India’s defence sector is witnessing strong growth and stocks in the segment have outperformed the market in the last three years. A multitude of factors have supported this growth and being structural, the momentum can continue to carry the stocks in the medium term. This could be reaffirmed with full Budget announcements, expected in the second half of July.

The NFO of Motilal Oswal Nifty India Defence Index Fund, a passive index fund, is open till June 27 for investors. The tailwinds for the sector and the index performance is analysed here for investors to take a call on the NFO.

Atmanirbhar in defence

The defence procurement pie is growing, and the share of domestic industry is also getting bigger, providing two tailwinds for the sector. The overall budgeted capital expenditure has grown to ₹1.82-lakh crore, which accounts for 3.8 per cent of India’s total budgeted expenditure. This has grown at 11 per cent CAGR in the last five years.

Indigenisation is also evident – not only in policy but also in actual procurement announcements. For instance, of the ₹2.23-lakh crore capital acquisition proposals made by the Ministry of Defence in November 2023, 98 per cent will be sourced from Indian companies. In an order of priority, starting with Buy Indian and ending with sixth level of Buy Global, companies have to secure domestic sourcing or offset domestically. This has been accompanied by a positive indigenisation list, restricting imports of items that can be domestically procured. In the fifth such notification, the Department of Military Affairs has announced import bans of 411 military items, and defence procurement has a list of 4,666 items under import bans. The list is expected to keep expanding, benefitting Indian manufacturers..

In the long run, the domestic capability looks set for multi-fold growth with regulatory tailwinds. Indian exports, which have risen 334 per cent in the last five years, are opening a new and nascent avenue for revenue diversification as well for domestic companies.

Benchmark performance

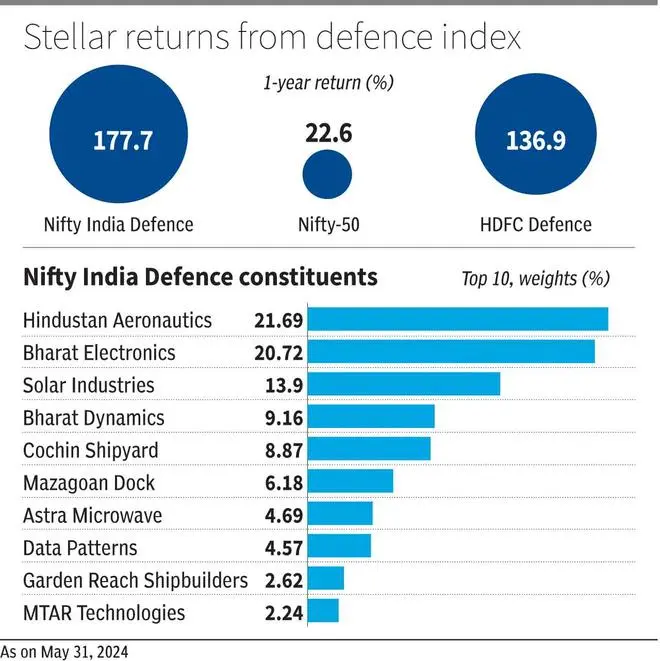

The NFO will track and be benchmarked to Nifty India Defence Index. The nascent index was launched in January 2022 and has returned 177 per cent in the last year and 38 per cent CAGR since inception. HDFC Defence Fund, launched in June 2023, is the only other fund in the sector. This active fund has returned 137 per cent in the last year, and is beaten by the Nifty defence index.

The index portfolio, consisting of 15 stocks, is concentrated though, with the top-five stocks accounting for 74 per cent as on May 31, 2024. The segment is highly valued as well, with a trailing PE ratio of 58.8 times earnings. Despite a large presence of PSU stocks, the dividend yield is still 0.44 per cent. Value investors cannot find much to cheer in the index after the stellar run last year.

Driven by peak order-books and long-term revenue visibility, index constituents may offer strong growth prospects. Hindustan Aeronautics, the largest index member, has an order-book three times its FY24 revenues consisting of Light Combat Aircrafts (Tejas Mark-1A) and Advanced Medium Combat Aircraft (AMCA) helicopters. After the full Budget announcement, INS Vikrant and submarine orders are expected to crystallise, further reinforcing the direction of spending in the new coalition government. The IAC 2 (aircraft carrier) order for Cochin Shipyard, a ₹5,000-crore per year contract for 10 years, is one of them. Similarly, orders for the P76 submarines (Mazagon Dock) are also expected. Bharat Electronics and Bharat Dynamics and other electronics and drone manufacturers can expect further orders.

The stellar run last year, current valuations, high concentration and low dividend yield are a hurdle to high returns. But investors with a high risk-appetite can allocate a small portion of their portfolio to track the index through the NFO. The tailwinds do point to sustained capex outlay for the sector and the primacy of indigenisation benefitting the stocks should aid investors in the long run.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.