Though PSU stocks have been old market favourites for reasons such as attractive valuations, high dividend yields, sovereign support on account of government ownership and good return potential, the pack did not deliver for long , forcing investors to wait it out. The PSU thematic funds category, which has recently seen some new launches, had a forgettable phase between 2018 and 2020. But winds of change blew and PSU funds were among the top equity schemes of 2022, with about 20-30 per cent annual return. This came on the back of 30-45 per cent returns logged in 2021. With passive funds gaining traction, the active vs. passive debate is relevant for PSU equity funds too. Let us see how they differ in terms of performance, portfolio etc.

PSU universe

The term ‘PSU’ refers to any undertaking where 51 per cent or more of the company is held by the Central government, State government, or jointly by the Central and one or more State governments. The PSU space has three types of companies — CPSEs (Central public sector enterprises), PSBs and SLPEs (State-level public enterprises). There are about over 50 listed PSU index stocks including those belonging to government-controlled banks. This list is broadly the stock universe for PSU funds. The relevant benchmarks are Nifty CPSE TRI and S&P BSE PSU TRI.

Half-a-dozen funds can be included in the PSU equity funds theme — Invesco India PSU, SBI PSU, ABSL PSU, ICICI Pru PSU, CPSE ETF (managed by Nippon) and Bharat 22 ETF (managed by ICICI Pru). Investor assets of the four actively-managed funds stands at about ₹3,300 crore, just a fraction of the ₹29,300-odd crore managed by CPSE ETF and Bharat 22 ETF. Mind you that the ETFs have extremely low expense ratios (5 bps) compared to over 200 bps for actively-managed PSU equity funds.

Also read: For the long haul

Except for Bharat 22 ETF, which is based on 22 select companies (including some private sector ones such as ITC, L&T, Axis) disinvested by the Central government, other PSU equity funds including CPSE ETF are true-to-label with all PSU stocks in their portfolio. Actively-managed offerings have portfolio constituent counts ranging from 22 to 30-odd stocks.

Actively-managed PSU equity funds portfolios are concentrated in stocks such as SBI, BoB, NTPC, Coal India, PGCIL, PNB, Bank Of India, BPCL, GAIL, NMDC, HAL and Indian Bank.

In that context, passively-managed PSU offering portfolios are differentiated. For instance, CPSE ETF is an indirect energy play, given that power, oil, consumable fuels account for over three-fourth of the portfolio. In comparison, Bharat 22 ETF’s sectoral break-up is more diversified with large weights in favour of banks, consumer durables, power, construction and petroleum products.

Given that PSU stocks trade cheap, the four actively-managed PSU funds sport portfolio PE of 14-16 times, which is at substantial discount to most domestic-focused equity funds. Also, PSU funds in general have higher dividend yields (3-4 per cent), on account of the overall nature of PSU stocks.

Return performance

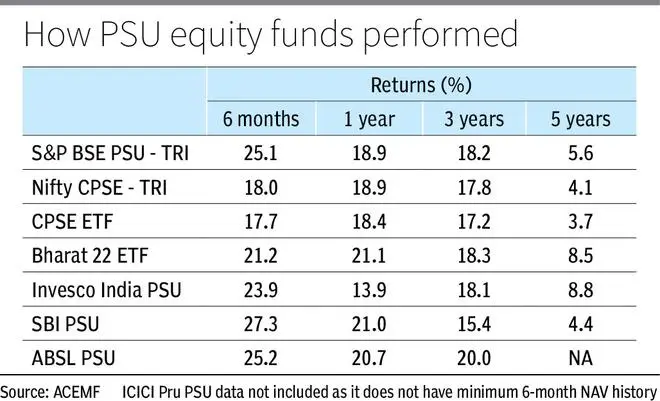

Even though the size of the category is small in terms of the number of existing funds, actively-managed PSU equity funds have largely done better than passive ones, but the performance against S&P BSE PSU TRI has been mixed.

In the last six months, when PSU stocks have come back into favour, actively-managed funds have edged past passive peers by a good margin of about 600-900 basis points.

Except for Invesco India PSU, actively-managed funds have maintained the lead individually over passive schemes in the one-year period.

In the three-year period, SBI PSU lags others in the active subset who again hold the edge over passive funds.

In the five-year period, it is a mixed bag with Bharat 22 ETF giving more than double the return of CPSE ETF while the Invesco fund has trounced the SBI fund by a wide margin.

In terms of calendar year performance, Bharat 22 ETF, after a bad start in 2018-20, has picked up pace in the last two years. CPSE ETF, too, has had a similar fate.

But Invesco India PSU did not fall as much as actively-managed peers and passive offerings in 2019 and 2020 when it, in fact, logged positive returns.

Our take

Coming after nearly a decade of underperformance, PSU stocks and PSU funds have been performing well lately. Historically, in the run-up to the elections, PSUs have performed well on optimism around reforms. Given that the next national elections are in 2024, there is hope that PSUs could continue to do well in the pre-election period. The noise around reforms changing the PSU fundamentals story has been around earlier too. Actively-managed funds may be a better way to play PSU theme given the discretion to pick stocks remains with the fund manager. Even though the PSU sector looks homogenuos, it is certainly not. Plus, a pure-play passive index based PSU offering is not around, and using the existing two options means you open yourself to different returns and risks.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.