Domestic stock markets have been volatile over the past month, with concerns regarding rising bond yields and the impact of the Israel-Hamas war on crude oil prices. Typically, dividend yield funds, due to their safe-haven appeal, gain relevance during such uncertain times. In India’s mutual fund market (MF mart), the dividend yield fund category comprises nine funds with a total AUM of about ₹18,500 crore. These funds are marketed as investments that target companies with stable business models and can limit drawdowns during challenging market conditions. Here, we provide details on fund strategies, allocations, and performance over the last one- and three-year periods.

Sector choices

The dividend yield is a financial ratio that shows how much a company pays out in dividends each year relative to its stock price. Dividend yield funds invest more than 65 per cent of their assets in dividend-yielding stocks. The funds aim to target companies with matured businesses, good corporate governance and surplus cash. One will typically find these funds allocating a significant portion to the IT sector on account of high return metrics, less capital-intensive businesses, and consistent cash flows. This is followed by holdings in sectors such as Financial Services, Power, Automobiles, and Pharmaceuticals.

While these funds don’t have a specific mandate to invest in stocks with a minimum dividend yield, some like SBI Dividend Yield Fund aim to construct a portfolio with an aggregate dividend yield at least 50 per cent higher than that of the Nifty 50.

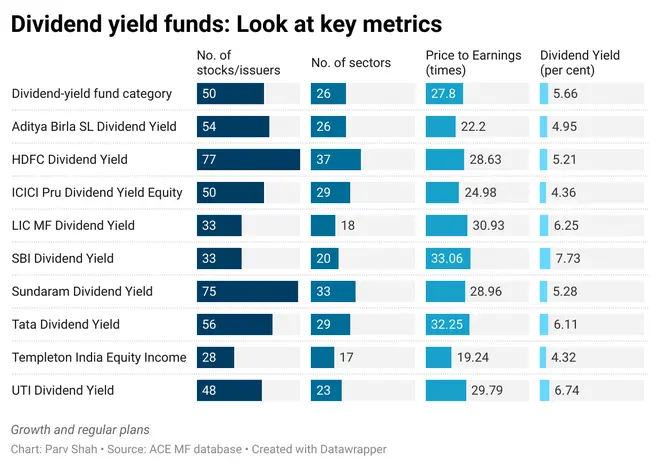

According to ACE MF data, the category’s average dividend yield is around 4.7 per cent, compared with the benchmark Nifty 500 index, which has a yield of only 1.22 per cent. Within the category, Sundaram, LIC, and HDFC offerings have dividend yields as high as 7-9 per cent, while ABSL, ICICI, and UTI have comparatively lower dividend yields.

M-cap allocations

Given the category’s mandate, these funds primarily invest in large-cap stocks. Barring ABSL Dividend Yield Fund (40 per cent), Tata Dividend Yield Fund (56 per cent), and Templeton India Equity Fund (50 per cent), all funds in the category allocate more than 60 per cent of their corpus to large-cap stocks.

LIC MF Dividend Yield (67 per cent) and ICICI Pru (65 per cent) offerings have particularly high allocations to large-caps. While some other schemes invest around 5-20 per cent of their corpus in small-cap stocks, ABSL fund is an outlier with nearly 32 per cent small-cap exposure.

In terms of holdings, HDFC Dividend Yield MF and Sundaram Dividend Yield MF attempt to diversify their holdings by investing in 75-77 stocks, while Templeton India Equity Income Fund and LIC Dividend Yield MF (low AUM) invest in 30-40 stocks.

Funds currently are overweight (higher exposure vs. benchmark) on IT, Power, Consumable Fuels, FMCG, and Defence sectors. The category is right now underweight on Banks. The IT sector commands the highest allocation of corpus for nearly all funds, with stocks such as TechM, TCS, and Infosys present in all funds. ICICI Pru is an exception with its underweight stance on IT compared with the benchmark Nifty 500. Except for Tata and ICICI funds, all other funds have allocated 12-18 per cent to the sector. The Power sector constitutes a significant share of the corpus in all funds. With the exception of UTI and SBI funds, almost every fund is overweight on Power. Templeton, LIC and ICICI have allocated 13-18 per cent of their corpus to the Power sector, with investments primarily made in PSU Power companies such as NTPC, NHPC, and Power Grid Corporation. Although most of these funds allocate a significant portion to Financials, except for Tata fund, they have been underweight compared with the benchmark, which allocates 28 per cent to the sector.

Performance

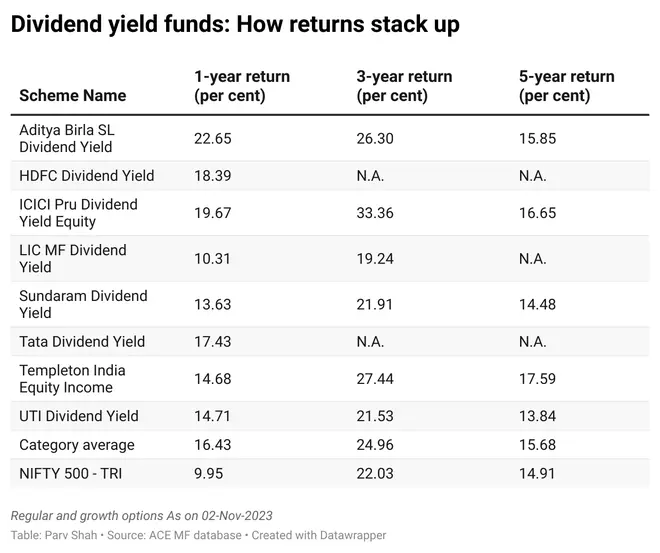

Divided yield funds are benchmarked against Nifty 500 TRI, with the second benchmark being Nifty Dividend Opportunities 50 TRI. With returns averaging around 15 per cent and 24 per cent over the last one-year and three-year periods, the category has comfortably outperformed the Nifty 500.

While the category has underperformed the Nifty Dividend Opportunities 50 over the last one year, it has delivered returns in line with the benchmark if we consider the three-year performance. During the past year, ABSL and ICICI Pru funds have been the best performers in the category, while LIC and Sundaram funds have been laggards.

Strong performance from stocks such as NTPC, ITC, and Coal India drove the returns for ABSL and ICICI Pru funds. The performance of the ABSL fund was further enhanced by bets in other stocks such as CMS Info Systems, Mannapuram and NLC, while the same for the ICICI fund were ONGC, L&T and Britannia.

Six funds in the category have a history of more than three years. Over the last three-year period, the ICICI fund has been the best performer in the category, while LIC has been the worst performer.

One of the main purposes of dividend yield funds is to protect investors from downside risk, making it important to consider the down capture ratio. Nearly all funds have been able to withstand tough market conditions, with down capture ratios ranging from 37 per cent to84 per cent. Templeton (38 per cent) and ICICI Pru (52 per cent) have been the best as they captured least downside. LIC and Tata schemes (~ 84 per cent) captured most of the downsides.

Risks of investing in dividend yield funds may include interest rate risk, as dividend stocks may become less attractive when interest rates rise; the possibility of dividend cuts by companies, particularly during challenging economic times; and sector concentration risk when funds focus on specific industries.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.