After the sharp rise in equity indices for much of calendar year 2024, the last couple of months have seen markets correct sharply on the back of heavy FII selling. Increasing allocation to the US from foreign investors after the Presidential elections, underwhelming show from domestic companies in the recent quarter and weakening consumer sentiments have hurt flows.

With several segments in the markets correcting sharply, there appear to be pockets of value available for investors. This is especially so in the large-cap space, though there are some attractive parts in the lower market cap segments as well.

In this regard, a seasoned flexicap fund that is tilted towards large-cap stocks and has a robust track record would suit investors with a medium risk appetite looking to save for long-term goals.

Franklin India Flexi Cap fund (Franklin India Equity earlier) completed 30 years and has recorded a solid performance over the decades. It does have the odd patches of occasional underperformance, such as during a few years in the middle of the previous decade. But over the last seven years, the fund has remarkably improved in consistency while beating its benchmark.

Investors can consider deploying sums in the fund via the systematic investment plan (SIP) route.

Delivering outperformance

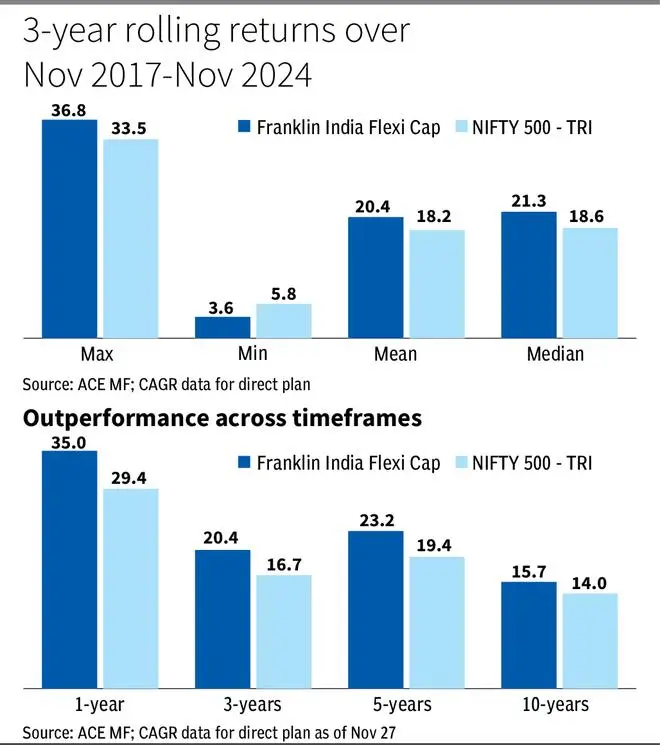

Over the past 1-year, 3-year, 5-year and 10-year periods, the fund has delivered compounded annual returns of 35 per cent, 20.4 per cent, 23.2 per cent and 15.7 per cent, respectively on a point-to-point basis. This performance places it among the top few funds in the category. The scheme outperformed the Nifty 500 TRI by 2-4 percentage points over the medium to long term.

When three-year rolling returns over the past seven years (November 2017-November 2024) are considered, Franklin India Flexi Cap has delivered mean returns of 20.4 per cent.

Also, in the aforementioned 7-year period, on a 3-year rolling basis, the scheme has beaten the Nifty 500 TRI more than 80 per cent of the time. It has delivered more than 15 per cent nearly 79 per cent time over this period and more than 12 per cent nearly 90 per cent of the time.

The fund’s SIP returns (XIRR) over the past 10 years are fairly robust at 18.7 per cent. An SIP in the Nifty 500 TRI would have returned 16.8 per cent over this period.

All return figures pertain to the direct plan of Franklin India Flexi Cap.

The fund has an upside capture ratio of nearly 102, indicating that its NAV rises a bit more than the benchmark during rallies. But more importantly, it has a downside capture ratio of 84.7, indicating that the scheme’s NAV falls a lot less than the Nifty 500 TRI during corrections. A score of 100 indicates that a fund performs in line with its benchmark. This is based on data from November 2021-November 2023.

Stable sector mix

Franklin India Flexi Cap has favoured large cap stocks in its stock selection. Usually, these large-caps account for 70-75 per cent of the overall portfolio. During short periods in the past the proportion has gone a few percentage points below the 70 per cent mark. Mid and small-cap stocks usually make up 20-25 per cent of the fund value. Barring rare occasions such as during the October 2023 volatility due to geopolitical tensions and US yields rising rapidly at that time, the fund has kept cash and equivalent to less than 5 per cent of the portfolio.

With valuations in the reasonably comfortable zone in the large cap space, especially after the recent correction, the tilt may help the fund deliver steady returns over the medium to long term.

Banks and software companies have always been the top couple of sectors held by the fund. Investments in segments such as construction, telecom-services, automobiles, cement and cement products are the other key ones and are churned based on market and industry conditions.

The fund favours the value style for most part as private banks figure among top the holdings. A few growth picks also figure in the portfolio.

Mid and small-cap exposure is in sectors where there is limited availability of large-cap stocks such as auto components, industrial products, capital markets and so forth.

Th fund takes concentrated exposure to the top few stocks. The top 10 stocks account for a little less than 47 per cent of the overall portfolio. The holdings start to get diffused beyond the top 10.

Sticking to the fund via the SIP route for 7-10 years is necessary for healthy performance outcomes.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.