space, PMS strategies hold the lead MF peers in the 1 and 3-year period., thanks to best performers such as Molecue Ventures Growth strategy, ICICI Pru PIPE Strategy and Right Horizons Minerva India Under-Served strategy. However, smallcap mutual funds made a comeback in five years(see below), on performances by schemes such as Quant Small Cap, Axis Small Cap and SBI Small Cap.

MFs dominate multicaps

The multicap fund category is technically new for mutual funds, with a handful current schemes. Still, multicap MFs came on top of PMS rivals in 1, 3 and 5 year period. While one may argue that the category average of multicap MFs is based on nine schemes against a whopping 137 for the PMS segment, but numbers seldom lie. Best multicap MF performers across all periods include Quant Active, Mahindra Manulife Multi Cap Badhat and Nippon India Multi Cap.

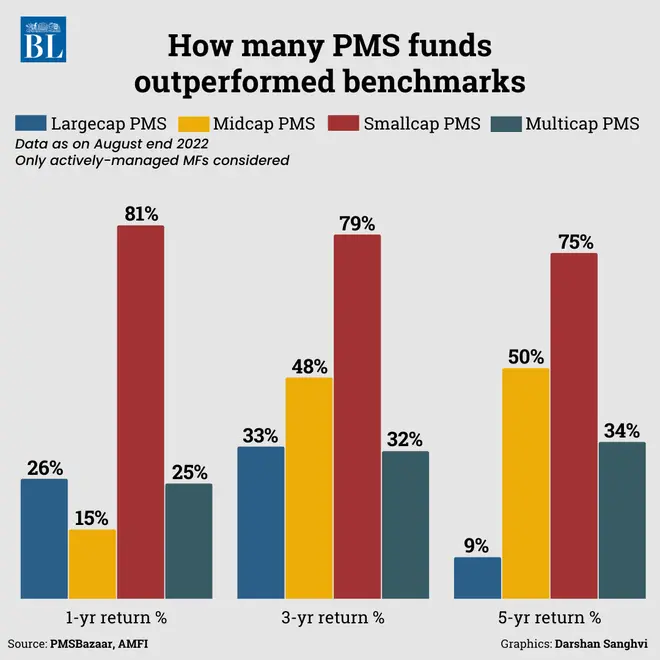

Beating benchmarks

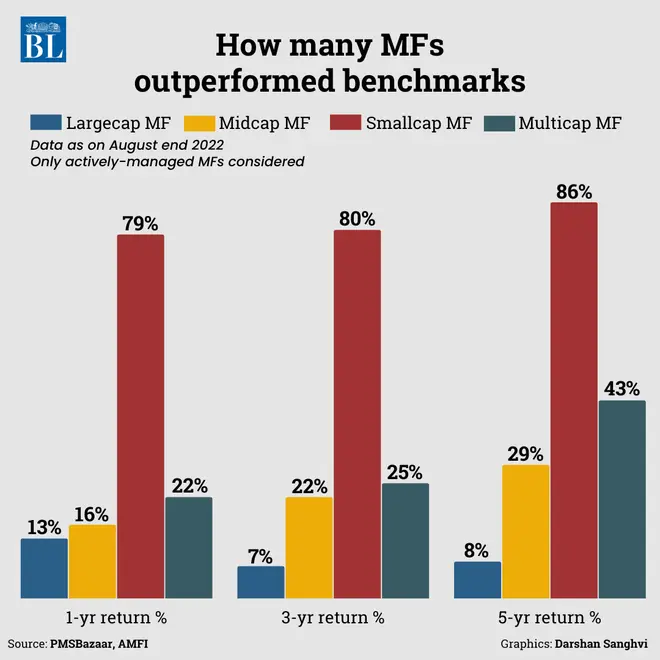

Notwithstanding the absolute returns, actively managed funds should better benchmark returns, be they MFs or PMS entities. Here is a look at PMS strategy performance vis-a-vis benchmarks (see below). For both PMS and MF, we took the same yardsticks. So, largecap benchmark is S&P BSE 100 TRI, midcap benchmark is Nifty Midcap 150 TRI, smallcap benchmark is S&P BSE 250 SmallCap TRI and multicap benchmark is Nifty 500 Multicap 50:25:25 TRI.

Here is how MFs performed against the same benchmarks (see below). In smallcap and multicap segments, MFs appear to have given tough competition to PMS rivals.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.