In an environment where advanced economies and even China seem to be slowing down on economic growth, India seems to be charting a relatively much better course. The recent GDP data for Q4 of FY23 shows that India grew 6.1 per cent and ended the fiscal at an estimated 7.2 per cent growth over the previous year.

There is an upswing in government and private capital expenditure. Segments such as manufacturing, industrials, construction and the like have particularly had a good run in recent years.

With infrastructure being a much talked-about theme among investors, companies and governments alike, this may be a good time to look for long-term opportunities in the theme.

Invesco India Infrastructure is among the steady performers tracking this segment and has delivered healthy risk-adjusted returns over the years. Investors can consider the fund for diversification as a part of their satellite portfolio.

Thematic outperformance

The fund has a track record of more than 15 years and has consistently delivered robust outperformance over this period, despite being a play on a cyclical and volatile theme.

Also read: Invesco India Contra: Why you should invest in this fund

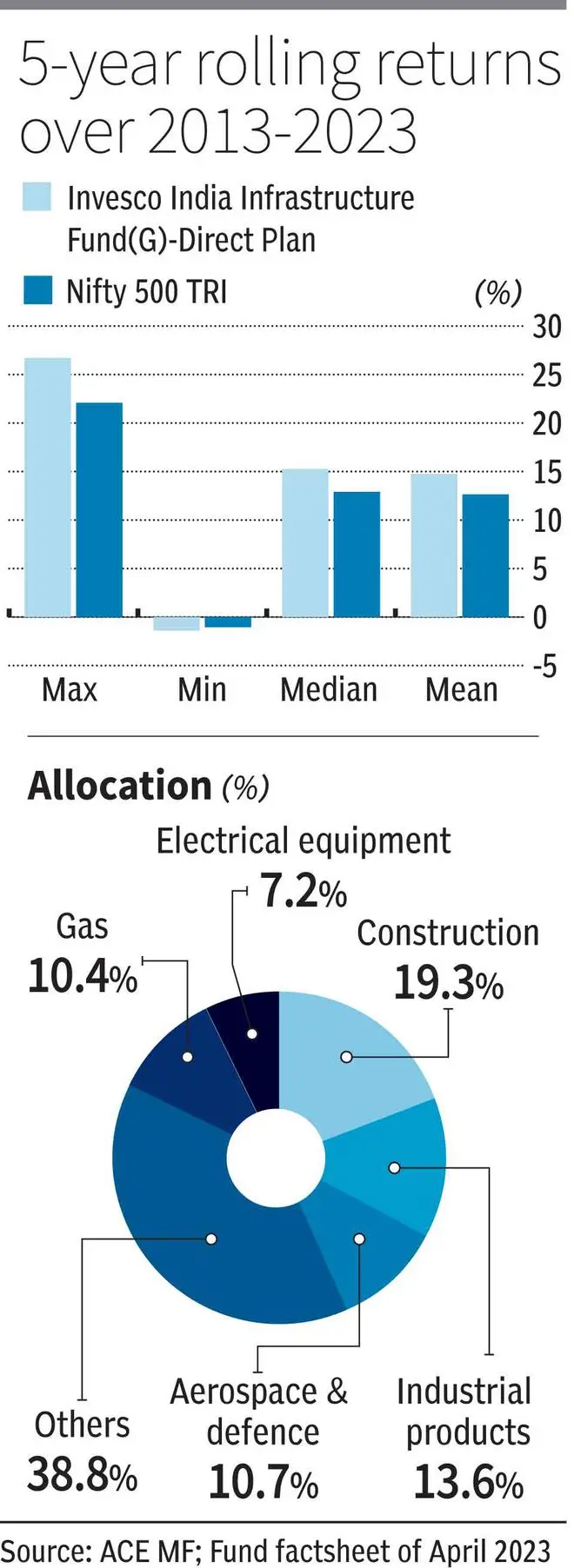

Rolling five-year returns over the period May 2013 to May 2023 reveal that Invesco Infrastructure has delivered a mean of 14.7 per cent. This is higher than the returns from the likes of Bandhan Infrastructure, SBI infrastructure and Tata Infrastructure funds.

When compared with the Nifty Infrastructure TRI on a five-year rolling basis over the past 10 years, Invesco Infrastructure has beaten the index all the time. Taking a broader market benchmark such as Nifty 500 TRI, over the same rolling period, it has outperformed the index around 71 per cent of the time. It has thus proven to be a steady outperformer over the long term.

If systematic investment plan (SIP) returns over the past 10 years are taken, Invesco Infrastructure has delivered a healthy 18 per cent over this period, according to Valueresearch data, placing it among the top few in the category.

Also read: Fund Query: Are these four funds good for a ₹20-crore goal in 30 years?

The upside and downside capture ratios, which reflect the performance of a fund in relation to its benchmark during rallying and correcting markets, make for interesting observations in the case of the fund.

Invesco Infrastructure has an upside capture ratio of 108.7, indicating that it rises more than the benchmark during rallies. Its downside capture ratio is 76.7, suggesting that the fund’s NAV falls a lot less than the benchmark during corrections. A score of 100 indicates that a fund performs in line with its benchmark.

Steady portfolio

Given that the fund is focused on infrastructure, the top sector holdings are not too surprising. So, construction, industrial products, cement and power are generally held across timelines by the company. In recent periods, Invesco Infrastructure has also increased exposure to aerospace and defence segments of the market, with indigenisation and local manufacturing becoming key themes for the government. Allocations to top sector holdings generally hover in the range of 10-20 per cent of the portfolio.

Also read: ITI Focused Equity Fund: Should you invest in the NFO?

Stocks such as Larsen & Toubro, KEI Industries, Bharti Airtel, KNR Constructions and UltraTech Cement usually figure among the key holdings of the fund over the years. Barring two or three top stock holdings, exposure to individual stocks is well below 5 per cent, making it a well-diversified portfolio without concentrated bets.

In the Budget of 2023, the capital outlay for FY24 towards infrastructure was ₹10-lakh crore, an increase of over 33 per cent compared to FY23. With private capex likely to take off soon, government thrust in domestic defence manufacturing, measures such as production-linked incentives (PLI), booming railways and the upswing in real estate mean that the infrastructure is well-positioned to do well over the next several years.

Investors can consider small lump-sums over a period of time to buy units of Invesco Infrastructure Fund. SIPs can be considered by those not wanting to take undue risk, if they can stay put for five years at least.

Being a thematic fund, if there is a massive rally over short periods (say, 20-25 per cent within months), investors must look to actively take profits from the table.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.