Shriram AMC has launched a new fund that will invest in trending sectors by using a quantamental approach: an approach that combines quantitative and fundamentals. The NFO aims to ride on sectors with relative momentum while avoiding long exposures to underperforming sectors. The Shriram Multi Sector Rotation Fund’s NFO will be open till December 2. We analyse how the NFO will approach both sector and stock selection for its fund and its suitability for investors.

Refining sector focus

Sector or thematic mutual fund investing has found traction in the recent periods with the number of such funds doubling in the last five years to around 190 and AUM growing by eight times as per the NFO brochure. With holdings concentrated in a particular theme, the funds tend to fare well in the respective periods during which the theme is in the limelight. Thus, for retail investors the performance depends on timely ingress and exit from the fund. Either overstaying in a sector or entering a sector at its peak can dilute the returns. For instance, Nifty IT returned 226 per cent from Covid lows to January 22, whereas Nifty FMCG returned 45 per cent in the period. But from thereon, Nifty IT stagnated, returning 8 per cent till now compared to 50 per cent returns for the FMCG index. By switching between IT and FMCG at the right moment, investors could have compounded returns at a higher rate than by sticking to any one sector. . There is also a transaction cost and capital gains tax at every switch that is made that further depletes returns. For investors moving from an IT fund to FMCG fund, even when timed right, the capital gains tax at every leg of the transaction is an avoidable hurdle.

The NFO addresses this primary concern. It aims to identify trending sectors and switch investments to leverage the sector momentum. At the same time, by exiting an earlier trending sector, it avoids sector traps. Business cycle funds are also similar in approach to investing. But with focus on strategic business cycles with or without underlying momentum, they differ from this multi sector rotation fund that aims to don a more tactical approach to sector rotation.

How it works

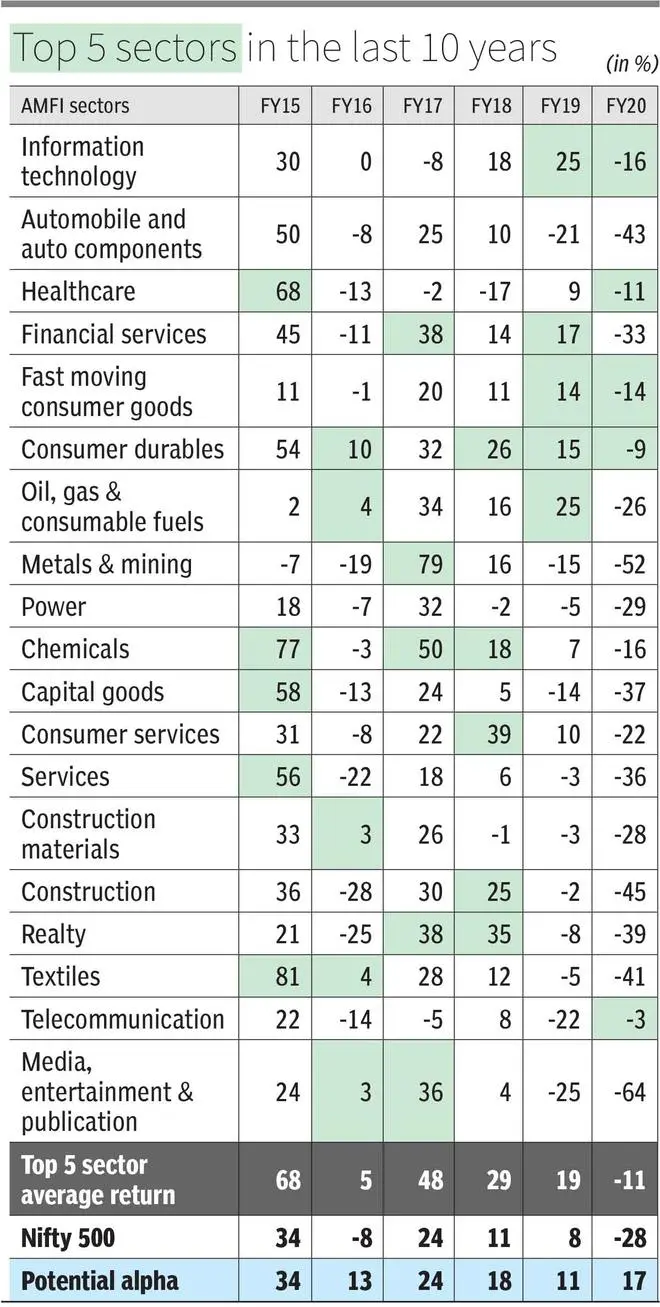

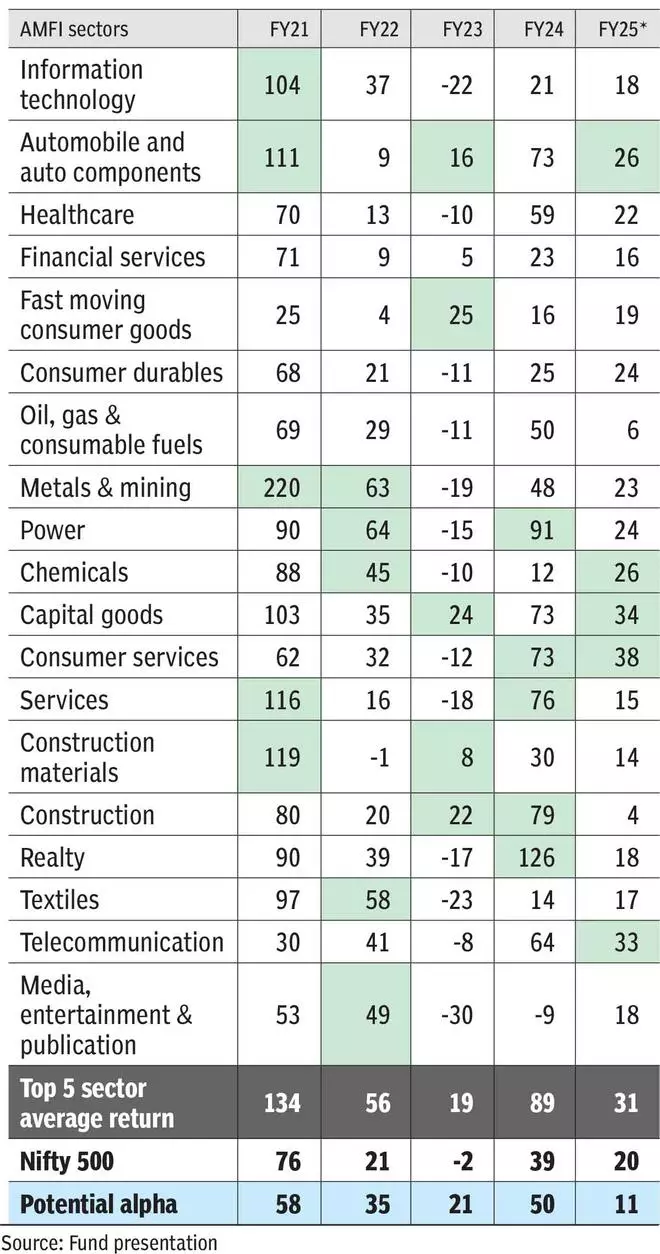

The fund will pick sectors from NSE-500 as defined by AMFI. It will then apply a propriety quantitative model to identify sectors that are trending based on momentum, earnings expectations, volatility and other factors. The quant shortlisted sectors will be further augmented by a fundamental analysis using macroeconomic indicators, investment indicators, sentiment, and allied commodity trends. From the 19-20 sectors, the fund aims to arrive at 3-6 sectors which it will invest in. After the sector selection, each sector will be analysed following a similar quantamental approach to arrive at the top stocks in those sectors, and zeroing-in on the final list of stocks. The fundamental analysis at the stock level will focus on evaluation of quality, management, risk, valuation, and technicals. The fund may likely open with investments in Healthcare, Consumer Services, Consumer Durables, IT and FMCG or Financial services.

According to company’s internal backtested model, on a rolling return basis in the last 10 years, the fund returned an average of 13.9 per cent above Nifty-500 for a five-year period, 13.5 per cent in a three-year period and 15.4 per cent in a one year period.

As can be inferred, the primary risk is from constant turnover of the fund. With sector switching, it is expected to have a higher-than-average turnover compared to a regular diversified fund. The risk of moving into a sector which underperforms or exiting a sector that continues to deliver are also inherent risks in the fund. The NFO is expected to have an expense ratio of 2.25 per cent.

Our take

Sector funds usually suit only high risk investors. Even then, it is advisable to hold sector funds as part of one’s satellite portfolio only. High risk investors eyeing an approach that considers dynamic allocation to sectors with momentum can consider the fund. The fund could be a good alternative to holding multiple sector funds and taking individual entry/exit calls on them. By investing in this single fund, investors can look to ride on a sector when it is hot, and potentially avoid overstaying in a sector too. . But keep in mind that the fund hasn’t yet established a track record of navigating the shifts well. The efficiency of the proprietary model to identify sectors and the stocks within the sector to deliver monetary gains must be established.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.