Equity markets are surging to new highs in recent months. Though there have been corrections in certain segments of the broader market, valuations still seem uncomfortably high for most indices.

As benchmarks rise and broader markets correct, a portfolio anchored in strong value-based stock-selection criteria may work well for investors. Even otherwise, for investors preferring the value style, a systematic approach over the long term is desirable.

As it celebrates 20 years since inception, ICICI Prudential Value Discovery fund may be a suitable choice for investors looking to create long-term wealth.

The scheme, which started operations in August 2024, has delivered a stellar 21.2 per cent return compounded annually over the past 20-plus years (regular plan). Despite occasional underperformance, the fund has consistently delivered robust performance over the years.

ICICI Prudential Value Discovery may be considered for the core of their portfolio by investors looking to stay put for 10 years or more. Investments that are made via the SIP route could be rewarding over longer timeframes.

Delivering outperformance

The fund has been among the best performers across equity categories over the past couple of decades. It is also consistent in delivering returns.

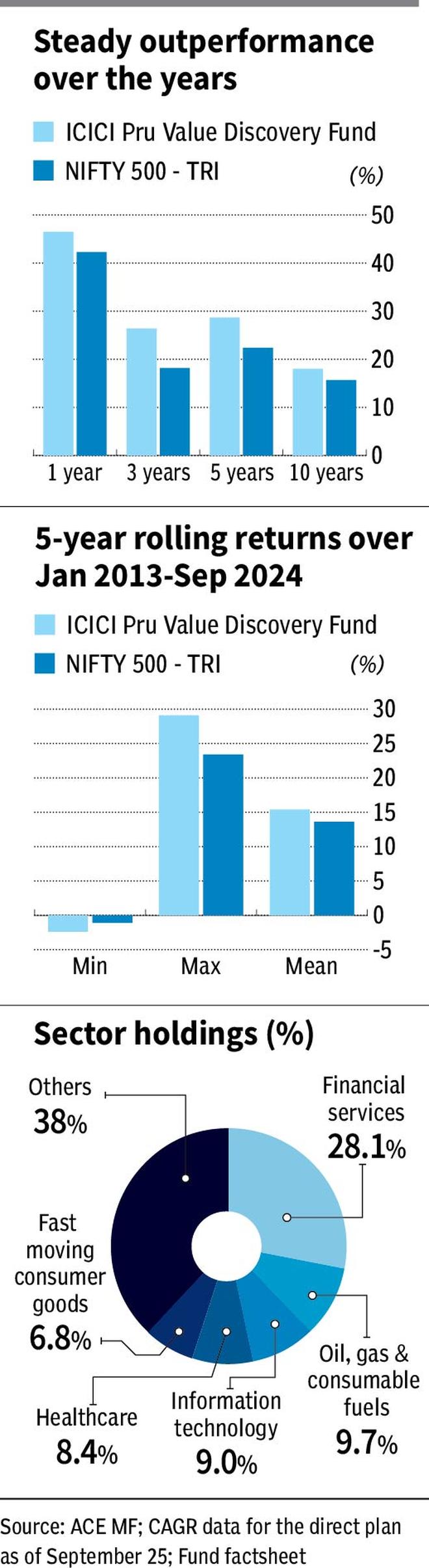

Over the past 1-year, 3-year, 5-year and 10-year timeframes periods, the fund has delivered 46.5 per cent, 26.4 per cent, 28.7 per cent and 18 per cent, respectively on a point-to-point basis. This performance places it among the top performers across equity categories. The scheme outperformed the Nifty 500 TRI by 3-8 percentage points across time periods.

When five-year rolling returns over the past the period January 2013 to September 2024 are considered, ICICI Prudential Value Discovery has delivered mean returns of 15.4 per cent. In comparison, the Nifty 500 TRI delivered average returns of 13.6 per cent.

Also, in the period mentioned above, on a 5-year rolling basis, the scheme has beaten its benchmark Nifty 500 TRI over 63 per cent of the time, which is quite healthy. It has delivered more than 12 per cent over 76 per cent of the time over this period and more than 15 per cent over 50 per cent of the time.

The fund’s SIP returns (XIRR) over the past 10 years are top-notch, at 21.5 per cent. A SIP in its benchmark Nifty 500 TRI would have returned 18.7 per cent over the same period.

All return figures pertain to the direct plan of the fund.

ICICI Prudential Value Discovery has an upside capture ratio of 102.8, indicating that its NAV rises a bit more than the benchmark during rallies. But more importantly, it has a downside capture ratio of just 50.9, suggesting that the scheme’s NAV falls much less than the Nifty 500 TRI during corrections. A score of 100 indicates that a fund performs in line with its benchmark. These observations are based on data from September 2021-September 2024.

Value anchor

The fund has always had a large-cap bias in stock selection, with small portions of mid and small-caps thrown in. Often, the scheme has held 70 per cent of the portfolio or more in large-cap stocks, while occasionally dipping below that level. Even in the frenzied mid and small-cap rally of the past few years, ICICI Prudential Value Discovery has been careful about not going overboard on those segments.

The fund has for most part kept value at the centre of its portfolio churn. In late 2019 and early 2020, when IT, pharmaceutical and automobile stocks were beaten down, the fund increased stakes in these sectors, which rallied well subsequently. However, in the last 2-3 years, the fund has increased focus on banks and made them the top holdings in the fund. While IT and pharma stocks still figure among the top segments held, exposure has been somewhat trimmed from the post-COVID period. Exposure is generally taken to the top private or public sector names in any segment. With relatively better value present in a the large-cap space, the fund’s approach can be a relatively moderate-risk approach to return generation.

The fund has tended to maintain cash positions of 5-7 per cent. But in recent months, ICICI Prudential Value Discovery has increased the cash levels heavily – it is almost 13 per cent, according to the August portfolio.

As with all styles, value can underperform in phases that are too momentum driven, especially in one-way upward market rallies. However, patient accumulation can help over the long term.

Overall, the fund is suitable for an investor with a moderate risk appetite, looking to create long-term wealth.

Comments

Comments have to be in English, and in full sentences. They cannot be abusive or personal. Please abide by our community guidelines for posting your comments.

We have migrated to a new commenting platform. If you are already a registered user of TheHindu Businessline and logged in, you may continue to engage with our articles. If you do not have an account please register and login to post comments. Users can access their older comments by logging into their accounts on Vuukle.