Among the debt fund categories, one segment that is low on risks and generates reasonable returns over the medium term of about three years is the money market mutual funds. This category did not face any accidents during the period of debt defaults and the turmoil in the bond markets over 2018-20 that plagued short-duration, liquid and ultra-short duration funds. Credit risk funds, of course, faced the brunt then.

Money market funds usually beat fixed deposit returns over three-year periods on a post-tax basis. By investing in the safest of instruments with low maturities – less than a year usually – these funds kept credit risks at bay. When interest rates are on the rise, funds with shorter duration are preferred over longer-duration schemes. As the RBI tightens rates, this category can be good option for investors with a low-risk appetite.

Which are the best money market funds to invest in? Read on to get a perspective on four quality funds from the category that you can invest in for the medium term.

Funds making the cut

Since debt funds have a three-year holding period for capital gains to be considered long term, we took three-year rolling returns (with daily NAV) from January 2013, which was the time direct plans started.

In debt funds, the asset size is important, as is having a highly diversified portfolio of debt holdings with no concentration. The latter is to ensure that in case of any default, the overall portfolio doesn’t suffer much. We took a threshold of ₹5,000 crore for choosing the schemes.

In terms of returns, we considered those funds that delivered 7.5 per cent or more annually on a three-year rolling basis. The minimum threshold over the three-year period was kept at 5 per cent. Those delivering less were eliminated. We also ensured that over the past nine calendar years, these funds remained in the top one-third of the funds in the category in terms of returns most of the time.

Aditya Birla Sun Life Money Manager, HDFC Money Market, SBI Savings and Nippon India Money Market were the four funds that made it past these hurdles with consistent returns.

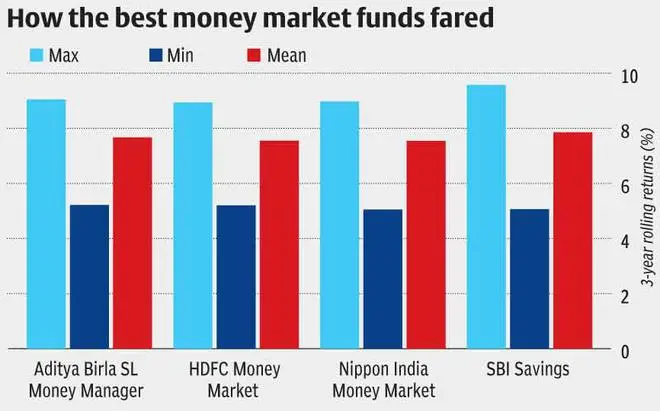

How the schemes fared

These funds delivered 7.5-7.8 per cent on an average over three-year rolling periods. They managed a maximum of 8.9-9.5 per cent returns over these periods, while the minimum returns were 5-5.2 per cent. Barring 2021, which was a difficult year for bonds, these funds have given 6.2-9.2 per cent returns over the previous 10 calendar years.

These are better than even the best of fixed deposits offering 7-8 per cent interest, especially for those in the higher tax brackets. Effective returns in the case of FDs would be 5-5.5 per cent, at best.

When held for three or more years, gains from debt funds are taxed at 20 per cent after indexation. Given the inflation trajectory in recent times and even over the long term, 5-7 per cent may be a good ballpark figure. Therefore, investors would effectively have to pay little or no taxes on the gains made. They may even be able to harvest losses after indexation, without actually incurring any losses. Thus, over three-five year time-frames, close to 7 per cent post-tax returns may be achieved without taking too many risks.

Given that money market funds invest in the safest of instruments — certificates of deposits, repo windows, treasury bills and corporate bonds with highest short-term ratings — these are healthy returns.

Fund portfolios

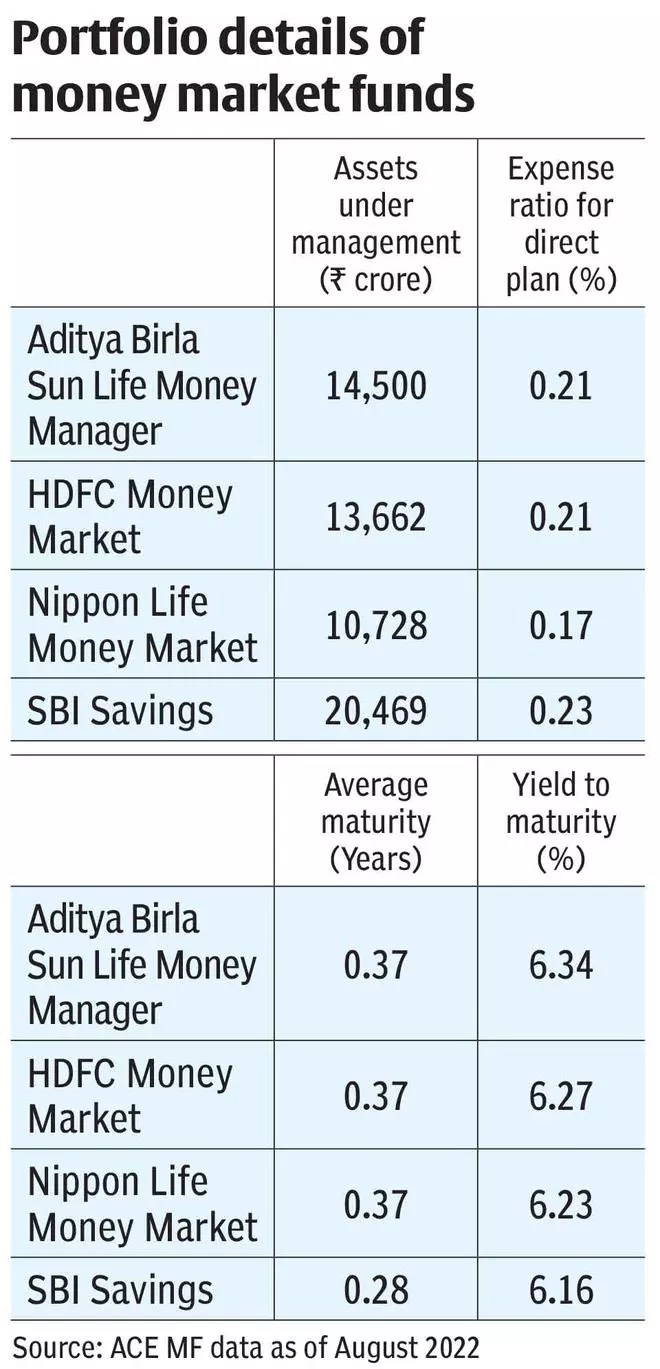

Aditya Birla Sun Life Money Manager, HDFC Money Market, SBI Savings and Nippon India Money Market have portfolios that are very low on risk. The average maturity of holdings going by their latest portfolio is 0.28-0.38 years, which translates to about three-four months. The yield to maturity is in the range of 6.2-6.3 per cent. They hold 71-113 securities in their portfolios, making them quite diversified. Exposure to even the top holdings are usually less than 5 per cent and are quite diffused.

Commercial paper of SIDBI, RBI’s 182-day T-Bills, certificates of deposits of top banks, CPs from firms such as L&T, Reliance Jio Infocomm, Tata Steel, Bharti Enterprises, Vedanta, LIC Housing Finance, and NABARD among many others. All short-term instruments carry the highest A1+ rating.

With asset size of ₹10,000 crore to ₹20,000 crore, these are fairly large funds with quality holdings.

Investors can choose to park a portion of their debt portfolio in these funds for three years to make the most of such investments.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.