Debt market investors have been on the tenterhooks over the past year, given the rise in interest rates and the sticky outlook around inflation necessitating a hawkish stance from Central Banks. But as the peak of interest rates was being called out in the US and India, Silicon Valley Bank collapsed. The bank’s shuttering sent yields, especially at the shorter end of the curve, on a downward spiral.

The concerns of Central Bankers now revolve around whether the high interest rates could seriously affect growth and cause accidents in the banking system.

The RBI raised interest rates by 250 basis points from mid-2022. Given the slowing global economy and concerns around the domestic growth story as well as on slowing exports, we may be close to the peak in terms of the interest rate cycle.

Is this a good time to lock into higher yields available in the fixed-income market for investors? JM Corporate Bond Fund’s new scheme is being offered with this assumption of a roll-down strategy and also that a portion of the portfolio would be actively managed.

Here’s what you must know before investing in the scheme.

Yield movements

When interest rates started increasing in 2022, the brunt of the impact was felt in the shorter tenor T-bills and bonds. The yields increased by 275-300 basis points in one year. At the 10-year g-sec level, the yields rose a bit above 100 basis points but have since decreased to around 65-70 basis points. In the middle lay the five-year g-sec with a 120 basis point increase in yields at around 7.3 per cent currently. In fact, the 364-day t-bill, 5-year g-sec, and 10-year g-sec trade at yields of 7.3-7.36 per cent. This narrow band may be an indicator of the peaking of interest rates.

Now, JM Corporate Bond Fund is looking to invest in the five-year maturity profile of the yield curve that presents an attractive opportunity. The accruals or coupon payouts are attractive in this maturity profile. A roll-down approach means that the fund would hold the securities till maturity and the tenure keeps reducing as the portfolio approaches maturity. Data from Kotak Mutual Fund indicate that five-year AAA rated bonds currently trade at 7.7 per cent yield.

Also read: Mirae Asset Nifty 100 Low Vol 30 ETF: Should you invest in the NFO?

JM Mutual has researched the past five interest rate down cycles for the past 22 years and has found that the 10-year g-sec falls 180-500 basis points in about 1.9 years since the time interest rates peak.

The fund house has indicated that 85 per cent of the portfolio would be invested in AAA-rated securities with a maturity of five years to roll down. It will invest the balance 15 per cent in sovereign securities and the duration will be actively managed. As interest rates tend to fall in the 2-3 years following the peak, there may be scope for capital appreciation after a three-year period. JM Mutual has indicated that there is a scope of generating alpha of 15 basis points annually with this approach towards sovereigns.

How have corporate bond funds performed?

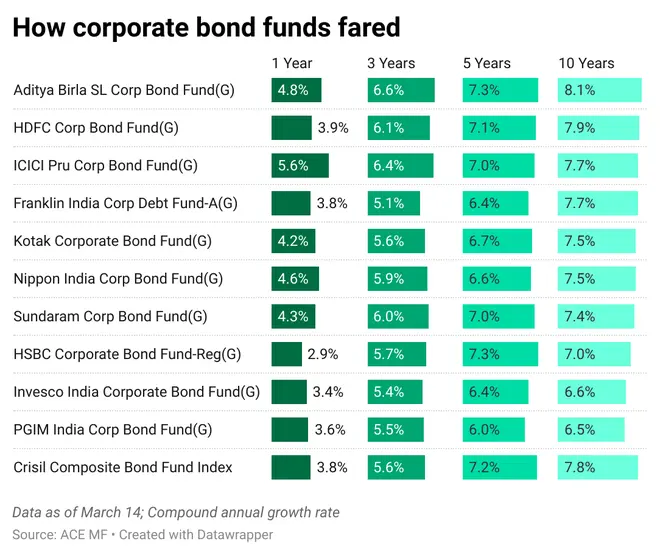

The top three corporate bond funds have generally tended to outperform inflation over the medium to long term. When a 5-10-year timeframe is considered these funds have delivered 7-8 per cent comfortably. SEBI guidelines mandate investing 80 per cent AA+ and above rated securities.

But data from ACE MF shows that most funds invest 70-75 per cent of their portfolio in AAA-rated securities and about 10-25 per cent in sovereign securities. Most corporate bond funds are averse to taking credit risk, especially in the aftermath of the IL&FS crisis in 2018.

Should you invest?

The proposition around a roll down strategy with five-year maturity and with relatively low credit risk, JM Corporate Bond Fund’s investment proposition is interesting.

There are, however, many corporate bond funds – from the stables of Aditya Birla Sun Life, ICICI Prudential, and HDFC – that have delivered very well over the long term. These should be your first choices for investing in corporate bond funds.

If you have a surplus after your investments in your core portfolio of debt and equity schemes, you can consider a small lump sum in the JM Corporate Bond fund’s NFO if you have a medium risk appetite.

Those not willing to take in risks can wait till the fund develops a track record before considering it for investments.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.