A thematic category that is receiving increasing focus from asset management companies (AMCs) is the business cycle category. Following the trend of a few other peers, HDFC Mutual Fund is rolling out a new business cycle fund that will open for subscription from Friday(November 11).

As far as the broad philosophy of investment goes, the new fund will seek to invest mostly in companies within sectors that are on the verge of an upward cycle. Which are the segments the fund likely to prefer? How have other business cycle funds delivered in the limited period of their existence and what has been the market-cap split in their portfolio? Read on to understand what you could expect from the NFO (new fund offer) before investing.

Playing on a cyclical revival

After a period of weak economic activity leading up to the COVID lockdown period, India’s GDP growth is on the rise over the past year. Of course, there are macroeconomic concerns on persistently high inflation rate, strengthening dollar against the rupee (which may hurt imports), a global slowdown and geopolitical tensions. But India is still likely to record a GDP growth of 6-7 per cent in FY23, among the highest in the world. Indeed, over the last couple of years, there has been a broader market participation in terms of sectors gaining from the massive rally in equities.

- Auto and auto ancillaries seem to be on the verge of an upcycle, led by traction in electric vehicles and XUVs. Firms manufacturing commercial vehicles also are witnessing a valuation increase.

- Credit growth has been in excess of 15 per cent, higher than even deposits growth for banks. Gross non-performing assets (NPAs) are down to 5.9 per cent from nearly double that figure in FY18. Net NPA is down to 1.7 per cent.

- Manufacturing and capital goods are set for a revival. Capacity utilization is in excess of 70 per cent, indicating sound growth expectations.

- After a period of lull between 2015 and 2019, pharmaceutical and healthcare players had a great run in 2020 and early part of 2021 in the aftermath of the first and second waves of COVID-19. They have corrected since then. Pricing power in generics and the US market hold the key for many of these. But there are other players in diagnostics, hospitals and medical devices spaces domestically that could present opportunities.

- As corporates deleverage, their capex cycle is likely to bounce back after years of being in the slow lane. The government made up by higher spending over the past several years and may continue to do so for the foreseeable future.

The investing universe

HDFC Business Cycle fund will take into account macro indicators – GDP growth, inflation, interest rates, global growth etc. – and business-specific factors – growth outlook, pricing power, capex plans, and capacity utilization – to make investment decisions.

It would take a multi-cap approach to investing in sectors related to the theme. Given that segments such as manufacturing, auto ancillaries, capital goods and construction have more presence in the mid-cap stocks space, HDFC Business Cycle will have to go down the market-capitalization curve for finding suitable picks.

The other business cycle funds have about 50-70 per cent in large-caps, with the rest being in invested in mid and small-cap stocks.

Predictably, financial services, energy (oil & gas), capital goods and construction are among the top sectors held by these funds. Consumer staples, automobiles and healthcare also figure prominently in their portfolios.

What must investors do?

Investing in a cyclical theme does involve an element of timing of entry and exit. Though correct identification of sectors and stocks can be rewarding, it may still be risky for investors if they do not get in and get out at the right time, which can be tough to identify. For higher risk-reward payoff, infrastructure or banking & financial services themes may be better.

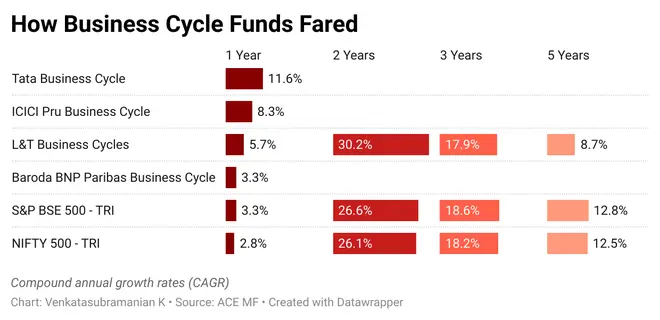

Most business cycle funds currently have been around for only a little over a year. L&T Business Cycles fund alone has a five-plus years’ track record. Though it has delivered well in the last couple of years, it has lagged the Nifty 500 TRI over the longer term.

Investors can wait for this theme and the fund to develop a strong track record before considering them for their satellite portfolios.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.