It is now over two years since the multi-cap funds category came into being after market regulator SEBI mandated specific allocation to small-, mid- and large-cap stocks (at least 25 per cent each) in their portfolio. In a way, multi-cap funds may suit investors in the sense that these can solve the problem of deciding on allocation across market-caps.

Mahindra Manulife Multi Cap fund has been an outperformer in the six years that it has been in existence. Investors with a medium risk appetite looking for above-average returns over the long term can consider investing in the scheme.

Even before SEBI’s multi-cap category norms were announced, the fund had a multi-cap portfolio, though, as with most of the schemes in the category earlier, large-cap stocks were dominant.

Here’s why Mahindra Manulife Multicap could be a healthy addition to the key portion of your portfolio.

Robust performance

Over the past several years, the fund has been among the best performers in its category.

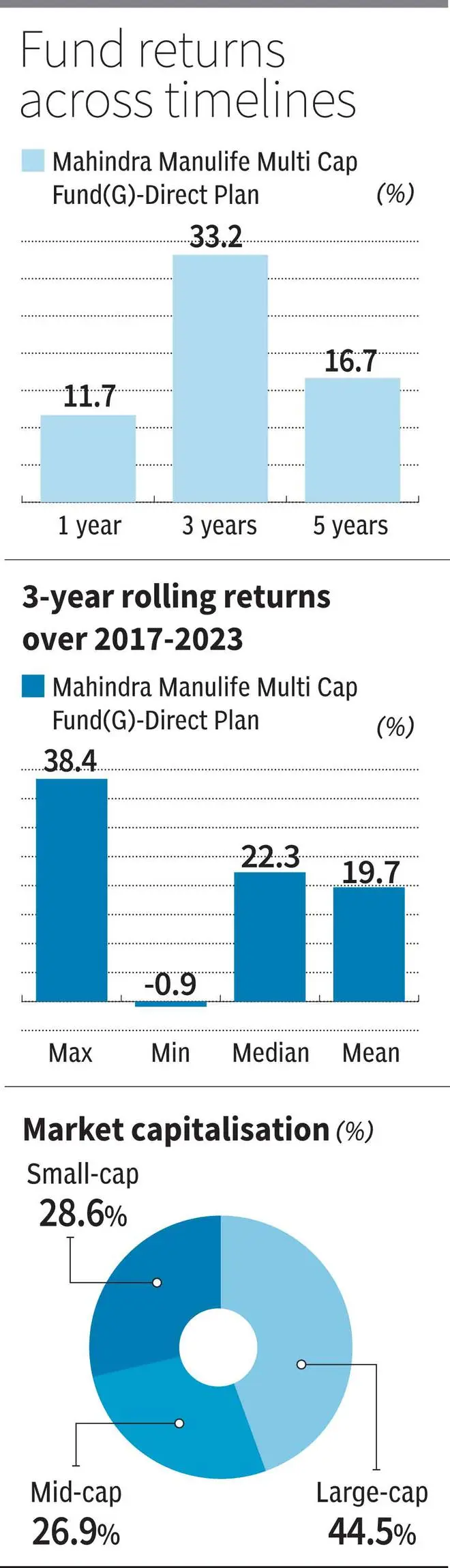

If three-year rolling returns over the past six years (May 2017-May 2023) are taken, Mahindra Manulife Multicap has delivered 19.6 per cent on an average. This performance places it among the top few in the category and ahead of peers such as Invesco India Multicap, Sundaram Multi Cap and Baroda BNP Paribas Multi Cap.

When point-to-point returns are taken, Mahindra Manulife Multicap has delivered a robust 16.7 per cent compounded annually over the past five years (as of May 17).

A systematic investment plan (SIP) investment in the scheme over a five-year period would have delivered a healthy 20.2 per cent returns (Valueresearch data), among the best in the category.

In mutual funds, the upside capture ratio measures a scheme’s performance in rallying markets relative to an index. The downside capture ratio measures a fund’s performance in declining markets relative to the index.

Mahindra Manulife Multicap has an upside capture ratio of 112, indicating that it rallies much more than the benchmark in bullish markets.

The fund has a downside capture ratio of 98.3, which means that it falls less than its benchmark during declining markets.

In general, the fund has been in the top quartile of schemes in the category over the past several years.

Steady portfolio

Mahindra Manulife Multicap portfolio moves suggest that it would bet more on sectors likely to benefit from long-term economic growth story, with a tilt towards cyclicals.

Financial Services and capital goods are two sectors that the fund has held across timelines. The fund did not go overboard with the popular choice of pharma in the aftermath of Covid-19. After holding information technology as a key segment in 2020 and 2021, it lowered exposure in 2022 and was able to escape the steep correction in IT stocks. After the deep correction, the fund has once again upped stakes in the sector. Oil & gas is another industry favoured by the fund.

The fund’s style suggests a blend of value and growth styles of investing.

Mahindra Manulife Multicap takes a very diffused approach to holding stocks. Barring the top 2-3 stocks, all other holdings account for less than 4 per cent of the portfolio each.

Thus, the fund takes a relatively low-risk approach. The fund remains almost fully invested across market cycles and holds cash positions of only 2-4 per cent.

True to the label of being a multi-cap fund, the scheme invests in a blended portfolio. Large-cap stocks account for 43-45 per cent of the portfolio. Mid- and small-cap stocks can range from 25 per cent to 29 per cent depending on the market conditions.

Investors can consider the fund with a 7-10 year perspective. Taking the SIP route to investing would help average costs across market cycles.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.