Indian investors are increasingly getting active on passively managed mutual fund schemes. Latest AMFI data show that monthly net flows into passive funds (comprising index funds and ETFs) in October stood at nearly three times (₹10,260 crore) that of active funds (₹3,872 crore). This is the highest net inflow multiple witnessed by this low-cost fund category compared with active funds in the last 24 months.

Every month over the last two years, the passive fund category has seen rising consecutive monthly net inflows totalling ₹2.6-lakh-crore. In comparison, active funds collected just 50 per cent — cumulative net inflows of ₹1.4-lakh-crore.

Why the interest

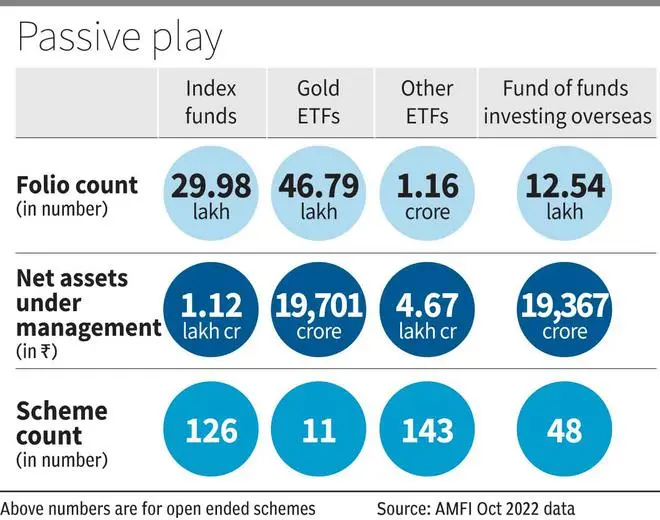

Under-performance of active funds, advent of debt passives and sustained launch of new offerings have driven the growth of the passive segment, which today has over 320 open-ended products and accounts for 16 per cent (₹6.4-lakh-crore) of the mutual fund (MF) industry assets (₹39-lakh-crore).

While EPFO inflows have also helped the passive fund segment gain heft since it invests in select ETFs, increasing retail interest is visible in the growing folio count. Post the Covid market crash, passive MF folios have enjoyed faster growth, albeit on a smaller base. In March 2020, for instance, the folio count for passive funds and active funds was 32 lakh and 8.3 crore, respectively. While the passive folio count has risen by over six6 times since, the active fund investor accounts have grown only 42 per cent.

Phenomenal growth

Till about five years ago, there were barely a 100-odd passive schemes that managed about ₹1-lakh-crore, index funds, ETFs and fund of funds investing overseas put together. But in half a decade, the number of passive schemes more than tripled and assets under management multiplied about six times. In fact, just in the last 12 months, more than 80 passive equity and about 50 debt products were launched.

On the equity side, 50-90 per cent of active funds lag benchmarks in 3-, 5- and 10-year periods across popular categories such as large-cap, ELSS and mid/small-cap, per latest SPIVA India data. This has been a trigger for passives, which also have a lower cost structure (expense ratio). Typically, passive offerings are 50-100 basis points cheaper than their active peers, though this can vary across categories.

The popularity of gold ETFs/funds in investors’ asset allocation is also another reason for growth in passives. Gold ETFs and fund of funds have nearly ₹20,000 crore AUM each currently.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.