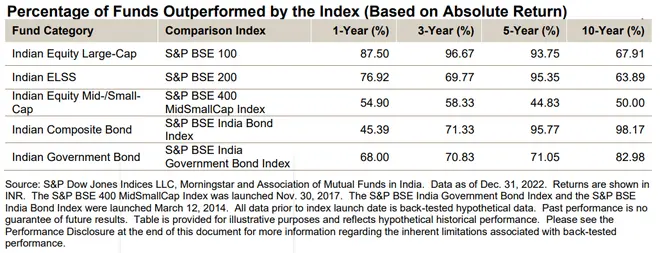

In 2022, the performance of India’s actively managed funds varied across categories. A majority of large-cap equity funds failed to beat their benchmark, with 88 per cent of actively managed funds failing to beat the S&P BSE 100. On the other hand, composite bonds performed relatively better, with only 45 per cent of the bonds failing to beat the the S&P BSE India Bond Index.

Here are key highlights from S&P Indices Versus Active Funds (SPIVA) India scorecard.

Large-cap funds

The S&P BSE 100 gained 6 per cent in 2022. According to the scorecard, 87.5 per cent of actively managed funds underperformed their benchmark over that period. Underperformance rates remained high over three- and five-year periods, at 96.7 per cent and 93.8 per cent, respectively.

Active managers produced relatively better results over the 10-year period, with the underperformance rate dropping to 67.9 per cent.

Mid- and small-cap funds

The benchmark for Indian equity mid-/small-cap funds, the S&P BSE 400 MidSmallCap Index, rose 2.2 per cent in 2022. About 54.9 per cent of active managers underperformed the index over that period.

Do note that among all the categories included in the SPIVA India scorecard, Indian equity mid-/small-cap funds fared better over the long run, with 50 per cent of them beating the S&P BSE 400 MidSmallCap Index over the 10-year period ending December 2022.

The below given table shows the performance of actively managed Indian equity and bond mutual funds with their respective benchmark indices over 1-, 3-, 5- and 10-year investment horizons.

ELSS funds

The S&P BSE 200 rose by 5.7 per cent in 2022. According to the scorecard, 76.9 per cent of Indian ELSS funds underperformed the index. Fund performance improved over the 10-year period, as 63.9 per cent of funds underperformed the benchmark.

Indian ELSS funds achieved the second-highest long-term survival rate across all categories in the SPIVA India scorecard, with 77.8 per cent of them still surviving after 10 years.

Government bond funds, composite bond funds

The S&P BSE India Government Bond Index increased 2.8 per cent in 2022. Less than one-third of active managers beat the benchmark in 2022, with an underperformance rate of 68 per cent. Fewer funds were able to outperform as time horizons extended, with underperformance rates over 3-, 5- and 10-year periods reaching 70.8 per cent, 71.1 per cent and 83 per cent, respectively.

Also read: New gas pricing formula: Short-term pain, long-term gain for ONGC and OIL

For the full-year 2022, the S&P BSE India Bond Index rose 3 per cent. With only 45.4 per cent of the funds failing to beat their benchmark, the underperformance of Indian composite bond fund managers was the lowest across all categories.

Over the 10-year period, however, Indian composite bond funds displayed the highest underperformance rate across categories, with 98.2 per cent of managers failing to beat the benchmark.

Market context for 2022

Volatile commodity prices, inflationary pressures and significant weakening of foreign exchange rates against the US dollar posed challenges for emerging markets in 2022. However, the Indian markets weathered these storms significantly better than most of their peers, the scorecard said.

Although India’s headline equity and fixed income benchmark indices dropped in H1, they reported a remarkable recovery in the second half of the year, closing 2022 in the black. Tightening lending standards weighed more heavily on smaller firms, with the S&P BSE 400 MidSmallCap Index underperforming the S&P BSE 200 by 4 per cent, the most since 2019.

Also read: Nifty returns trail earnings growth

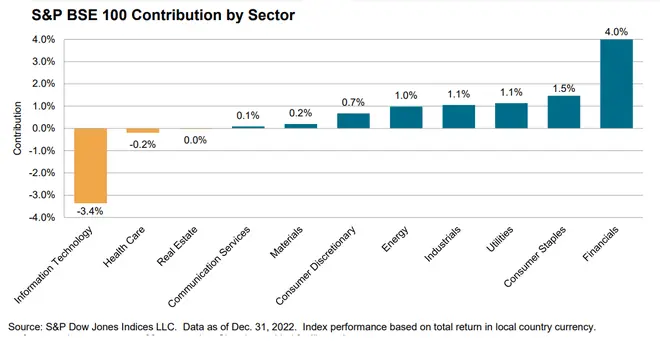

Rising interest rates and a turbulent economic and market environment made sector allocation particularly important and a potentially lucrative avenue for active managers to add value.

Avoiding Information Technology and overweighting Financials would have paid off as the latter segment accounted for two-thirds of the S&P BSE 100’s annual return.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.