With falling domestic markets so far in FY23, it has been a challenging phase for equity mutual funds. With just one-third of the equity schemes posting positive returns, the majority are set to end 2022-23 in the negative zone. Here is a look at which shined in FY23, which didn’t do well, how the categories fared and the great return variation even in each category.

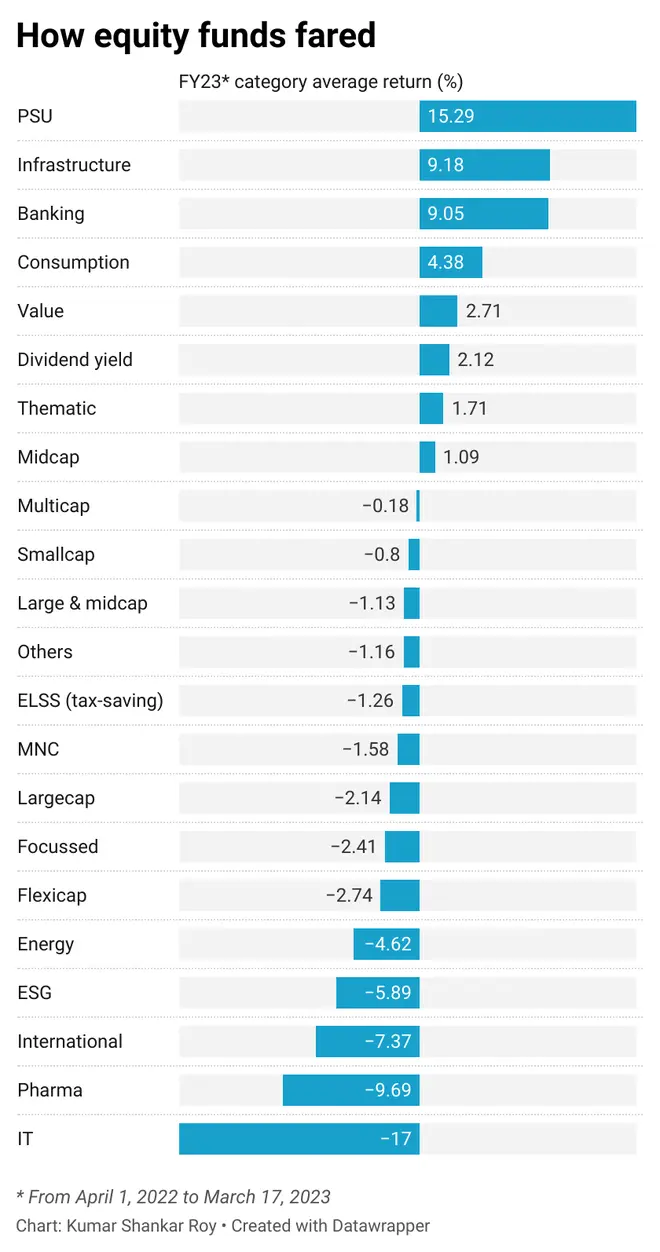

Fund category scorecard

FY23 belonged to equity fund categories that bet on PSU stocks, infrastructure , banking, consumptionand value-oriented shares. The small club of PSU funds logged the best category returns of over 15 per cent in FY23, easily out-performing the overall market, that is down about 1 per cent. Infrastructure funds, one time a market darling, also saw good gains with the category-average standing at over 9 per cent. See the individual fund category returns below.

Information Technology (IT) funds were at the bottom of pecking order, having lost an average 17 per cent in FY23. Pharma funds, after being in the limelight during Covid year, performed poorly with average loss of over 9 per cent.

Read also: Have flexi-cap funds lived up to expectations?

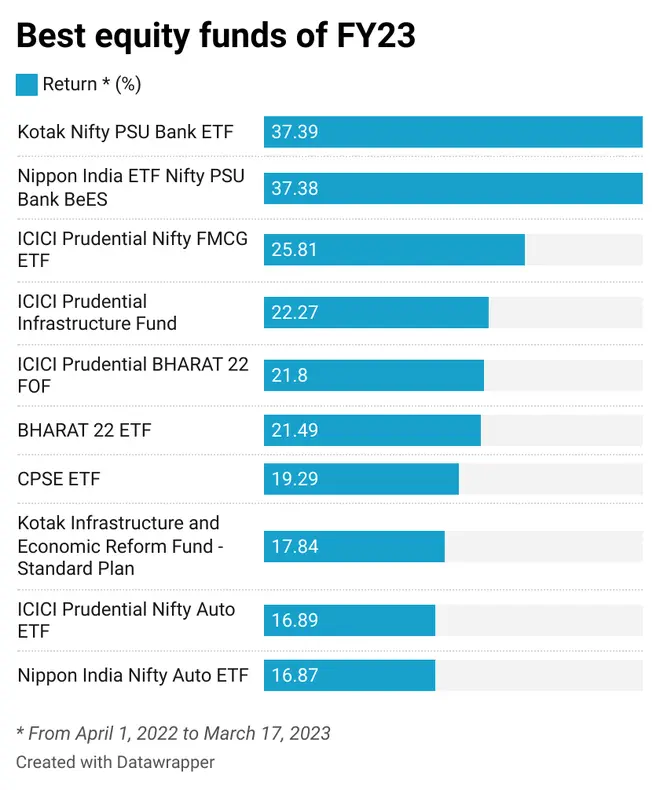

The leaders

Individually, banking equity funds ruled the chart in FY23 with passive schemes such as Kotak Nifty PSU Bank ETF, Nippon India ETF Nifty PSU Bank BeES logging 37 per cent rise. ICICI Pru FMCG Fund was ranked overall number 3 with over 25 per cent return, followed by ICICI Pru Infrastructure Fund (up 22.2 per cent), Bharat 22 ETF (up 21 per cent) and CPSE ETF (up 19 per cent) notching up smart gains.

Except for a handful of schemes, the majority of top-10 best equity funds in FY23 belonged to ETF space, which is yet another proof of passively managed offerings beating active peers.

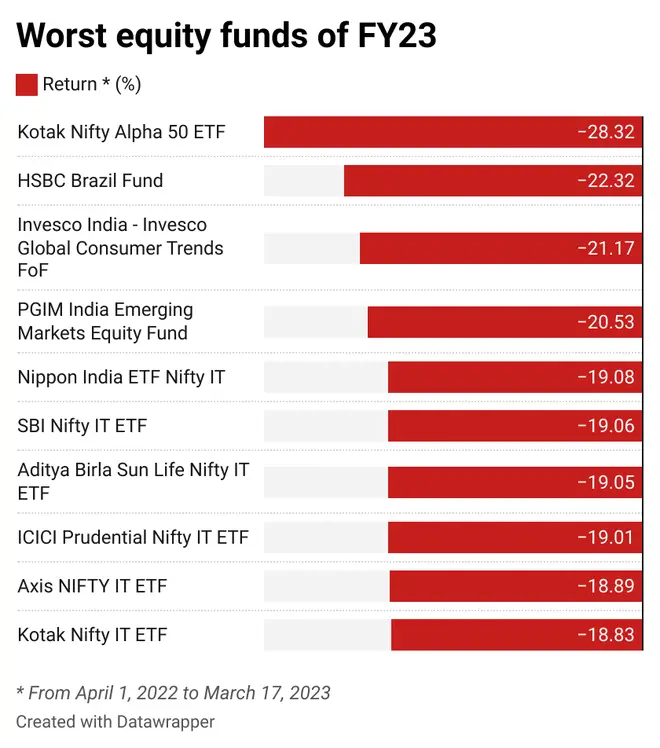

The laggards

On individual fund performance, Kotak Nifty Alpha 50 ETF led the laggards with a 28 per cent loss in FY23. It was followed by HSBC Brazil Fund (down 22 per cent). Infact, quite a few other international fund offerings such as Invesco India - Invesco Global Consumer Trends FoF and PGIM India Emerging Markets Equity Fund also found place in the biggest laggards list with over 20 per cent loss.

Six of the worst-10 funds were IT ETFs (down in 18-19 per cent range). Interestingly, IT passively managed offerings were hit harder than active-managed peers.

Fund selection holds the key

While investors seem to think fund categories are important, FY23 again taught a key lesson in terms of fund selection. Across different fund categories, the wide gap between best fund and worst fund returns is testament to the importance of selecting the right fund. For instance, in FY23, the Kotak Nifty PSU Bank ETF clocked 37 per cent while ABSL Banking and Financial Services Fund inched up by about 2 per cent only. Similarly in the ELSS category, HDFC Taxsaver gained 7.74 per cent but Axis Long Term Equity lost over 12 per cent.

Investors can use bl.portfolio Star Track MF ratings to select top rated funds here.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.