Past performance is not a guarantee for future returns and it is true for all categories of funds, but particularly true for sectoral funds. Many retail investors buy into sectoral funds after seeing good three-year return. However, they fail to realise that they might be getting in when that sector’s cycle has already played out — then they ride down the cycle of the sectoral fund and are left bitterly disappointed with their returns.

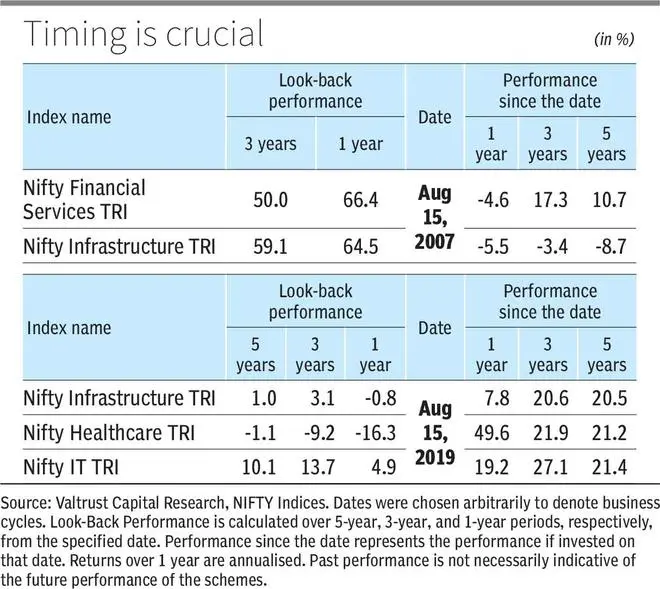

Sectoral funds usually are cyclical, which means their performance can swing significantly on account of various factors like economic, political and even market related. To illustrate this point, consider the accompanying tables which shows the past performance of different sectoral indices over various time periods.

For instance, the table highlights that the Nifty Infrastructure TRI had a strong look-back performance over three years at 59.1 per cent, but its performance drastically changed in the following years, showing a decrease of -8.7 per cent per annum in the following five years. This sharp decline illustrates the volatility and the risks of timing in sectoral investments.

Nifty Healthcare TRI experienced a downturn for quite some time, but post-2019, it rebounded remarkably, showcasing a surge of 49.6 per cent in just one year. It continued to show strong performance with gains of 21.2 per cent over five years. This example shows the unpredictable nature of sectoral funds, where sectors that once struggled can suddenly surge, reflecting broader market and economic shifts.

Sectoral funds also bring with them potential volatility; this also means an extension of impact on all the companies within the sector as a whole. For example, an impact on real estate industry will get further extended to cement, steel, paint etc. Some of these impacts on individual industries can sustain for a longer period, thus adding further complexities to a smooth entry into a sectoral fund.

The other important element one cannot afford to ignore is concentration risk. Sometimes, an investor allocates a significant portion of their portfolio to a single sector and loses out on the downside protection that may otherwise come with a properly diversified portfolio.

There are few thumb rules to follow in the sectoral space. A disciplined approach to it can help make better entry and exit in sectoral space. Here are a few pointers:

Identify discretionary and non-discretionary goods sectors to invest in. Economic instability might not have much impact on non-discretionary fields, but can lead to tightening of strings in discretionary spending. Similarly, the rise in interest rates can be detrimental to a few sectors — that are highly reliant on government spending; thus, political landscape can play a major role here.

Sector selection

One also needs to comprehend where the sector is, with respect to the stage in a cycle. There are multiple factors like evaluation of profitability and scale of operations to be considered. Similarly, inaccuracy on the depth and length of a particular phase in the cycle can do substantial harm to the portfolio.

In the end, there are challenges added to the entire process with the judgment in stock selection and trickling down to buying right businesses. While managing a sector play, the tax implications and transaction costs can further eat into the returns. Hence investors should be mindful of them while aligning their portfolios to exploit the next phase.

The writer is CIO and Founder, Valtrust

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.