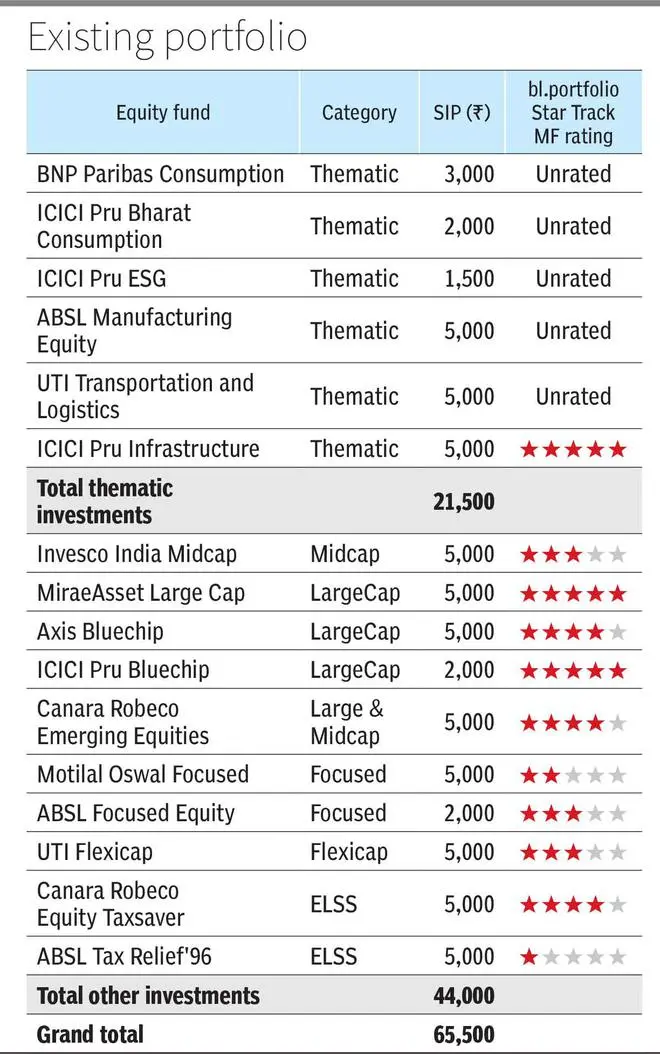

I read your column in bl.portfolio and I am really keen to get your advice on my mutual fund portfolio. I am 37 and have been doing SIPs in most funds mentioned below (growth option) over the last two years. SIPs in ABSL Manufacturing Equity, UTI Transportation, ICICI Pru Infra and Canara Robeco Tax Saver alone were started recently. My risk appetite is high. Pls suggest changes as needed. I am ok to be without any debt fund. I am also willing to invest ₹10,000-15,000 more per month. I have investments in shares, totalling ₹36 lakh and invest adhoc sums of about ₹10,000-15000 per month in stocks.

Kumar

While you have been a bit of a late-starter in investing in mutual funds for your goals, you are making up, by investing a big sum of ₹65,500 every month and are also looking to invest ₹10,000-15,000 more through SIPs. Your robust risk appetite is visible from two facts: one, all your investments are in equity funds and almost one-third of this, in high-risk thematic funds; two, you are actively managing a separate equity portfolio and also putting in additional monthly sums. We hope that you have balanced out your asset allocation by investing in debt products. Currently, fixed income instruments are offering high returns/yields and you should consider investing in some of them if your investment portfolio has negligible or no debt.

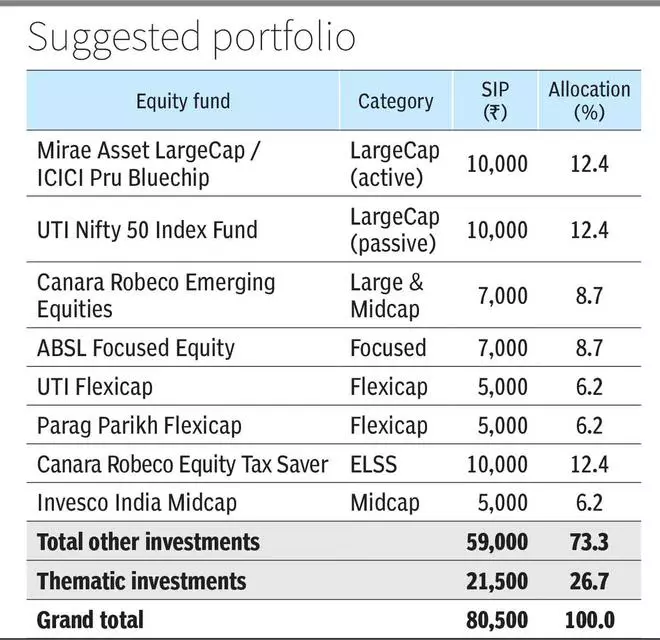

Coming to your mutual fund portfolio, the fund choices need a rejig. First, stop SIPs in ABSL Tax Relief 96 and Motilal Oswal Focused Equity — funds rated 1- and 2-star by bl.portfolio Star Track MF Ratings. Since you are investing in more than one fund in each of these categories, redirect the sums here to the better performing peers – Canara Robeco Equity Tax Saver and ABSL Focused Equity. We are assuming that you are investing in tax saver schemes as you wish to remain in the old tax regime and avail Sec 80C deductions. Secondly, instead of investing ₹12,000 across three actively managed large-cap funds, you can choose between one active fund in either Mirae Asset Bluechip or ICICI Pru Focused Bluechip and one passive fund in UTI Nifty 50 Index fund. We suggest you divide the additional ₹15,000 you wish to invest this way — ₹4,000 each in of the active and passive large-cap funds, ₹2,000 in the large- and mid-cap fund you are already investing (Canara Robeco Emerging Equities) and ₹5,000 in a new flexi-cap fund — Parag Parikh Flexicap.

Keep tabs on the change in ratings of 3-star funds – UTI Flexicap, Invesco India Midcap and ABSL Focused Equity. We revise our ratings every six months, the latest was in January 2023. If the ratings fall below 3-star, shift to other higher rated funds.

As far as thematic funds go, it is best you don’t consider them as part of your core portfolio where you save towards long-term goals. Themes go in and out of favour at different points and returns depend on being able to time entry and exit well. For the same reason, lump-sum investments are always better in such funds than SIPs. Since the purpose of your savings, the target amount and time to goal is not available, we are not able to comment on the suitability of thematic funds for the same. But these choices do go with your penchant for high risk if you are willing to invest through up and down cycles of a particular theme and hang on for the long term. We have worked on your portfolio in such a way that thematic funds now constitute only about 25 per cent of your total monthly investments and another 25 per cent is in safe large-cap funds.

After effecting all the above changes, your portfolio will be as follows :

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.