If you searched for the best performing funds of the last one year or the first six months of this fiscal, auto sector funds will come right on top. This coincides with the fact that the transportation and logistics segment, after a downcycle since 2017, has seen an upturn in recent times. The Nifty index built on this theme has clocked 12 per cent gains (year-to-date), delivering nearly 14 per cent outperformance over the Nifty 50 basket. Clearly, the auto cycle is back with a bang as utility vehicle (UV) and commercial vehicle (CV) sales lead the pack.

With investor interest building around this overall theme/ sector, IDFC AMC (NFO ends October 18) and ICICI Pru AMC (NFO closes October 20) are launching their respective transportation and logistics fund. The entry of these two funds spices up things for this thematic fund play, a space that for over 18 years has had the lone UTI Transportation and Logistics Fund. A couple of auto sector ETFs and index funds have been launched, but they are quite recent too.. Will the new actively-managed funds be able to create their own niche?

Sector opportunities

The transportation and logistics sector has been a key beneficiary of rapid urbanisation. With economic growth picking up a after the dip during the pandemic, a strong demand-led recovery is expected after a multi-year slowdown.

If experts are to be believed, with or without the EV disruption, the auto sector is at the start of a long-haul recovery cycle. This is brought out by the hopes of highest earnings growth (99 per cent) over the next two years (FY22-24), as per earnings estimates data collated by IDFC MF.

The auto ancillary space is set to benefit from this tailwind as well. On the logistics side, a supportive policy environment (unified logistics interface platform, multi modal logistics park and NLP ) places supply chain, rail and shipping on a good stead.

The stock market has been quick to acknowledge the change in fortunes, with stock prices and valuations inching up. Given the auto cycle typically holds for about two-three years, fund-houses believe a case for investment in funds focussed on the transportation and logistics sector is intact.

Portfolio constructs

The existing lone actively-managed fund viz. UTI Transportation and Logistics holds a total of 30-35 stocks currently, with a top heavy approach (8-14 per cent stake in big bets such as M&M, Maruti, Tata Motors, Eicher and Bajaj Auto), and the rest are well diversified, including mid- and small-cap stocks. While 78 per cent of the holdings are in auto and auto components, about 12 per cent are in the logistics space.

In comparison, IDFC Transportation and Logistics aims to hold a 30-stock portfolio with a multi-cap approach. The current thinking is to have 80-85 per cent in transportation stocks and 15-20 per cent in logistics stocks. The fund wants to follow growth at a reasonable price (GARP) equity investment strategy. No major cash calls are planned. Do note that the fund's manager was associated with UTI AMC, wherein he was managing, among others, the UTI Transportation & Logistics Fund.

In the transportation and logistics benchmark index (Nifty Transportation & Logistics TRI), auto OEM and auto ancillary combined is around 85 per cent of the constituents, and the logistics component is around 15 per cent. Targeting a 40-45 stock portfolio, ICICI Pru Transportation and Logistics Fund will take large active calls to ensure wide divergence between the benchmark index and fund on both individual stocks and overall sectoral weightages perspective. It aims to take a flexicap approach to likely ensure that the overall mid and small-cap proportion could find higher representation, over time. The fund's medium-term cash strategy is dependent on bottom-up stock ideas and upside potential of those ideas over a 3-5 years’ time frame.. It will follow a GARP approach.

Our take

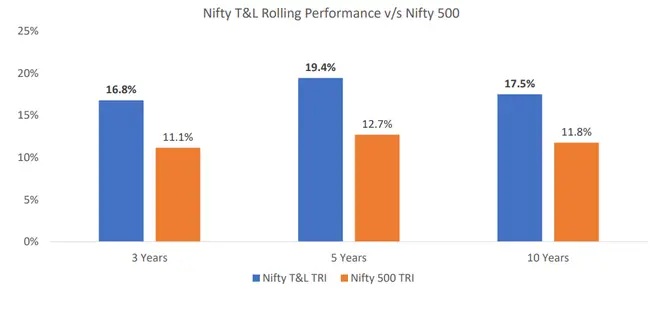

Thematic/ sectoral funds are ideal for those with a high risk appetite. They should form part of your satellite portfolio. The two new funds from IDFC and IPru stable are greenhorns i.e. they don’t have a track record. They can be considered if you are confident that their approach will result in performance that will be different from the existing UTI T&L fund, which has shown consistent alpha generation over various time periods vis-a-vis comparable sector benchmark and broader market indices.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.